Are you a seasoned Claim Processor seeking a new career path? Discover our professionally built Claim Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

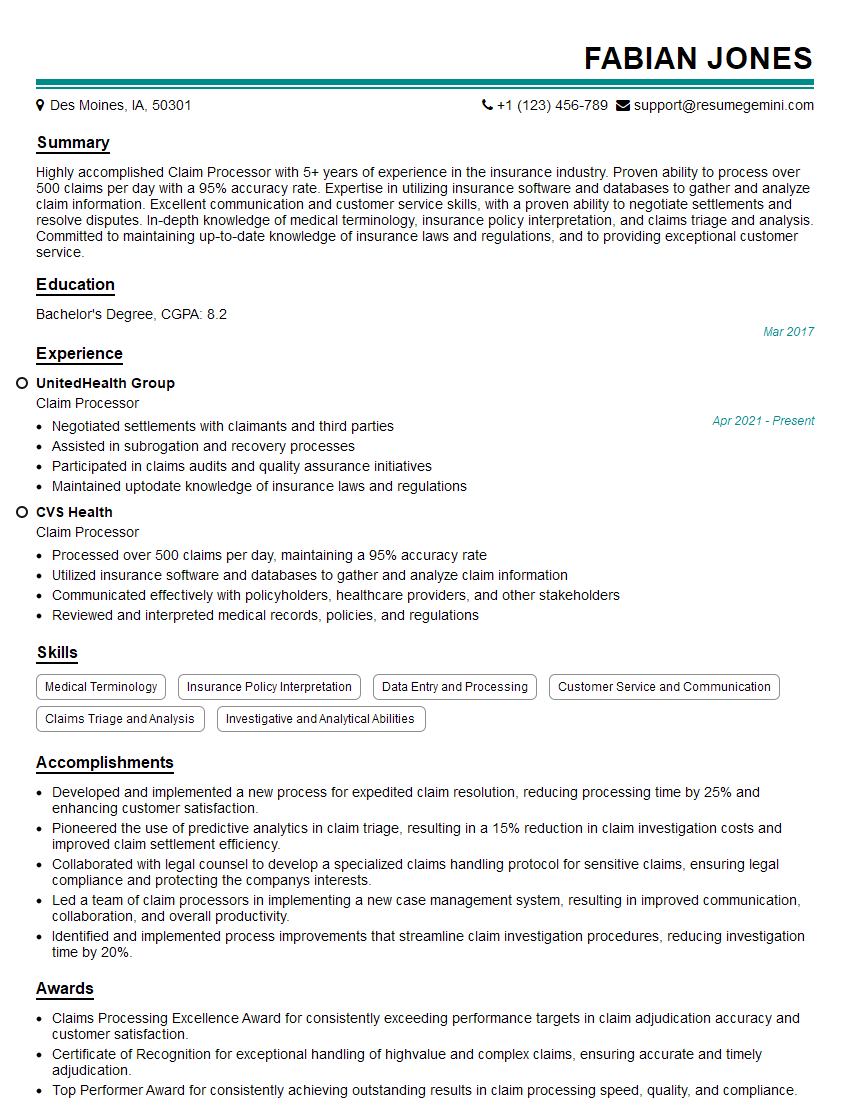

Fabian Jones

Claim Processor

Summary

Highly accomplished Claim Processor with 5+ years of experience in the insurance industry. Proven ability to process over 500 claims per day with a 95% accuracy rate. Expertise in utilizing insurance software and databases to gather and analyze claim information. Excellent communication and customer service skills, with a proven ability to negotiate settlements and resolve disputes. In-depth knowledge of medical terminology, insurance policy interpretation, and claims triage and analysis. Committed to maintaining up-to-date knowledge of insurance laws and regulations, and to providing exceptional customer service.

Education

Bachelor’s Degree

March 2017

Skills

- Medical Terminology

- Insurance Policy Interpretation

- Data Entry and Processing

- Customer Service and Communication

- Claims Triage and Analysis

- Investigative and Analytical Abilities

Work Experience

Claim Processor

- Negotiated settlements with claimants and third parties

- Assisted in subrogation and recovery processes

- Participated in claims audits and quality assurance initiatives

- Maintained uptodate knowledge of insurance laws and regulations

Claim Processor

- Processed over 500 claims per day, maintaining a 95% accuracy rate

- Utilized insurance software and databases to gather and analyze claim information

- Communicated effectively with policyholders, healthcare providers, and other stakeholders

- Reviewed and interpreted medical records, policies, and regulations

Accomplishments

- Developed and implemented a new process for expedited claim resolution, reducing processing time by 25% and enhancing customer satisfaction.

- Pioneered the use of predictive analytics in claim triage, resulting in a 15% reduction in claim investigation costs and improved claim settlement efficiency.

- Collaborated with legal counsel to develop a specialized claims handling protocol for sensitive claims, ensuring legal compliance and protecting the companys interests.

- Led a team of claim processors in implementing a new case management system, resulting in improved communication, collaboration, and overall productivity.

- Identified and implemented process improvements that streamline claim investigation procedures, reducing investigation time by 20%.

Awards

- Claims Processing Excellence Award for consistently exceeding performance targets in claim adjudication accuracy and customer satisfaction.

- Certificate of Recognition for exceptional handling of highvalue and complex claims, ensuring accurate and timely adjudication.

- Top Performer Award for consistently achieving outstanding results in claim processing speed, quality, and compliance.

- Employee of the Month Award for exceptional dedication and contribution to enhancing claim processing efficiency.

Certificates

- Certified Professional Biller (CPB)

- Certified Coding Associate (CCA)

- Certified Medical Reimbursement Specialist (CMRS)

- Associate in Claim Examination (ACE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Processor

- Highlight your experience and skills in processing a high volume of claims with a high level of accuracy.

- Demonstrate your proficiency in using insurance software and databases to gather and analyze claim information.

- Emphasize your strong communication and customer service skills, as well as your ability to negotiate settlements and resolve disputes.

- Showcase your knowledge of medical terminology, insurance policy interpretation, and claims triage and analysis.

- Highlight your commitment to maintaining up-to-date knowledge of insurance laws and regulations, and to providing exceptional customer service.

Essential Experience Highlights for a Strong Claim Processor Resume

- Processed over 500 claims per day, maintaining a 95% accuracy rate

- Utilized insurance software and databases to gather and analyze claim information

- Communicated effectively with policyholders, healthcare providers, and other stakeholders

- Reviewed and interpreted medical records, policies, and regulations

- Negotiated settlements with claimants and third parties

- Assisted in subrogation and recovery processes

- Participated in claims audits and quality assurance initiatives

Frequently Asked Questions (FAQ’s) For Claim Processor

What is a Claim Processor?

A Claim Processor is responsible for reviewing, investigating, and processing insurance claims. They gather information, verify coverage, and determine the amount of benefits to be paid.

What are the key skills required for a Claim Processor?

Key skills include strong attention to detail, analytical thinking, problem-solving abilities, and excellent communication and customer service skills.

What are the career prospects for a Claim Processor?

Claim Processors can advance to roles such as Claims Supervisor, Claims Manager, or Insurance Underwriter.

What is the average salary for a Claim Processor?

The average salary for a Claim Processor in the United States is around $50,000 per year.

What are the educational requirements for a Claim Processor?

Most Claim Processors have a high school diploma or equivalent, although some employers may prefer candidates with a bachelor’s degree in a related field, such as insurance or healthcare.

What are the certification options available for Claim Processors?

There are several certifications available for Claim Processors, including the Certified Professional Insurance Agent (CPIA) and the Associate in Claims (AIC) designation.

What are the challenges faced by Claim Processors?

Claim Processors often face challenges such as dealing with complex or high-value claims, meeting deadlines, and resolving disputes with claimants.

What are the rewards of being a Claim Processor?

Claim Processors find satisfaction in helping policyholders during difficult times, contributing to the insurance industry, and developing valuable skills and knowledge.