Are you a seasoned Claims Examiner seeking a new career path? Discover our professionally built Claims Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

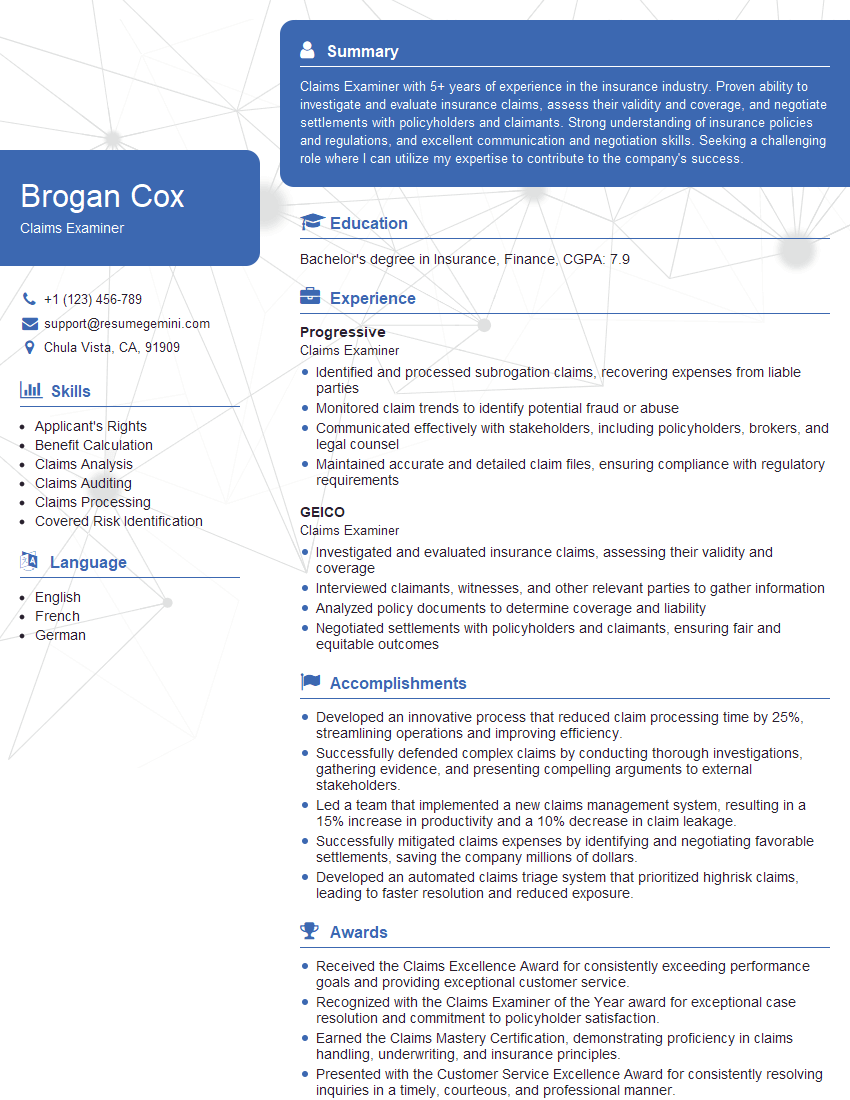

Brogan Cox

Claims Examiner

Summary

Claims Examiner with 5+ years of experience in the insurance industry. Proven ability to investigate and evaluate insurance claims, assess their validity and coverage, and negotiate settlements with policyholders and claimants. Strong understanding of insurance policies and regulations, and excellent communication and negotiation skills. Seeking a challenging role where I can utilize my expertise to contribute to the company’s success.

Education

Bachelor’s degree in Insurance, Finance

December 2015

Skills

- Applicant’s Rights

- Benefit Calculation

- Claims Analysis

- Claims Auditing

- Claims Processing

- Covered Risk Identification

Work Experience

Claims Examiner

- Identified and processed subrogation claims, recovering expenses from liable parties

- Monitored claim trends to identify potential fraud or abuse

- Communicated effectively with stakeholders, including policyholders, brokers, and legal counsel

- Maintained accurate and detailed claim files, ensuring compliance with regulatory requirements

Claims Examiner

- Investigated and evaluated insurance claims, assessing their validity and coverage

- Interviewed claimants, witnesses, and other relevant parties to gather information

- Analyzed policy documents to determine coverage and liability

- Negotiated settlements with policyholders and claimants, ensuring fair and equitable outcomes

Accomplishments

- Developed an innovative process that reduced claim processing time by 25%, streamlining operations and improving efficiency.

- Successfully defended complex claims by conducting thorough investigations, gathering evidence, and presenting compelling arguments to external stakeholders.

- Led a team that implemented a new claims management system, resulting in a 15% increase in productivity and a 10% decrease in claim leakage.

- Successfully mitigated claims expenses by identifying and negotiating favorable settlements, saving the company millions of dollars.

- Developed an automated claims triage system that prioritized highrisk claims, leading to faster resolution and reduced exposure.

Awards

- Received the Claims Excellence Award for consistently exceeding performance goals and providing exceptional customer service.

- Recognized with the Claims Examiner of the Year award for exceptional case resolution and commitment to policyholder satisfaction.

- Earned the Claims Mastery Certification, demonstrating proficiency in claims handling, underwriting, and insurance principles.

- Presented with the Customer Service Excellence Award for consistently resolving inquiries in a timely, courteous, and professional manner.

Certificates

- Associate in Claims (AIC)

- Associate in Risk Management (ARM)

- Certified Claim Professional (CCP)

- Certified Insurance Claims Specialist (CICS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Examiner

- Highlight your experience in claims investigation and evaluation.

- Showcase your knowledge of insurance policies and regulations.

- Demonstrate your strong communication and negotiation skills.

- Quantify your accomplishments whenever possible.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Claims Examiner Resume

- Investigated and evaluated insurance claims for validity and coverage

- Interviewed claimants, witnesses, and other relevant parties to gather information

- Analyzed policy documents to determine coverage and liability

- Negotiated settlements with policyholders and claimants, ensuring fair and equitable outcomes

- Identified and processed subrogation claims, recovering expenses from liable parties

- Monitored claim trends to identify potential fraud or abuse

- Communicated effectively with stakeholders, including policyholders, brokers, and legal counsel

Frequently Asked Questions (FAQ’s) For Claims Examiner

What are the key responsibilities of a Claims Examiner?

Claims Examiners investigate and evaluate insurance claims, assess their validity and coverage, and negotiate settlements with policyholders and claimants. They also interview claimants, witnesses, and other relevant parties to gather information, analyze policy documents to determine coverage and liability, and identify and process subrogation claims.

What are the qualifications for becoming a Claims Examiner?

Most Claims Examiners have a bachelor’s degree in insurance, finance, or a related field. They also typically have several years of experience in the insurance industry, and strong communication and negotiation skills.

What is the job outlook for Claims Examiners?

The job outlook for Claims Examiners is expected to be good over the next few years. As the population ages and the number of insurance claims increases, there will be a growing need for qualified Claims Examiners.

What are the earning prospects for Claims Examiners?

Claims Examiners can earn a wide range of salaries, depending on their experience, education, and location. The median annual salary for Claims Examiners is around $60,000.

What are the benefits of working as a Claims Examiner?

Claims Examiners can enjoy a number of benefits, including: job security, a competitive salary, and the opportunity to help people in need. They also have the opportunity to learn about the insurance industry and develop valuable skills.

What are the challenges of working as a Claims Examiner?

Claims Examiners can face a number of challenges, including: dealing with difficult customers, working long hours, and being exposed to traumatic events. They must also be able to handle stress and make difficult decisions.