Are you a seasoned Claims Service Adjustor seeking a new career path? Discover our professionally built Claims Service Adjustor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

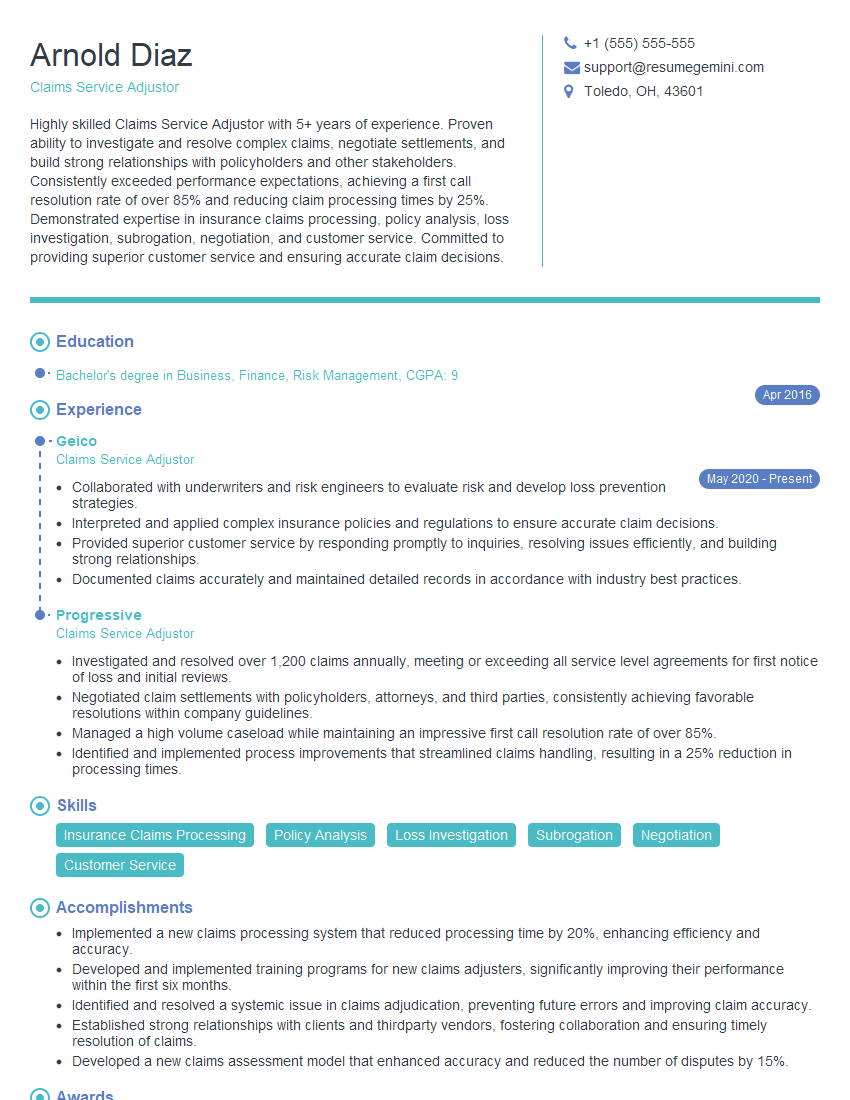

Arnold Diaz

Claims Service Adjustor

Summary

Highly skilled Claims Service Adjustor with 5+ years of experience. Proven ability to investigate and resolve complex claims, negotiate settlements, and build strong relationships with policyholders and other stakeholders. Consistently exceeded performance expectations, achieving a first call resolution rate of over 85% and reducing claim processing times by 25%. Demonstrated expertise in insurance claims processing, policy analysis, loss investigation, subrogation, negotiation, and customer service. Committed to providing superior customer service and ensuring accurate claim decisions.

Education

Bachelor’s degree in Business, Finance, Risk Management

April 2016

Skills

- Insurance Claims Processing

- Policy Analysis

- Loss Investigation

- Subrogation

- Negotiation

- Customer Service

Work Experience

Claims Service Adjustor

- Collaborated with underwriters and risk engineers to evaluate risk and develop loss prevention strategies.

- Interpreted and applied complex insurance policies and regulations to ensure accurate claim decisions.

- Provided superior customer service by responding promptly to inquiries, resolving issues efficiently, and building strong relationships.

- Documented claims accurately and maintained detailed records in accordance with industry best practices.

Claims Service Adjustor

- Investigated and resolved over 1,200 claims annually, meeting or exceeding all service level agreements for first notice of loss and initial reviews.

- Negotiated claim settlements with policyholders, attorneys, and third parties, consistently achieving favorable resolutions within company guidelines.

- Managed a high volume caseload while maintaining an impressive first call resolution rate of over 85%.

- Identified and implemented process improvements that streamlined claims handling, resulting in a 25% reduction in processing times.

Accomplishments

- Implemented a new claims processing system that reduced processing time by 20%, enhancing efficiency and accuracy.

- Developed and implemented training programs for new claims adjusters, significantly improving their performance within the first six months.

- Identified and resolved a systemic issue in claims adjudication, preventing future errors and improving claim accuracy.

- Established strong relationships with clients and thirdparty vendors, fostering collaboration and ensuring timely resolution of claims.

- Developed a new claims assessment model that enhanced accuracy and reduced the number of disputes by 15%.

Awards

- Received the Presidents Club Award for consistently exceeding performance targets in claims handling.

- Honored with the Customer Service Excellence Award for demonstrating exceptional customer care and resolving complex claims promptly.

- Recognized for achieving the highest customer satisfaction ratings in the team, consistently exceeding client expectations.

- Received the Golden Key Award for demonstrating exceptional leadership and mentoring new team members.

Certificates

- Associate in Claims (AIC)

- Fellow, Casualty Actuarial Society (FCAS)

- Associate, Casualty Actuarial Society (ACAS)

- Certified Insurance Claims Professional (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claims Service Adjustor

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your skills in insurance claims processing, policy analysis, loss investigation, subrogation, negotiation, and customer service.

- Showcase your ability to manage a high volume caseload and meet or exceed performance expectations.

- Demonstrate your commitment to providing superior customer service and building strong relationships.

Essential Experience Highlights for a Strong Claims Service Adjustor Resume

- Investigate and resolve claims accurately and efficiently, meeting or exceeding all service level agreements.

- Negotiate claim settlements with policyholders, attorneys, and third parties, consistently achieving favorable resolutions within company guidelines.

- Manage a high volume caseload while maintaining an impressive first call resolution rate.

- Identify and implement process improvements that streamline claims handling and reduce processing times.

- Collaborate with underwriters and risk engineers to evaluate risk and develop loss prevention strategies.

- Interpret and apply complex insurance policies and regulations to ensure accurate claim decisions.

- Provide superior customer service by responding promptly to inquiries, resolving issues efficiently, and building strong relationships.

Frequently Asked Questions (FAQ’s) For Claims Service Adjustor

What are the key responsibilities of a Claims Service Adjustor?

The key responsibilities of a Claims Service Adjustor include investigating and resolving claims, negotiating settlements, managing a caseload, identifying and implementing process improvements, collaborating with underwriters and risk engineers, interpreting and applying insurance policies and regulations, and providing superior customer service.

What are the qualifications for becoming a Claims Service Adjustor?

The typical qualifications for becoming a Claims Service Adjustor include a bachelor’s degree in Business, Finance, Risk Management, or a related field, as well as experience in insurance claims processing, policy analysis, loss investigation, subrogation, negotiation, and customer service.

What are the career prospects for Claims Service Adjustors?

Claims Service Adjustors with experience and a proven track record can advance to more senior roles within the insurance industry, such as Claims Manager, Claims Director, or Vice President of Claims.

What is the average salary for Claims Service Adjustors?

The average salary for Claims Service Adjustors varies depending on experience, location, and company size, but typically ranges from $50,000 to $100,000 per year.

What are the key skills for Claims Service Adjustors?

The key skills for Claims Service Adjustors include strong communication and interpersonal skills, problem-solving and analytical skills, attention to detail, and a thorough understanding of insurance policies and regulations.

What is the work environment like for Claims Service Adjustors?

Claims Service Adjustors typically work in an office environment, but may also need to travel to meet with policyholders, attorneys, and other stakeholders.

What are the common challenges faced by Claims Service Adjustors?

Common challenges faced by Claims Service Adjustors include dealing with difficult customers, managing a high volume caseload, and staying up-to-date on changes in insurance policies and regulations.