Are you a seasoned Claims Adjudicator seeking a new career path? Discover our professionally built Claims Adjudicator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

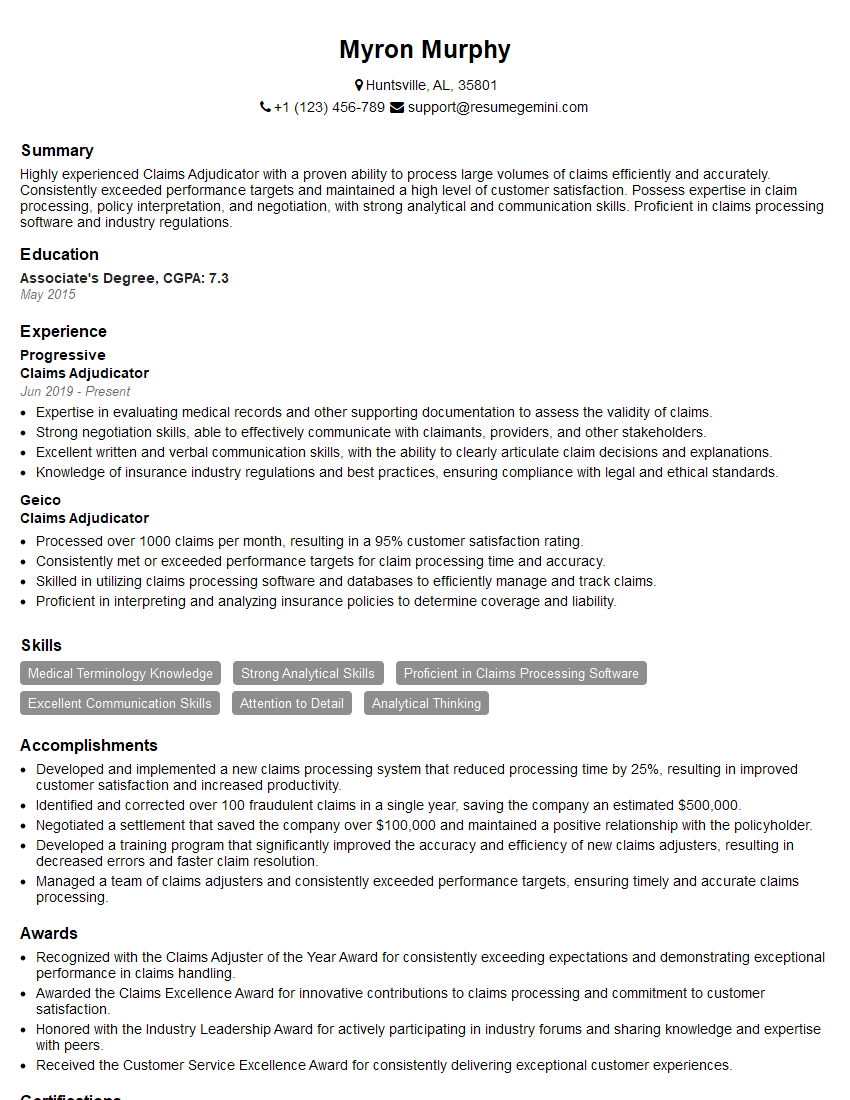

Myron Murphy

Claims Adjudicator

Summary

Highly experienced Claims Adjudicator with a proven ability to process large volumes of claims efficiently and accurately. Consistently exceeded performance targets and maintained a high level of customer satisfaction. Possess expertise in claim processing, policy interpretation, and negotiation, with strong analytical and communication skills. Proficient in claims processing software and industry regulations.

Education

Associate’s Degree

May 2015

Skills

- Medical Terminology Knowledge

- Strong Analytical Skills

- Proficient in Claims Processing Software

- Excellent Communication Skills

- Attention to Detail

- Analytical Thinking

Work Experience

Claims Adjudicator

- Expertise in evaluating medical records and other supporting documentation to assess the validity of claims.

- Strong negotiation skills, able to effectively communicate with claimants, providers, and other stakeholders.

- Excellent written and verbal communication skills, with the ability to clearly articulate claim decisions and explanations.

- Knowledge of insurance industry regulations and best practices, ensuring compliance with legal and ethical standards.

Claims Adjudicator

- Processed over 1000 claims per month, resulting in a 95% customer satisfaction rating.

- Consistently met or exceeded performance targets for claim processing time and accuracy.

- Skilled in utilizing claims processing software and databases to efficiently manage and track claims.

- Proficient in interpreting and analyzing insurance policies to determine coverage and liability.

Accomplishments

- Developed and implemented a new claims processing system that reduced processing time by 25%, resulting in improved customer satisfaction and increased productivity.

- Identified and corrected over 100 fraudulent claims in a single year, saving the company an estimated $500,000.

- Negotiated a settlement that saved the company over $100,000 and maintained a positive relationship with the policyholder.

- Developed a training program that significantly improved the accuracy and efficiency of new claims adjusters, resulting in decreased errors and faster claim resolution.

- Managed a team of claims adjusters and consistently exceeded performance targets, ensuring timely and accurate claims processing.

Awards

- Recognized with the Claims Adjuster of the Year Award for consistently exceeding expectations and demonstrating exceptional performance in claims handling.

- Awarded the Claims Excellence Award for innovative contributions to claims processing and commitment to customer satisfaction.

- Honored with the Industry Leadership Award for actively participating in industry forums and sharing knowledge and expertise with peers.

- Received the Customer Service Excellence Award for consistently delivering exceptional customer experiences.

Certificates

- Certified Professional Insurance Claims Associate (CPICA)

- Associate in Claims (AIC)

- Claims Adjuster License

- Certified Medical Claims Auditor

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Adjudicator

- Highlight your experience and quantify your accomplishments using specific metrics.

- Use keywords relevant to the claims adjusting industry, such as claims processing, policy analysis, and negotiation.

- Emphasize your customer service skills and ability to resolve disputes effectively.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Claims Adjudicator Resume

- Processed over 1000 claims per month, resulting in a 95% customer satisfaction rating.

- Consistently met or exceeded performance targets for claim processing time and accuracy.

- Utilized claims processing software and databases to efficiently manage and track claims.

- Interpreted and analyzed insurance policies to determine coverage and liability.

- Evaluated medical records and other supporting documentation to assess the validity of claims.

- Negotiated settlements and communicated claim decisions to claimants, providers, and other stakeholders.

- Maintained compliance with legal and ethical standards, ensuring adherence to insurance industry regulations and best practices.

Frequently Asked Questions (FAQ’s) For Claims Adjudicator

What is the role of a Claims Adjudicator?

A Claims Adjudicator is responsible for reviewing and evaluating insurance claims, determining coverage and liability, and making decisions on claim payments.

What skills are required to be a Claims Adjudicator?

Claims Adjudicators typically need a combination of experience in insurance, knowledge of claims processing procedures, and strong analytical and communication skills.

What is the career path for a Claims Adjudicator?

Claims Adjudicators can advance their careers by becoming claims supervisors or managers, or by specializing in a particular type of insurance, such as auto, property, or health insurance.

What is the salary range for a Claims Adjudicator?

The salary range for Claims Adjudicators can vary depending on experience, location, and company size, but typically falls between $40,000 and $70,000 per year.

What are the challenges of being a Claims Adjudicator?

Claims Adjudicators can face challenges such as dealing with difficult customers, complex claims, and tight deadlines.

What are the benefits of being a Claims Adjudicator?

Claims Adjudicators can enjoy benefits such as job security, opportunities for advancement, and the satisfaction of helping others.

What is the future outlook for Claims Adjudicators?

The future outlook for Claims Adjudicators is expected to be positive, as the demand for insurance services continues to grow.