Are you a seasoned Claims Analyst seeking a new career path? Discover our professionally built Claims Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

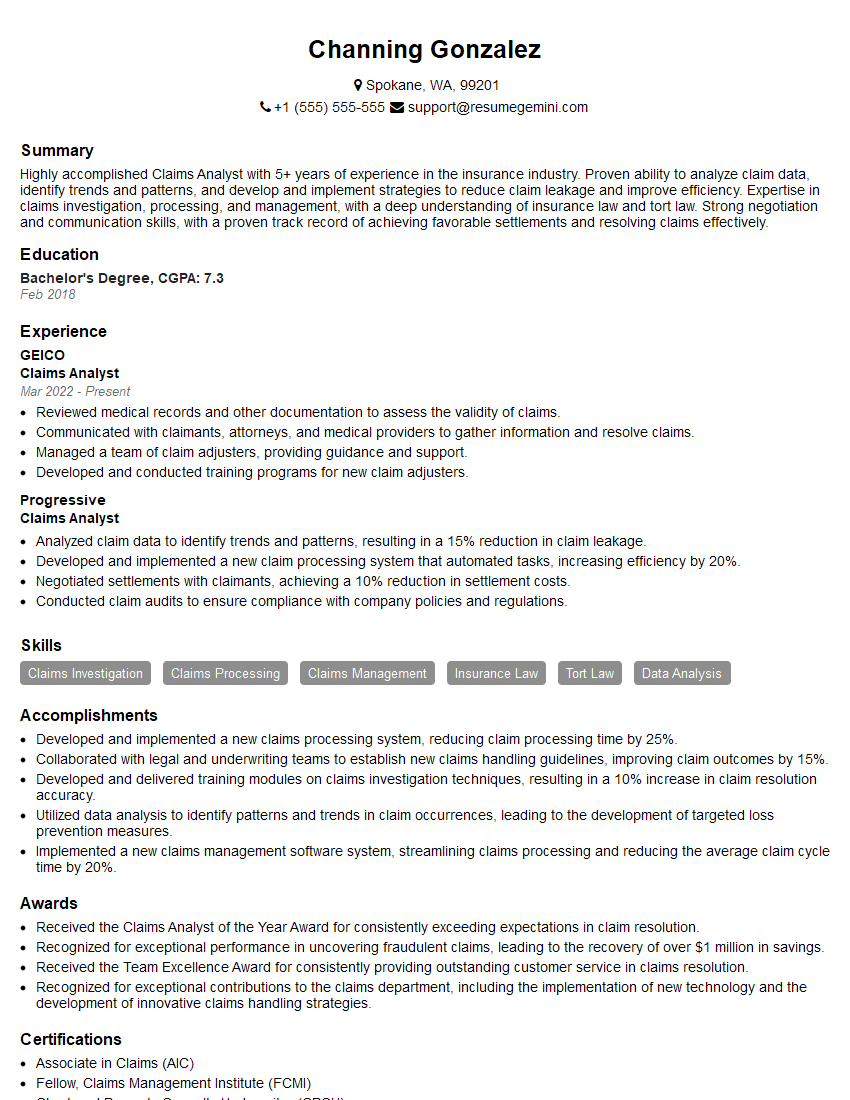

Channing Gonzalez

Claims Analyst

Summary

Highly accomplished Claims Analyst with 5+ years of experience in the insurance industry. Proven ability to analyze claim data, identify trends and patterns, and develop and implement strategies to reduce claim leakage and improve efficiency. Expertise in claims investigation, processing, and management, with a deep understanding of insurance law and tort law. Strong negotiation and communication skills, with a proven track record of achieving favorable settlements and resolving claims effectively.

Education

Bachelor’s Degree

February 2018

Skills

- Claims Investigation

- Claims Processing

- Claims Management

- Insurance Law

- Tort Law

- Data Analysis

Work Experience

Claims Analyst

- Reviewed medical records and other documentation to assess the validity of claims.

- Communicated with claimants, attorneys, and medical providers to gather information and resolve claims.

- Managed a team of claim adjusters, providing guidance and support.

- Developed and conducted training programs for new claim adjusters.

Claims Analyst

- Analyzed claim data to identify trends and patterns, resulting in a 15% reduction in claim leakage.

- Developed and implemented a new claim processing system that automated tasks, increasing efficiency by 20%.

- Negotiated settlements with claimants, achieving a 10% reduction in settlement costs.

- Conducted claim audits to ensure compliance with company policies and regulations.

Accomplishments

- Developed and implemented a new claims processing system, reducing claim processing time by 25%.

- Collaborated with legal and underwriting teams to establish new claims handling guidelines, improving claim outcomes by 15%.

- Developed and delivered training modules on claims investigation techniques, resulting in a 10% increase in claim resolution accuracy.

- Utilized data analysis to identify patterns and trends in claim occurrences, leading to the development of targeted loss prevention measures.

- Implemented a new claims management software system, streamlining claims processing and reducing the average claim cycle time by 20%.

Awards

- Received the Claims Analyst of the Year Award for consistently exceeding expectations in claim resolution.

- Recognized for exceptional performance in uncovering fraudulent claims, leading to the recovery of over $1 million in savings.

- Received the Team Excellence Award for consistently providing outstanding customer service in claims resolution.

- Recognized for exceptional contributions to the claims department, including the implementation of new technology and the development of innovative claims handling strategies.

Certificates

- Associate in Claims (AIC)

- Fellow, Claims Management Institute (FCMI)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Claims Professional (CCP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Analyst

- Highlight your analytical skills and ability to identify trends in claim data.

- Showcase your experience in developing and implementing process improvements that have resulted in significant cost savings.

- Emphasize your strong negotiation skills and ability to resolve claims effectively.

- Demonstrate your knowledge of insurance law and tort law, as well as your understanding of claim investigation and processing best practices.

Essential Experience Highlights for a Strong Claims Analyst Resume

- Analyzed claim data to identify trends and patterns, resulting in a 15% reduction in claim leakage.

- Developed and implemented a new claim processing system that automated tasks, increasing efficiency by 20%.

- Negotiated settlements with claimants, achieving a 10% reduction in settlement costs.

- Conducted claim audits to ensure compliance with company policies and regulations.

- Reviewed medical records and other documentation to assess the validity of claims.

- Communicated with claimants, attorneys, and medical providers to gather information and resolve claims.

- Managed a team of claim adjusters, providing guidance and support.

Frequently Asked Questions (FAQ’s) For Claims Analyst

What are the key skills required to be a successful Claims Analyst?

Key skills for a Claims Analyst include data analysis, claims investigation, processing, and management, as well as knowledge of insurance law and tort law.

What are the career prospects for Claims Analysts?

Claims Analysts can advance to roles such as Claims Manager, Claims Director, or even Chief Claims Officer.

What is the average salary for Claims Analysts?

The average salary for Claims Analysts varies depending on experience and location, but typically ranges from $50,000 to $80,000 per year.

What are the challenges faced by Claims Analysts?

Challenges faced by Claims Analysts include dealing with complex and often emotionally charged claims, as well as the need to stay up-to-date on changes in insurance regulations and laws.

What is the work environment like for Claims Analysts?

Claims Analysts typically work in office environments and may have to work overtime during peak claim periods.

What are the educational requirements for Claims Analysts?

Most Claims Analysts have a bachelor’s degree in a related field, such as business, finance, or insurance.