Are you a seasoned Claims Manager seeking a new career path? Discover our professionally built Claims Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

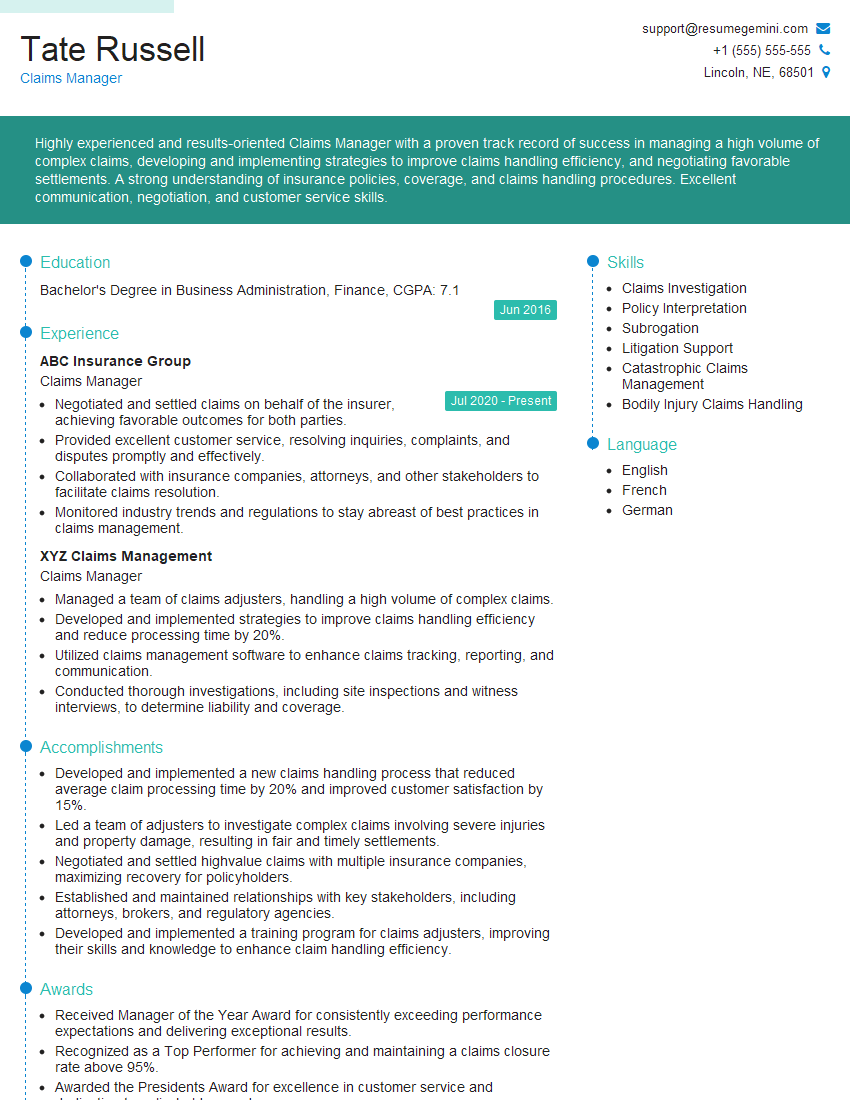

Tate Russell

Claims Manager

Summary

Highly experienced and results-oriented Claims Manager with a proven track record of success in managing a high volume of complex claims, developing and implementing strategies to improve claims handling efficiency, and negotiating favorable settlements. A strong understanding of insurance policies, coverage, and claims handling procedures. Excellent communication, negotiation, and customer service skills.

Education

Bachelor’s Degree in Business Administration, Finance

June 2016

Skills

- Claims Investigation

- Policy Interpretation

- Subrogation

- Litigation Support

- Catastrophic Claims Management

- Bodily Injury Claims Handling

Work Experience

Claims Manager

- Negotiated and settled claims on behalf of the insurer, achieving favorable outcomes for both parties.

- Provided excellent customer service, resolving inquiries, complaints, and disputes promptly and effectively.

- Collaborated with insurance companies, attorneys, and other stakeholders to facilitate claims resolution.

- Monitored industry trends and regulations to stay abreast of best practices in claims management.

Claims Manager

- Managed a team of claims adjusters, handling a high volume of complex claims.

- Developed and implemented strategies to improve claims handling efficiency and reduce processing time by 20%.

- Utilized claims management software to enhance claims tracking, reporting, and communication.

- Conducted thorough investigations, including site inspections and witness interviews, to determine liability and coverage.

Accomplishments

- Developed and implemented a new claims handling process that reduced average claim processing time by 20% and improved customer satisfaction by 15%.

- Led a team of adjusters to investigate complex claims involving severe injuries and property damage, resulting in fair and timely settlements.

- Negotiated and settled highvalue claims with multiple insurance companies, maximizing recovery for policyholders.

- Established and maintained relationships with key stakeholders, including attorneys, brokers, and regulatory agencies.

- Developed and implemented a training program for claims adjusters, improving their skills and knowledge to enhance claim handling efficiency.

Awards

- Received Manager of the Year Award for consistently exceeding performance expectations and delivering exceptional results.

- Recognized as a Top Performer for achieving and maintaining a claims closure rate above 95%.

- Awarded the Presidents Award for excellence in customer service and dedication to policyholder needs.

- Received the Industry Recognition Award for contributions to the advancement of claims management best practices.

Certificates

- Associate in Claims (AIC)

- Certified Claims Professional (CCP)

- Fellow, Claims and Litigation Management (FCLM)

- Certified Insurance Litigation Specialist (CILS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Manager

- Highlight your experience in claims management, particularly your ability to handle complex claims and achieve favorable outcomes.

- Emphasize your skills in claims investigation, policy interpretation, subrogation, litigation support, and catastrophic claims management.

- Demonstrate your proficiency in using claims management software and your understanding of insurance policies and coverage.

- Showcase your commitment to customer service and your ability to resolve inquiries, complaints, and disputes effectively.

Essential Experience Highlights for a Strong Claims Manager Resume

- Managed a team of claims adjusters, providing guidance, support, and training.

- Developed and implemented strategies to improve claims handling efficiency and reduce processing time by 20%.

- Utilized claims management software to enhance claims tracking, reporting, and communication.

- Conducted thorough investigations, including site inspections and witness interviews, to determine liability and coverage.

- Negotiated and settled claims on behalf of the insurer, achieving favorable outcomes for both parties.

- Provided excellent customer service, resolving inquiries, complaints, and disputes promptly and effectively.

- Collaborated with insurance companies, attorneys, and other stakeholders to facilitate claims resolution.

Frequently Asked Questions (FAQ’s) For Claims Manager

What is the role of a Claims Manager?

A Claims Manager is responsible for overseeing the claims handling process, including investigation, evaluation, negotiation, and settlement of claims on behalf of an insurance company or self-insured organization.

What are the key skills and qualifications required for a Claims Manager?

Key skills and qualifications include a strong understanding of insurance policies and coverage, claims handling procedures, investigation techniques, negotiation skills, customer service skills, and proficiency in claims management software.

What are the career prospects for a Claims Manager?

Claims Managers with experience and expertise can advance to leadership roles such as Claims Director, Chief Claims Officer, or Vice President of Claims.

What are the challenges faced by Claims Managers?

Claims Managers face challenges such as managing a high volume of claims, dealing with complex and often contentious claims, and staying abreast of changes in insurance regulations and industry best practices.

What are the key trends in claims management?

Key trends include the use of technology to improve claims handling efficiency, the focus on customer experience, and the increasing emphasis on fraud detection and prevention.