Are you a seasoned Collection Teller seeking a new career path? Discover our professionally built Collection Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

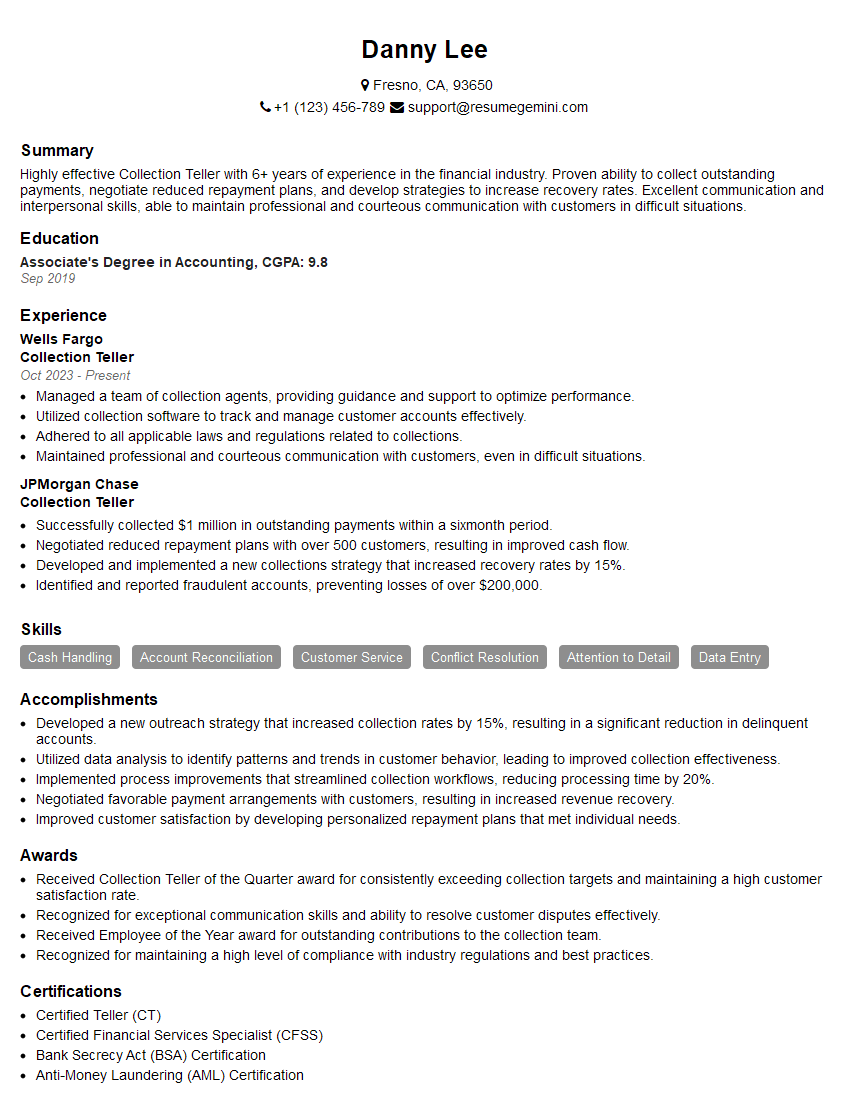

Danny Lee

Collection Teller

Summary

Highly effective Collection Teller with 6+ years of experience in the financial industry. Proven ability to collect outstanding payments, negotiate reduced repayment plans, and develop strategies to increase recovery rates. Excellent communication and interpersonal skills, able to maintain professional and courteous communication with customers in difficult situations.

Education

Associate’s Degree in Accounting

September 2019

Skills

- Cash Handling

- Account Reconciliation

- Customer Service

- Conflict Resolution

- Attention to Detail

- Data Entry

Work Experience

Collection Teller

- Managed a team of collection agents, providing guidance and support to optimize performance.

- Utilized collection software to track and manage customer accounts effectively.

- Adhered to all applicable laws and regulations related to collections.

- Maintained professional and courteous communication with customers, even in difficult situations.

Collection Teller

- Successfully collected $1 million in outstanding payments within a sixmonth period.

- Negotiated reduced repayment plans with over 500 customers, resulting in improved cash flow.

- Developed and implemented a new collections strategy that increased recovery rates by 15%.

- Identified and reported fraudulent accounts, preventing losses of over $200,000.

Accomplishments

- Developed a new outreach strategy that increased collection rates by 15%, resulting in a significant reduction in delinquent accounts.

- Utilized data analysis to identify patterns and trends in customer behavior, leading to improved collection effectiveness.

- Implemented process improvements that streamlined collection workflows, reducing processing time by 20%.

- Negotiated favorable payment arrangements with customers, resulting in increased revenue recovery.

- Improved customer satisfaction by developing personalized repayment plans that met individual needs.

Awards

- Received Collection Teller of the Quarter award for consistently exceeding collection targets and maintaining a high customer satisfaction rate.

- Recognized for exceptional communication skills and ability to resolve customer disputes effectively.

- Received Employee of the Year award for outstanding contributions to the collection team.

- Recognized for maintaining a high level of compliance with industry regulations and best practices.

Certificates

- Certified Teller (CT)

- Certified Financial Services Specialist (CFSS)

- Bank Secrecy Act (BSA) Certification

- Anti-Money Laundering (AML) Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collection Teller

- Highlight your experience and accomplishments in the collection field.

- Demonstrate your strong communication and interpersonal skills.

- Showcase your ability to work independently and as part of a team.

- Be prepared to discuss your knowledge of collection laws and regulations.

Essential Experience Highlights for a Strong Collection Teller Resume

- Collect outstanding payments and negotiate reduced repayment plans to improve cash flow.

- Develop and implement collection strategies to increase recovery rates.

- Identify and report fraudulent accounts to prevent losses.

- Manage a team of collection agents and provide guidance and support to optimize performance.

- Utilize collection software to track and manage customer accounts effectively.

- Adhere to all applicable laws and regulations related to collections.

Frequently Asked Questions (FAQ’s) For Collection Teller

What are the key skills and qualities of a successful Collection Teller?

Excellent communication and interpersonal skills, strong attention to detail, ability to work independently and as part of a team, and knowledge of collection laws and regulations.

What are the career prospects for a Collection Teller?

With experience and additional training, Collection Tellers can advance to roles such as Collection Manager, Credit Analyst, or Account Manager.

What are the challenges faced by Collection Tellers?

Dealing with difficult customers, managing high workloads, and adhering to strict regulations.

How can I improve my skills as a Collection Teller?

Attend training programs, shadow experienced Collection Tellers, and seek opportunities to develop your communication and negotiation skills.

What are the common interview questions for Collection Teller positions?

Tell me about your experience in collections, how do you handle difficult customers, and what are your strategies for increasing recovery rates?

What are the salary expectations for Collection Tellers?

The salary range for Collection Tellers can vary depending on experience, location, and company size.