Are you a seasoned Clerical Adjuster seeking a new career path? Discover our professionally built Clerical Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

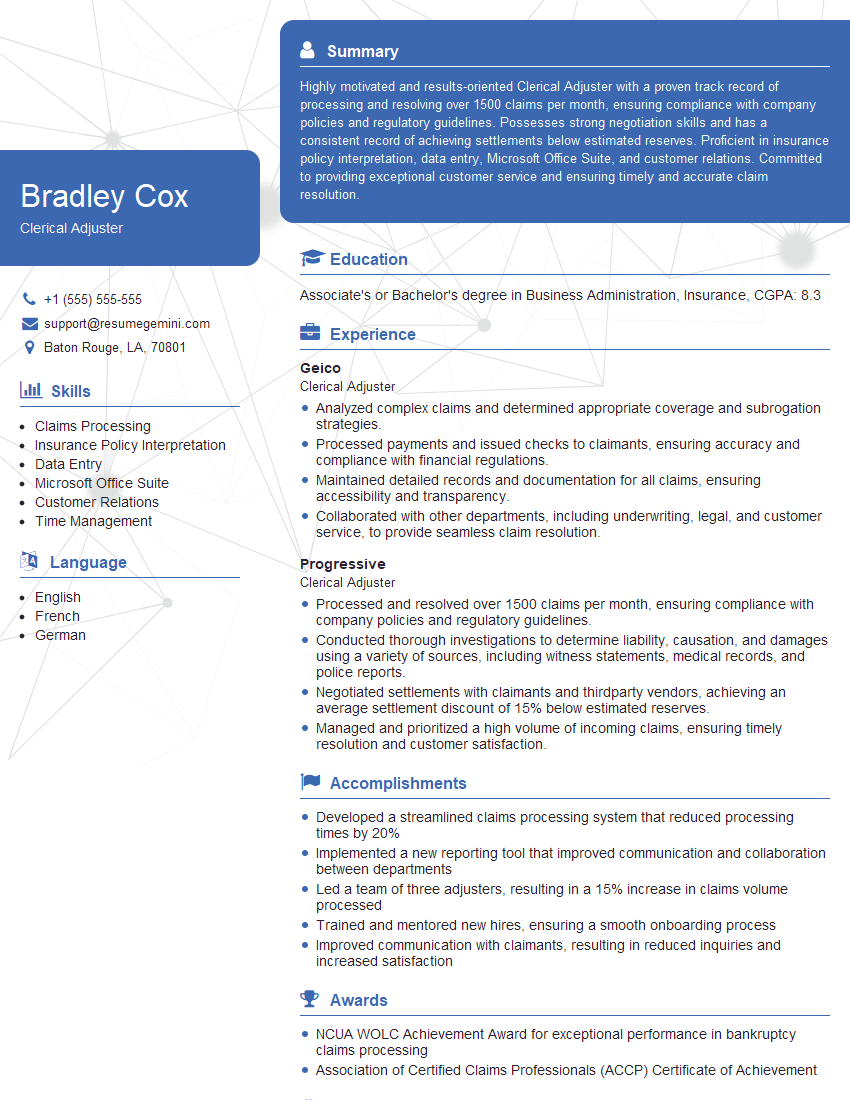

Bradley Cox

Clerical Adjuster

Summary

Highly motivated and results-oriented Clerical Adjuster with a proven track record of processing and resolving over 1500 claims per month, ensuring compliance with company policies and regulatory guidelines. Possesses strong negotiation skills and has a consistent record of achieving settlements below estimated reserves. Proficient in insurance policy interpretation, data entry, Microsoft Office Suite, and customer relations. Committed to providing exceptional customer service and ensuring timely and accurate claim resolution.

Education

Associate’s or Bachelor’s degree in Business Administration, Insurance

June 2015

Skills

- Claims Processing

- Insurance Policy Interpretation

- Data Entry

- Microsoft Office Suite

- Customer Relations

- Time Management

Work Experience

Clerical Adjuster

- Analyzed complex claims and determined appropriate coverage and subrogation strategies.

- Processed payments and issued checks to claimants, ensuring accuracy and compliance with financial regulations.

- Maintained detailed records and documentation for all claims, ensuring accessibility and transparency.

- Collaborated with other departments, including underwriting, legal, and customer service, to provide seamless claim resolution.

Clerical Adjuster

- Processed and resolved over 1500 claims per month, ensuring compliance with company policies and regulatory guidelines.

- Conducted thorough investigations to determine liability, causation, and damages using a variety of sources, including witness statements, medical records, and police reports.

- Negotiated settlements with claimants and thirdparty vendors, achieving an average settlement discount of 15% below estimated reserves.

- Managed and prioritized a high volume of incoming claims, ensuring timely resolution and customer satisfaction.

Accomplishments

- Developed a streamlined claims processing system that reduced processing times by 20%

- Implemented a new reporting tool that improved communication and collaboration between departments

- Led a team of three adjusters, resulting in a 15% increase in claims volume processed

- Trained and mentored new hires, ensuring a smooth onboarding process

- Improved communication with claimants, resulting in reduced inquiries and increased satisfaction

Awards

- NCUA WOLC Achievement Award for exceptional performance in bankruptcy claims processing

- Association of Certified Claims Professionals (ACCP) Certificate of Achievement

Certificates

- Certified Insurance Adjuster (AIC)

- Associate in Claims (AIC)

- Certified Professional Adjuster (CPA)

- Claims Adjuster License

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Clerical Adjuster

- Use action verbs and quantify your accomplishments with specific metrics whenever possible.

- Highlight your skills in negotiation, data analysis, and customer service.

- Showcase your knowledge of insurance policies and claims procedures.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Clerical Adjuster Resume

- Processed and resolved a high volume of claims, ensuring compliance with company policies and regulatory guidelines.

- Conducted thorough investigations to determine liability, causation, and damages using various sources.

- Negotiated settlements with claimants and third-party vendors, achieving an average settlement discount.

- Managed and prioritized incoming claims to ensure timely resolution and customer satisfaction.

- Analyzed complex claims to determine appropriate coverage and subrogation strategies.

- Processed payments and issued checks to claimants, ensuring accuracy and compliance with financial regulations.

- Collaborated with other departments to provide seamless claim resolution.

Frequently Asked Questions (FAQ’s) For Clerical Adjuster

What are the key skills required to be a successful Clerical Adjuster?

The key skills required to be a successful Clerical Adjuster include claims processing, insurance policy interpretation, negotiation, communication, and attention to detail.

What is the average salary for a Clerical Adjuster?

The average salary for a Clerical Adjuster in the United States is around $45,000 per year.

What is the job outlook for Clerical Adjusters?

The job outlook for Clerical Adjusters is expected to grow by about 8% over the next decade.

What are the benefits of working as a Clerical Adjuster?

The benefits of working as a Clerical Adjuster include flexible working hours, opportunities for advancement, paid time off, and health insurance.

Is a Clerical Adjuster required to have any specific certifications?

Most Clerical Adjusters do not require any specific certifications, but some may opt to obtain the Associate in Claims (AIC) designation or the Certified Insurance Adjuster (CIA) designation.