Are you a seasoned Clearing Hand seeking a new career path? Discover our professionally built Clearing Hand Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

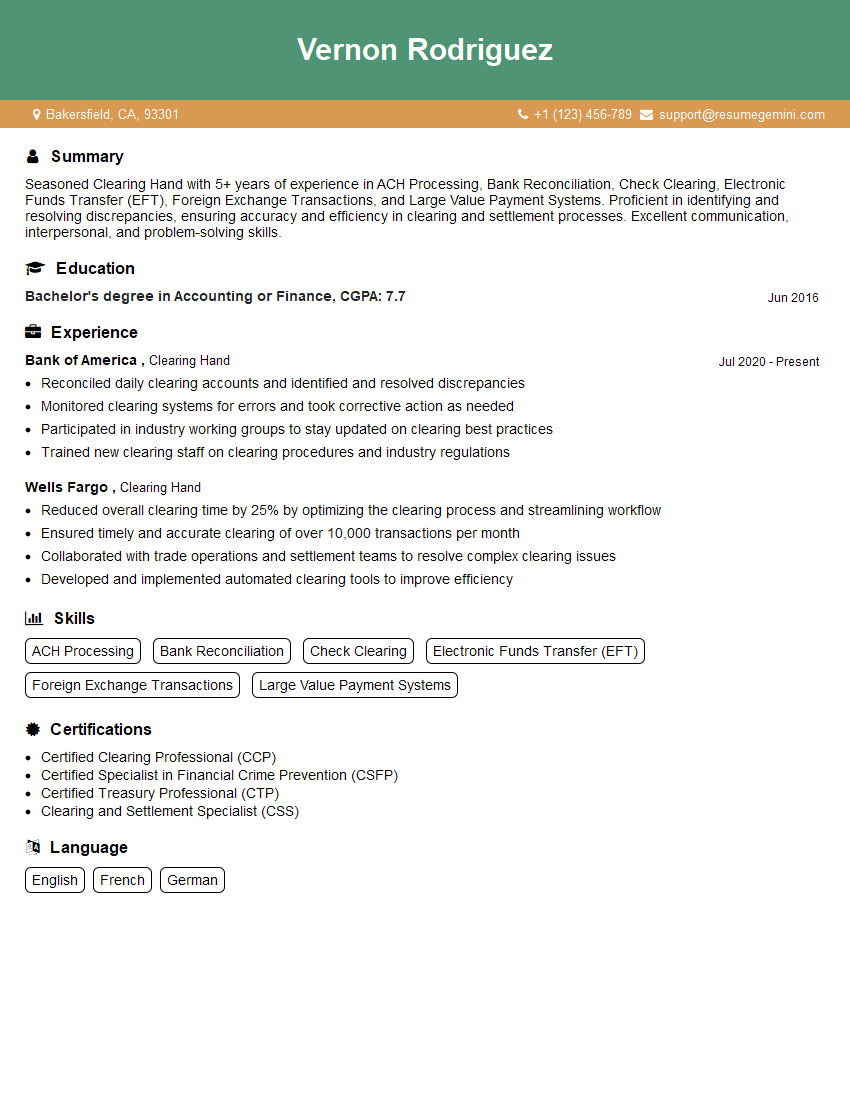

Vernon Rodriguez

Clearing Hand

Summary

Seasoned Clearing Hand with 5+ years of experience in ACH Processing, Bank Reconciliation, Check Clearing, Electronic Funds Transfer (EFT), Foreign Exchange Transactions, and Large Value Payment Systems. Proficient in identifying and resolving discrepancies, ensuring accuracy and efficiency in clearing and settlement processes. Excellent communication, interpersonal, and problem-solving skills.

Education

Bachelor’s degree in Accounting or Finance

June 2016

Skills

- ACH Processing

- Bank Reconciliation

- Check Clearing

- Electronic Funds Transfer (EFT)

- Foreign Exchange Transactions

- Large Value Payment Systems

Work Experience

Clearing Hand

- Reconciled daily clearing accounts and identified and resolved discrepancies

- Monitored clearing systems for errors and took corrective action as needed

- Participated in industry working groups to stay updated on clearing best practices

- Trained new clearing staff on clearing procedures and industry regulations

Clearing Hand

- Reduced overall clearing time by 25% by optimizing the clearing process and streamlining workflow

- Ensured timely and accurate clearing of over 10,000 transactions per month

- Collaborated with trade operations and settlement teams to resolve complex clearing issues

- Developed and implemented automated clearing tools to improve efficiency

Certificates

- Certified Clearing Professional (CCP)

- Certified Specialist in Financial Crime Prevention (CSFP)

- Certified Treasury Professional (CTP)

- Clearing and Settlement Specialist (CSS)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Clearing Hand

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your ability to identify and resolve discrepancies efficiently.

- Demonstrate your knowledge of regulatory compliance and industry standards.

- Emphasize your strong communication and interpersonal skills.

Essential Experience Highlights for a Strong Clearing Hand Resume

- Process Automated Clearing House (ACH) transactions, including credits, debits, and returns.

- Reconcile bank statements and identify any discrepancies.

- Clear checks and other paper-based payments.

- Execute Electronic Funds Transfers (EFTs) and manage foreign exchange transactions.

- Participate in Large Value Payment Systems (LVPS) to facilitate high-value payments.

- Stay updated on regulatory changes and industry best practices related to clearing and settlement.

- Provide training and support to other team members on clearing and settlement processes.

Frequently Asked Questions (FAQ’s) For Clearing Hand

What is the primary role of a Clearing Hand?

The primary role of a Clearing Hand is to facilitate and ensure the smooth flow of financial transactions by processing, clearing, and settling payments and other financial instruments.

What skills are essential for a successful Clearing Hand?

Essential skills for a Clearing Hand include ACH Processing, Bank Reconciliation, Check Clearing, Electronic Funds Transfer (EFT), Foreign Exchange Transactions, Large Value Payment Systems, attention to detail, accuracy, and problem-solving abilities.

What is the career progression path for a Clearing Hand?

Clearing Hands can advance to roles such as Payment Specialist, Settlement Officer, or Treasury Analyst with experience and additional qualifications.

What are the key challenges faced by Clearing Hands in the current financial landscape?

Key challenges for Clearing Hands include regulatory compliance, technological advancements, and the increasing complexity of financial transactions.

How can I prepare myself for a career as a Clearing Hand?

To prepare for a career as a Clearing Hand, consider pursuing a degree in Accounting or Finance, gaining experience in a related field, and obtaining certifications in relevant areas.

What is the average salary range for a Clearing Hand?

The average salary range for a Clearing Hand varies depending on experience, location, and company size, but typically falls within the range of $50,000 to $80,000 per year.

What are the benefits of working as a Clearing Hand?

Benefits of working as a Clearing Hand include job stability, opportunities for career growth, and the satisfaction of contributing to the smooth functioning of the financial system.