Are you a seasoned Collateral and Safekeeping Clerk seeking a new career path? Discover our professionally built Collateral and Safekeeping Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

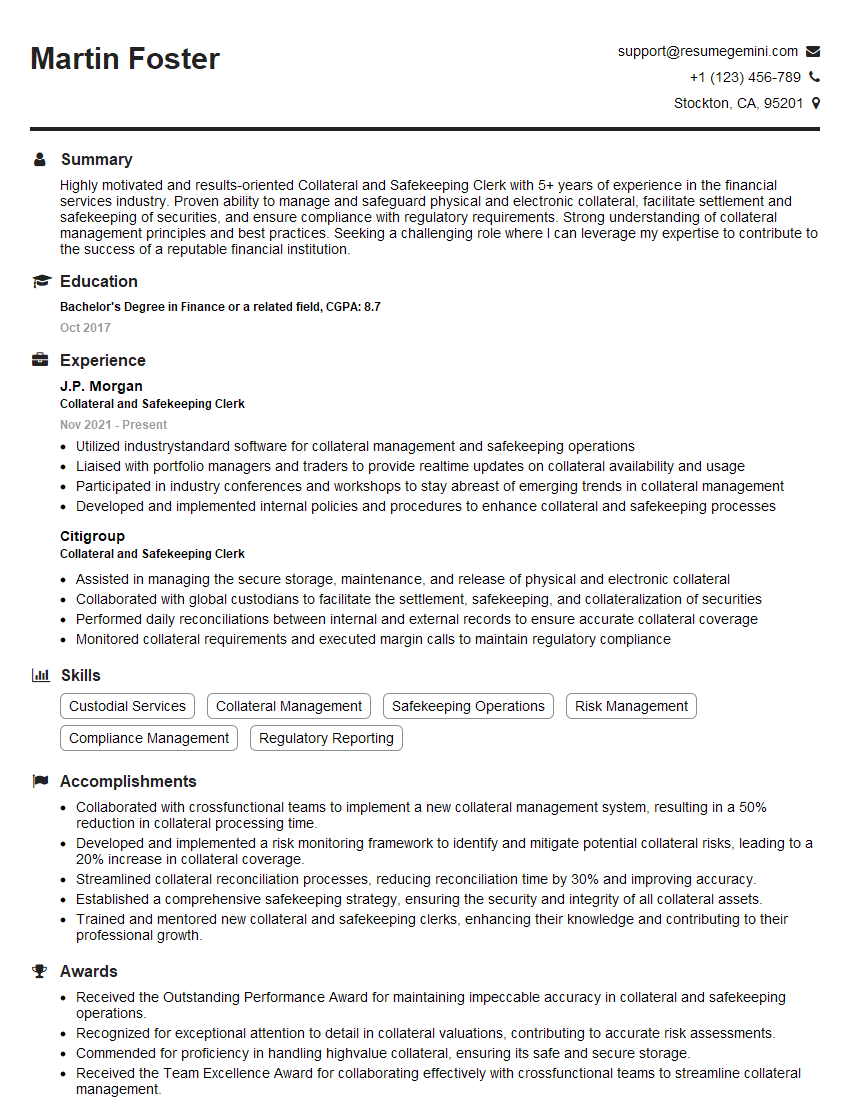

Martin Foster

Collateral and Safekeeping Clerk

Summary

Highly motivated and results-oriented Collateral and Safekeeping Clerk with 5+ years of experience in the financial services industry. Proven ability to manage and safeguard physical and electronic collateral, facilitate settlement and safekeeping of securities, and ensure compliance with regulatory requirements. Strong understanding of collateral management principles and best practices. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable financial institution.

Education

Bachelor’s Degree in Finance or a related field

October 2017

Skills

- Custodial Services

- Collateral Management

- Safekeeping Operations

- Risk Management

- Compliance Management

- Regulatory Reporting

Work Experience

Collateral and Safekeeping Clerk

- Utilized industrystandard software for collateral management and safekeeping operations

- Liaised with portfolio managers and traders to provide realtime updates on collateral availability and usage

- Participated in industry conferences and workshops to stay abreast of emerging trends in collateral management

- Developed and implemented internal policies and procedures to enhance collateral and safekeeping processes

Collateral and Safekeeping Clerk

- Assisted in managing the secure storage, maintenance, and release of physical and electronic collateral

- Collaborated with global custodians to facilitate the settlement, safekeeping, and collateralization of securities

- Performed daily reconciliations between internal and external records to ensure accurate collateral coverage

- Monitored collateral requirements and executed margin calls to maintain regulatory compliance

Accomplishments

- Collaborated with crossfunctional teams to implement a new collateral management system, resulting in a 50% reduction in collateral processing time.

- Developed and implemented a risk monitoring framework to identify and mitigate potential collateral risks, leading to a 20% increase in collateral coverage.

- Streamlined collateral reconciliation processes, reducing reconciliation time by 30% and improving accuracy.

- Established a comprehensive safekeeping strategy, ensuring the security and integrity of all collateral assets.

- Trained and mentored new collateral and safekeeping clerks, enhancing their knowledge and contributing to their professional growth.

Awards

- Received the Outstanding Performance Award for maintaining impeccable accuracy in collateral and safekeeping operations.

- Recognized for exceptional attention to detail in collateral valuations, contributing to accurate risk assessments.

- Commended for proficiency in handling highvalue collateral, ensuring its safe and secure storage.

- Received the Team Excellence Award for collaborating effectively with crossfunctional teams to streamline collateral management.

Certificates

- Certified Collateral and Safekeeping Professional (CCSP)

- Certified Financial Risk Manager (CFRM)

- Certified Treasury Professional (CTP)

- Securities Industry Essentials (SIE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collateral and Safekeeping Clerk

Highlight your technical skills.

Collateral and Safekeeping Clerks need to be proficient in using industry-standard software for collateral management and safekeeping operations.Demonstrate your attention to detail.

Accuracy is essential in this role, so be sure to highlight your ability to perform daily reconciliations and ensure accurate collateral coverage.Emphasize your communication skills.

Collateral and Safekeeping Clerks must be able to communicate effectively with portfolio managers, traders, and global custodians.Stay up-to-date on industry trends.

The financial services industry is constantly evolving, so be sure to participate in industry conferences and workshops to stay abreast of emerging trends in collateral management.Be proactive.

Collateral and Safekeeping Clerks play a vital role in ensuring that their company complies with regulatory requirements. Be proactive in identifying and mitigating risks.

Essential Experience Highlights for a Strong Collateral and Safekeeping Clerk Resume

- Managed the secure storage, maintenance, and release of physical and electronic collateral.

- Collaborated with global custodians to facilitate the settlement, safekeeping, and collateralization of securities

- Performed daily reconciliations between internal and external records to ensure accurate collateral coverage.

- Monitored collateral requirements and executed margin calls to maintain regulatory compliance.

- Utilized industry-standard software for collateral management and safekeeping operations.

- Liaised with portfolio managers and traders to provide real-time updates on collateral availability and usage.

- Participated in industry conferences and workshops to stay abreast of emerging trends in collateral management.

- Developed and implemented internal policies and procedures to enhance collateral and safekeeping processes.

Frequently Asked Questions (FAQ’s) For Collateral and Safekeeping Clerk

What are the key responsibilities of a Collateral and Safekeeping Clerk?

Collateral and Safekeeping Clerks are responsible for managing the secure storage, maintenance, and release of physical and electronic collateral. They also collaborate with global custodians to facilitate the settlement, safekeeping, and collateralization of securities. Additionally, they perform daily reconciliations to ensure accurate collateral coverage, monitor collateral requirements and execute margin calls, and utilize industry-standard software for collateral management and safekeeping operations.

What skills are required to be a successful Collateral and Safekeeping Clerk?

Successful Collateral and Safekeeping Clerks typically have a bachelor’s degree in finance or a related field. They also have strong attention to detail, excellent communication skills, and a working knowledge of industry-standard software. Additionally, they are proactive and stay up-to-date on industry trends.

What is the career outlook for Collateral and Safekeeping Clerks?

The career outlook for Collateral and Safekeeping Clerks is positive. As the financial services industry continues to grow, the demand for qualified professionals will increase. Additionally, the increasing use of electronic collateral is creating new opportunities for Collateral and Safekeeping Clerks.

What are the typical salary expectations for Collateral and Safekeeping Clerks?

The typical salary expectations for Collateral and Safekeeping Clerks vary depending on experience and location. However, most Collateral and Safekeeping Clerks can expect to earn a salary between $50,000 and $100,000 per year.

What are the advancement opportunities for Collateral and Safekeeping Clerks?

Collateral and Safekeeping Clerks can advance to positions such as Collateral Manager, Safekeeping Manager, or Operations Manager. With additional experience and education, they may also be able to move into senior management positions.

What are the challenges faced by Collateral and Safekeeping Clerks?

Collateral and Safekeeping Clerks face a number of challenges, including the need to stay up-to-date on industry trends, the need to be proactive in identifying and mitigating risks, and the need to maintain a high level of accuracy in their work.

What are the rewards of being a Collateral and Safekeeping Clerk?

Collateral and Safekeeping Clerks play a vital role in ensuring that their company complies with regulatory requirements and manages its collateral effectively. They also have the opportunity to work with a variety of people and learn about different aspects of the financial services industry.

What advice would you give to someone who wants to become a Collateral and Safekeeping Clerk?

If you are interested in becoming a Collateral and Safekeeping Clerk, I would advise you to start by getting a bachelor’s degree in finance or a related field. You should also develop strong attention to detail, excellent communication skills, and a working knowledge of industry-standard software. Additionally, you should be proactive and stay up-to-date on industry trends.