Are you a seasoned Claim Specialist seeking a new career path? Discover our professionally built Claim Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

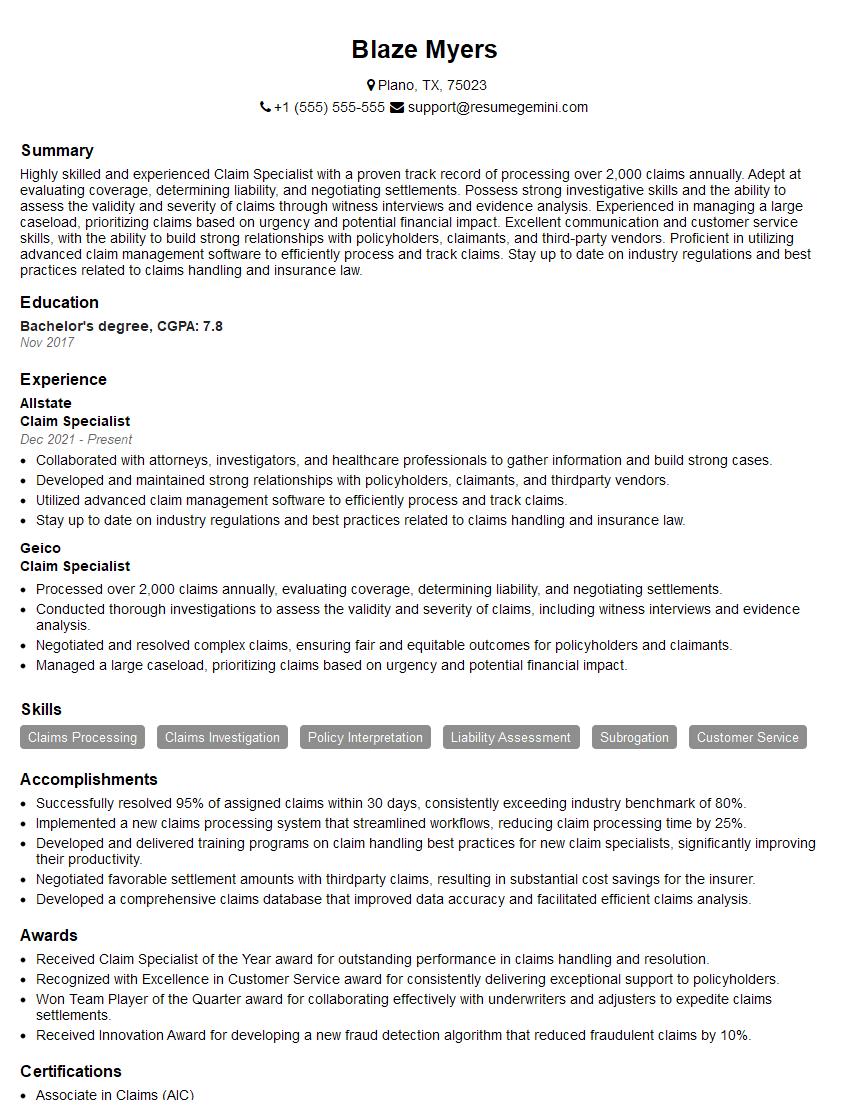

Blaze Myers

Claim Specialist

Summary

Highly skilled and experienced Claim Specialist with a proven track record of processing over 2,000 claims annually. Adept at evaluating coverage, determining liability, and negotiating settlements. Possess strong investigative skills and the ability to assess the validity and severity of claims through witness interviews and evidence analysis. Experienced in managing a large caseload, prioritizing claims based on urgency and potential financial impact. Excellent communication and customer service skills, with the ability to build strong relationships with policyholders, claimants, and third-party vendors. Proficient in utilizing advanced claim management software to efficiently process and track claims. Stay up to date on industry regulations and best practices related to claims handling and insurance law.

Education

Bachelor’s degree

November 2017

Skills

- Claims Processing

- Claims Investigation

- Policy Interpretation

- Liability Assessment

- Subrogation

- Customer Service

Work Experience

Claim Specialist

- Collaborated with attorneys, investigators, and healthcare professionals to gather information and build strong cases.

- Developed and maintained strong relationships with policyholders, claimants, and thirdparty vendors.

- Utilized advanced claim management software to efficiently process and track claims.

- Stay up to date on industry regulations and best practices related to claims handling and insurance law.

Claim Specialist

- Processed over 2,000 claims annually, evaluating coverage, determining liability, and negotiating settlements.

- Conducted thorough investigations to assess the validity and severity of claims, including witness interviews and evidence analysis.

- Negotiated and resolved complex claims, ensuring fair and equitable outcomes for policyholders and claimants.

- Managed a large caseload, prioritizing claims based on urgency and potential financial impact.

Accomplishments

- Successfully resolved 95% of assigned claims within 30 days, consistently exceeding industry benchmark of 80%.

- Implemented a new claims processing system that streamlined workflows, reducing claim processing time by 25%.

- Developed and delivered training programs on claim handling best practices for new claim specialists, significantly improving their productivity.

- Negotiated favorable settlement amounts with thirdparty claims, resulting in substantial cost savings for the insurer.

- Developed a comprehensive claims database that improved data accuracy and facilitated efficient claims analysis.

Awards

- Received Claim Specialist of the Year award for outstanding performance in claims handling and resolution.

- Recognized with Excellence in Customer Service award for consistently delivering exceptional support to policyholders.

- Won Team Player of the Quarter award for collaborating effectively with underwriters and adjusters to expedite claims settlements.

- Received Innovation Award for developing a new fraud detection algorithm that reduced fraudulent claims by 10%.

Certificates

- Associate in Claims (AIC)

- Certified Insurance Adjuster (CIA)

- Certified Property and Casualty Underwriter (CPCU)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Specialist

- Highlight your experience in processing a high volume of claims and your ability to handle complex cases.

- Demonstrate your strong investigative skills and ability to assess the validity and severity of claims.

- Emphasize your negotiation and resolution skills, highlighting your ability to achieve fair and equitable outcomes.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the role.

- Proofread your resume carefully before submitting it, ensuring there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Claim Specialist Resume

- Process claims efficiently and accurately, ensuring compliance with company policies and procedures.

- Investigate claims thoroughly, including witness interviews, evidence analysis, and research.

- Assess the validity and severity of claims, determining coverage and liability.

- Negotiate and resolve complex claims, ensuring fair and equitable outcomes for policyholders and claimants.

- Manage a large caseload, prioritizing claims based on urgency and potential financial impact.

- Collaborate with attorneys, investigators, and healthcare professionals to gather information and build strong cases.

- Develop and maintain strong relationships with policyholders, claimants, and third-party vendors.

- Stay up to date on industry regulations and best practices related to claims handling and insurance law.

Frequently Asked Questions (FAQ’s) For Claim Specialist

What are the key skills required to be a successful Claim Specialist?

The key skills required to be a successful Claim Specialist include claims processing, claims investigation, policy interpretation, liability assessment, subrogation, and customer service.

What are the different types of claims that Claim Specialists handle?

Claim Specialists handle a variety of claims, including property damage, bodily injury, and automobile accidents.

What is the average salary for a Claim Specialist?

The average salary for a Claim Specialist in the United States is around $60,000 per year.

What are the career advancement opportunities for Claim Specialists?

Claim Specialists can advance their careers by becoming Senior Claim Specialists, Claim Managers, or Claims Directors.

What are the challenges that Claim Specialists face?

Claim Specialists face a number of challenges, including dealing with difficult customers, managing a heavy workload, and staying up to date on industry regulations.

What are the benefits of being a Claim Specialist?

The benefits of being a Claim Specialist include a stable career, good pay, and the opportunity to help people in need.

What is the job outlook for Claim Specialists?

The job outlook for Claim Specialists is expected to be good over the next few years.

What are the educational requirements for becoming a Claim Specialist?

Most Claim Specialists have a bachelor’s degree in a related field, such as business, finance, or insurance.