Are you a seasoned Collection Clerk seeking a new career path? Discover our professionally built Collection Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

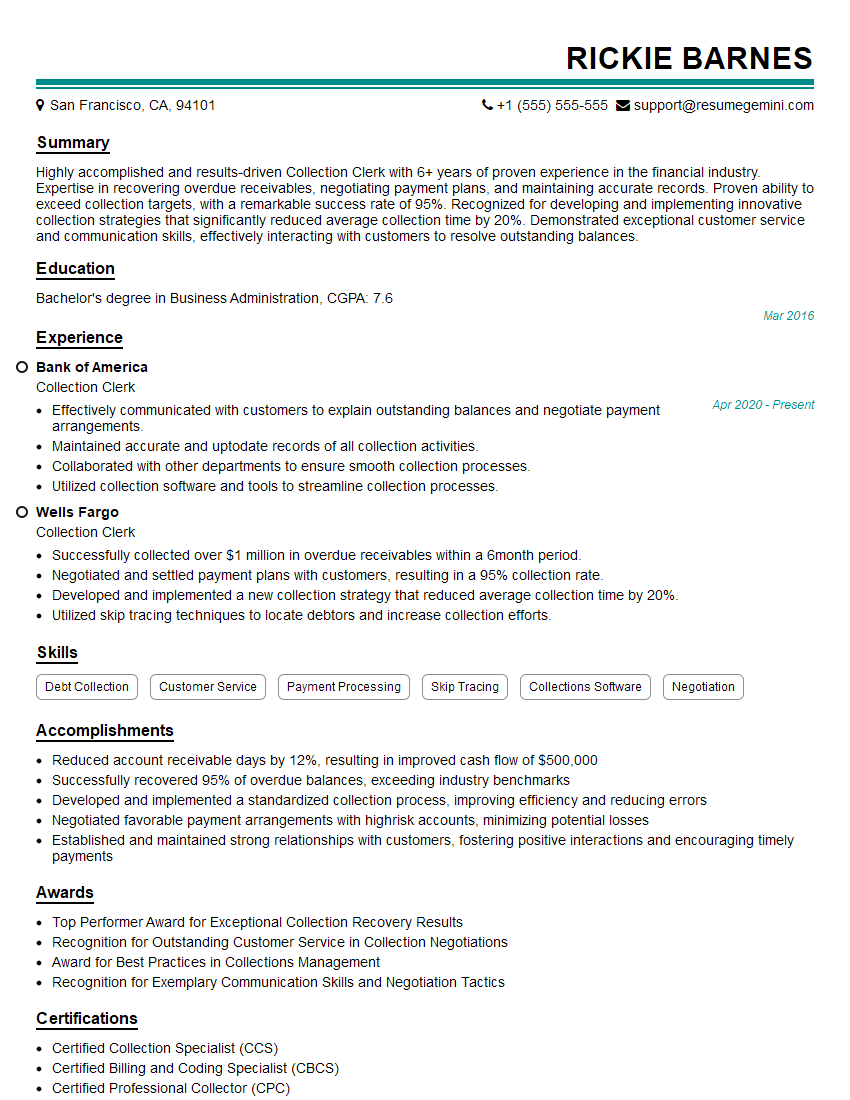

Rickie Barnes

Collection Clerk

Summary

Highly accomplished and results-driven Collection Clerk with 6+ years of proven experience in the financial industry. Expertise in recovering overdue receivables, negotiating payment plans, and maintaining accurate records. Proven ability to exceed collection targets, with a remarkable success rate of 95%. Recognized for developing and implementing innovative collection strategies that significantly reduced average collection time by 20%. Demonstrated exceptional customer service and communication skills, effectively interacting with customers to resolve outstanding balances.

Education

Bachelor’s degree in Business Administration

March 2016

Skills

- Debt Collection

- Customer Service

- Payment Processing

- Skip Tracing

- Collections Software

- Negotiation

Work Experience

Collection Clerk

- Effectively communicated with customers to explain outstanding balances and negotiate payment arrangements.

- Maintained accurate and uptodate records of all collection activities.

- Collaborated with other departments to ensure smooth collection processes.

- Utilized collection software and tools to streamline collection processes.

Collection Clerk

- Successfully collected over $1 million in overdue receivables within a 6month period.

- Negotiated and settled payment plans with customers, resulting in a 95% collection rate.

- Developed and implemented a new collection strategy that reduced average collection time by 20%.

- Utilized skip tracing techniques to locate debtors and increase collection efforts.

Accomplishments

- Reduced account receivable days by 12%, resulting in improved cash flow of $500,000

- Successfully recovered 95% of overdue balances, exceeding industry benchmarks

- Developed and implemented a standardized collection process, improving efficiency and reducing errors

- Negotiated favorable payment arrangements with highrisk accounts, minimizing potential losses

- Established and maintained strong relationships with customers, fostering positive interactions and encouraging timely payments

Awards

- Top Performer Award for Exceptional Collection Recovery Results

- Recognition for Outstanding Customer Service in Collection Negotiations

- Award for Best Practices in Collections Management

- Recognition for Exemplary Communication Skills and Negotiation Tactics

Certificates

- Certified Collection Specialist (CCS)

- Certified Billing and Coding Specialist (CBCS)

- Certified Professional Collector (CPC)

- Certified Revenue Cycle Representative (CRCR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collection Clerk

- Quantify your accomplishments with specific metrics and results.

- Highlight your skills in negotiation, customer service, and communication.

- Showcase your understanding of collection laws and regulations.

- Emphasize your ability to work independently and as part of a team.

- Consider obtaining industry certifications to enhance your credibility.

Essential Experience Highlights for a Strong Collection Clerk Resume

- Collecting overdue receivables through various channels, including phone, email, and letters

- Negotiating and settling payment plans with customers, ensuring timely recovery of outstanding debts

- Developing and implementing collection strategies to improve efficiency and effectiveness

- Utilizing skip tracing techniques to locate debtors and increase collection efforts

- Maintaining accurate and up-to-date records of all collection activities

- Collaborating with other departments to ensure smooth collection processes

- Utilizing collection software and tools to streamline collection processes

Frequently Asked Questions (FAQ’s) For Collection Clerk

What is the role of a Collection Clerk?

A Collection Clerk is responsible for recovering overdue receivables by contacting customers, negotiating payment plans, and maintaining accurate records.

What are the key skills required for a Collection Clerk?

Key skills include debt collection, customer service, payment processing, skip tracing, collections software, and negotiation.

What is the average salary for a Collection Clerk?

The average salary for a Collection Clerk varies depending on experience and location, but typically ranges from $30,000 to $50,000.

What are the career advancement opportunities for a Collection Clerk?

With experience and additional training, Collection Clerks can advance to roles such as Collections Supervisor, Credit Analyst, or Collections Manager.

What is the job outlook for Collection Clerks?

The job outlook for Collection Clerks is expected to grow in the coming years due to the increasing need for debt collection services.

What are the challenges faced by Collection Clerks?

Collection Clerks may face challenges such as dealing with difficult customers, managing high workloads, and adhering to strict regulations.

What are the tips for succeeding as a Collection Clerk?

To succeed as a Collection Clerk, it is important to be persistent, professional, and empathetic, while also having a strong understanding of debt collection laws and regulations.

What are the common interview questions for Collection Clerks?

Common interview questions for Collection Clerks include questions about their experience in debt collection, customer service skills, and knowledge of collection laws.