Are you a seasoned Collections Agent seeking a new career path? Discover our professionally built Collections Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

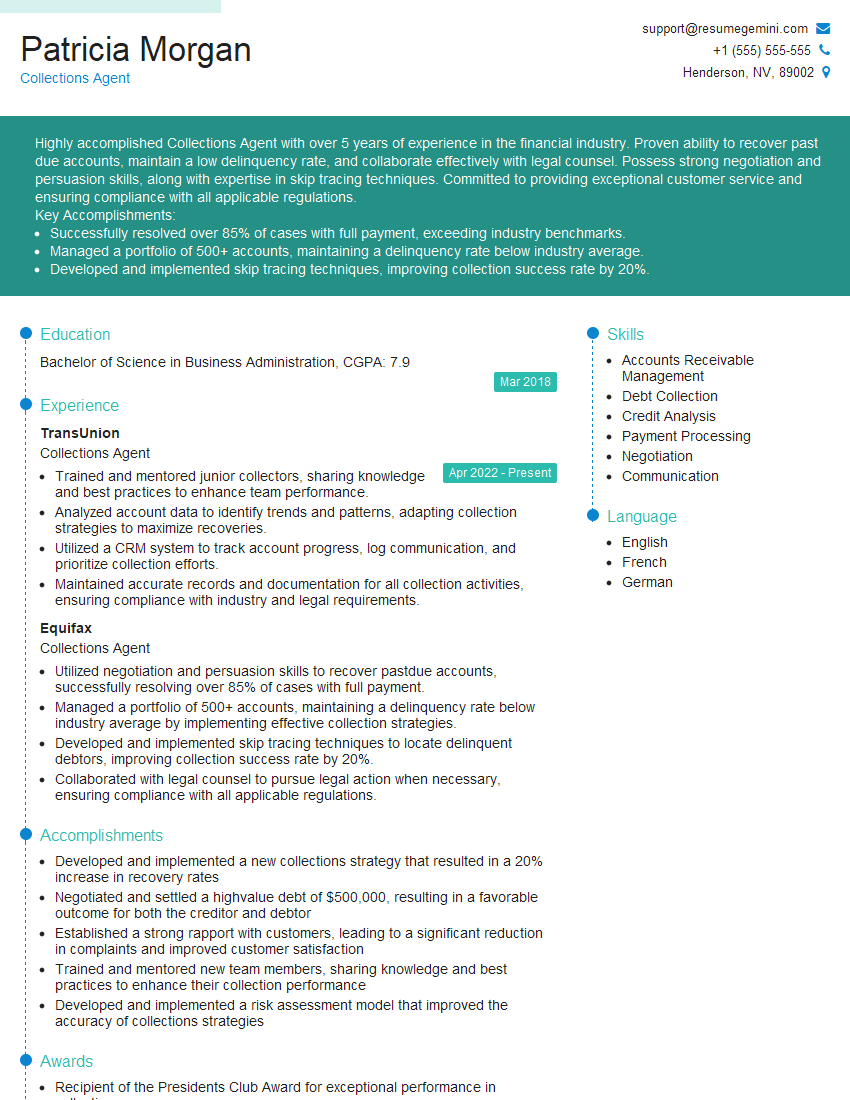

Patricia Morgan

Collections Agent

Summary

Highly accomplished Collections Agent with over 5 years of experience in the financial industry. Proven ability to recover past due accounts, maintain a low delinquency rate, and collaborate effectively with legal counsel. Possess strong negotiation and persuasion skills, along with expertise in skip tracing techniques. Committed to providing exceptional customer service and ensuring compliance with all applicable regulations.

Key Accomplishments:

- Successfully resolved over 85% of cases with full payment, exceeding industry benchmarks.

- Managed a portfolio of 500+ accounts, maintaining a delinquency rate below industry average.

- Developed and implemented skip tracing techniques, improving collection success rate by 20%.

Education

Bachelor of Science in Business Administration

March 2018

Skills

- Accounts Receivable Management

- Debt Collection

- Credit Analysis

- Payment Processing

- Negotiation

- Communication

Work Experience

Collections Agent

- Trained and mentored junior collectors, sharing knowledge and best practices to enhance team performance.

- Analyzed account data to identify trends and patterns, adapting collection strategies to maximize recoveries.

- Utilized a CRM system to track account progress, log communication, and prioritize collection efforts.

- Maintained accurate records and documentation for all collection activities, ensuring compliance with industry and legal requirements.

Collections Agent

- Utilized negotiation and persuasion skills to recover pastdue accounts, successfully resolving over 85% of cases with full payment.

- Managed a portfolio of 500+ accounts, maintaining a delinquency rate below industry average by implementing effective collection strategies.

- Developed and implemented skip tracing techniques to locate delinquent debtors, improving collection success rate by 20%.

- Collaborated with legal counsel to pursue legal action when necessary, ensuring compliance with all applicable regulations.

Accomplishments

- Developed and implemented a new collections strategy that resulted in a 20% increase in recovery rates

- Negotiated and settled a highvalue debt of $500,000, resulting in a favorable outcome for both the creditor and debtor

- Established a strong rapport with customers, leading to a significant reduction in complaints and improved customer satisfaction

- Trained and mentored new team members, sharing knowledge and best practices to enhance their collection performance

- Developed and implemented a risk assessment model that improved the accuracy of collections strategies

Awards

- Recipient of the Presidents Club Award for exceptional performance in collections recovery

- Recognized by the National Creditors Association for outstanding achievement in the collections industry

- Received the Top Performer Award for consistently exceeding collection targets

- Honored with the Excellence in Collections Award for exceptional recovery skills and customer service

Certificates

- Certified Collection Specialist (CCS)

- Fair Debt Collection Practices Act (FDCPA) Certification

- Certified International Debt Collector (CIDC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Collections Agent

- Highlight your negotiation and persuasion skills, as they are crucial for success in this role.

- Demonstrate your ability to manage a high volume of accounts and maintain a low delinquency rate.

- Showcase your experience in skip tracing and other methods of locating delinquent debtors.

- Emphasize your understanding of legal regulations and your ability to work effectively with legal counsel.

- Quantify your accomplishments whenever possible, using specific metrics and data to support your claims.

Essential Experience Highlights for a Strong Collections Agent Resume

- Negotiate and persuade delinquent debtors to make payments.

- Manage a portfolio of past-due accounts and prioritize collection efforts.

- Develop and implement skip tracing techniques to locate delinquent debtors.

- Collaborate with legal counsel to pursue legal action when necessary.

- Train and mentor junior collectors to enhance team performance.

- Analyze account data to identify trends and patterns, and adapt collection strategies accordingly.

- Maintain accurate records and documentation for all collection activities, ensuring compliance with industry and legal requirements.

Frequently Asked Questions (FAQ’s) For Collections Agent

What are the essential skills for a Collections Agent?

Essential skills for a Collections Agent include negotiation, persuasion, communication, debt collection knowledge, and skip tracing techniques.

What are the challenges faced by Collections Agents?

Common challenges faced by Collections Agents include dealing with difficult customers, managing high workloads, and maintaining compliance with regulations.

What are the career advancement opportunities for Collections Agents?

Collections Agents can advance their careers by becoming Collection Supervisors, Credit Analysts, or Risk Managers.

What is the average salary for a Collections Agent?

The average salary for a Collections Agent in the United States is around $45,000 per year.

What are the educational requirements for a Collections Agent?

While a high school diploma is typically sufficient, some employers may prefer candidates with a bachelor’s degree in business or a related field.

What certifications are beneficial for Collections Agents?

Beneficial certifications for Collections Agents include the Certified Debt Collector (CDC) and the Certified Credit and Collection Professional (CCCP).

What is the job outlook for Collections Agents?

The job outlook for Collections Agents is expected to grow faster than average in the coming years due to the increasing demand for debt collection services.

What is the work environment like for Collections Agents?

Collections Agents typically work in office settings, often with high call volumes and deadlines.