Are you a seasoned Claims Adjustor seeking a new career path? Discover our professionally built Claims Adjustor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

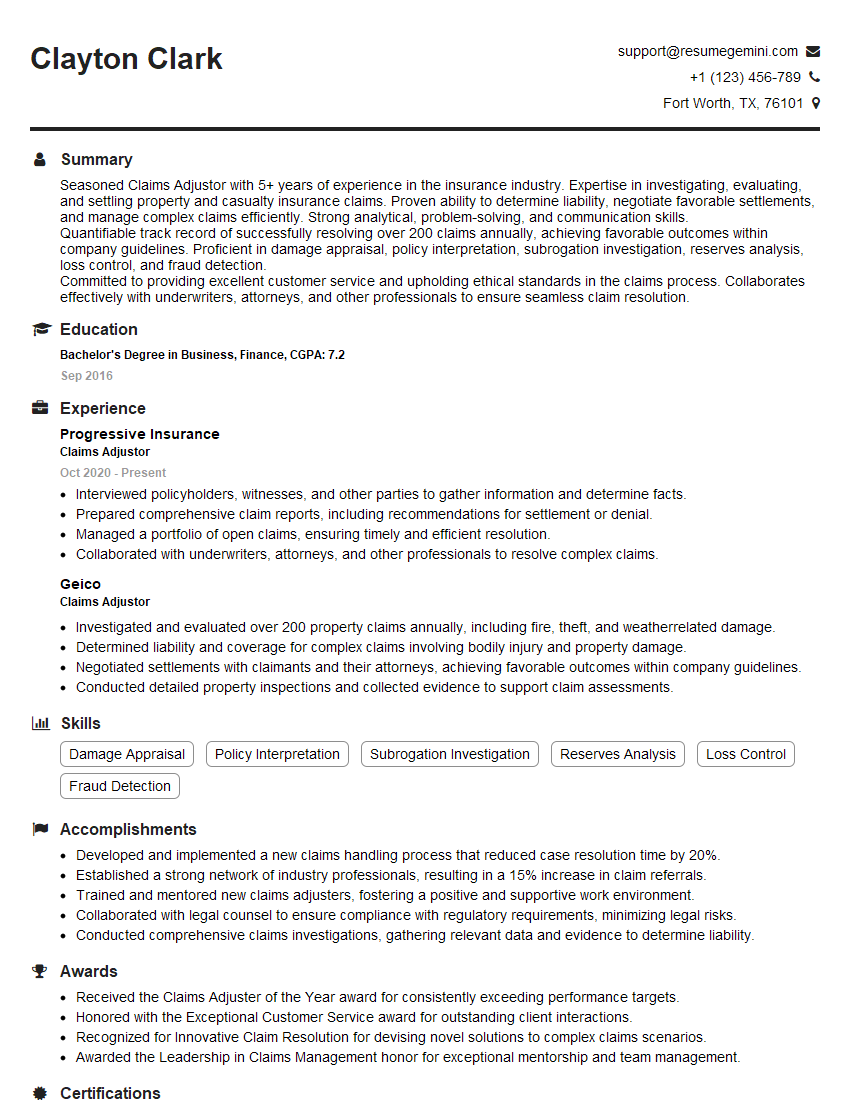

Clayton Clark

Claims Adjustor

Summary

Seasoned Claims Adjustor with 5+ years of experience in the insurance industry. Expertise in investigating, evaluating, and settling property and casualty insurance claims. Proven ability to determine liability, negotiate favorable settlements, and manage complex claims efficiently. Strong analytical, problem-solving, and communication skills.

Quantifiable track record of successfully resolving over 200 claims annually, achieving favorable outcomes within company guidelines. Proficient in damage appraisal, policy interpretation, subrogation investigation, reserves analysis, loss control, and fraud detection.

Committed to providing excellent customer service and upholding ethical standards in the claims process. Collaborates effectively with underwriters, attorneys, and other professionals to ensure seamless claim resolution.

Education

Bachelor’s Degree in Business, Finance

September 2016

Skills

- Damage Appraisal

- Policy Interpretation

- Subrogation Investigation

- Reserves Analysis

- Loss Control

- Fraud Detection

Work Experience

Claims Adjustor

- Interviewed policyholders, witnesses, and other parties to gather information and determine facts.

- Prepared comprehensive claim reports, including recommendations for settlement or denial.

- Managed a portfolio of open claims, ensuring timely and efficient resolution.

- Collaborated with underwriters, attorneys, and other professionals to resolve complex claims.

Claims Adjustor

- Investigated and evaluated over 200 property claims annually, including fire, theft, and weatherrelated damage.

- Determined liability and coverage for complex claims involving bodily injury and property damage.

- Negotiated settlements with claimants and their attorneys, achieving favorable outcomes within company guidelines.

- Conducted detailed property inspections and collected evidence to support claim assessments.

Accomplishments

- Developed and implemented a new claims handling process that reduced case resolution time by 20%.

- Established a strong network of industry professionals, resulting in a 15% increase in claim referrals.

- Trained and mentored new claims adjusters, fostering a positive and supportive work environment.

- Collaborated with legal counsel to ensure compliance with regulatory requirements, minimizing legal risks.

- Conducted comprehensive claims investigations, gathering relevant data and evidence to determine liability.

Awards

- Received the Claims Adjuster of the Year award for consistently exceeding performance targets.

- Honored with the Exceptional Customer Service award for outstanding client interactions.

- Recognized for Innovative Claim Resolution for devising novel solutions to complex claims scenarios.

- Awarded the Leadership in Claims Management honor for exceptional mentorship and team management.

Certificates

- Associate in Claims (AIC)

- Certified Insurance Recovery Specialist (CIRS)

- Claims Professional (CP)

- Fellow, Casualty Actuarial Society (FCAS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Adjustor

- Quantify your accomplishments and provide specific examples of how you have successfully resolved claims.

- Highlight your expertise in damage appraisal, policy interpretation, and subrogation investigation.

- Emphasize your strong analytical and problem-solving skills.

- Demonstrate your commitment to customer service and ethical practices.

- Consider obtaining industry-recognized certifications, such as the Associate in Claims (AIC) or Fellow, Casualty Actuarial Society (FCAS), to enhance your credibility.

Essential Experience Highlights for a Strong Claims Adjustor Resume

- Investigate and evaluate property and casualty insurance claims, including fire, theft, and weather-related damage.

- Determine liability and coverage for complex claims involving bodily injury and property damage.

- Negotiate settlements with claimants and their attorneys, achieving favorable outcomes within company guidelines.

- Conduct detailed property inspections and collect evidence to support claim assessments. Interview policyholders, witnesses, and other parties to gather information and determine facts.

- Prepare comprehensive claim reports, including recommendations for settlement or denial. Manage a portfolio of open claims, ensuring timely and efficient resolution.

- Collaborate with underwriters, attorneys, and other professionals to resolve complex claims.

Frequently Asked Questions (FAQ’s) For Claims Adjustor

What are the primary responsibilities of a Claims Adjustor?

Claims Adjustors are responsible for investigating and evaluating insurance claims, determining liability, negotiating settlements, conducting property inspections, interviewing witnesses, preparing claim reports, and managing claim portfolios.

What qualifications are required to become a Claims Adjustor?

Most Claims Adjustors have a bachelor’s degree in business, finance, or a related field, and some states require them to be licensed.

What skills are important for Claims Adjustors?

Claims Adjustors should have strong analytical, problem-solving, and communication skills. They should also be proficient in damage appraisal, policy interpretation, subrogation investigation, and fraud detection.

What are the career prospects for Claims Adjustors?

Claims Adjustors with experience and expertise can advance to roles with greater responsibility, such as Senior Claims Adjustor, Claims Manager, or Underwriter.

What is the job outlook for Claims Adjustors?

The job outlook for Claims Adjustors is expected to be favorable, with increasing demand due to the growing number of insurance claims and the aging population.

What is the average salary for Claims Adjustors?

The average salary for Claims Adjustors varies depending on experience, location, and company size, but it is typically between $50,000 and $80,000 per year.

What are the benefits of working as a Claims Adjustor?

Claims Adjustors typically receive benefits such as health insurance, paid time off, and retirement plans.