Are you a seasoned Commercial Credit Head seeking a new career path? Discover our professionally built Commercial Credit Head Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

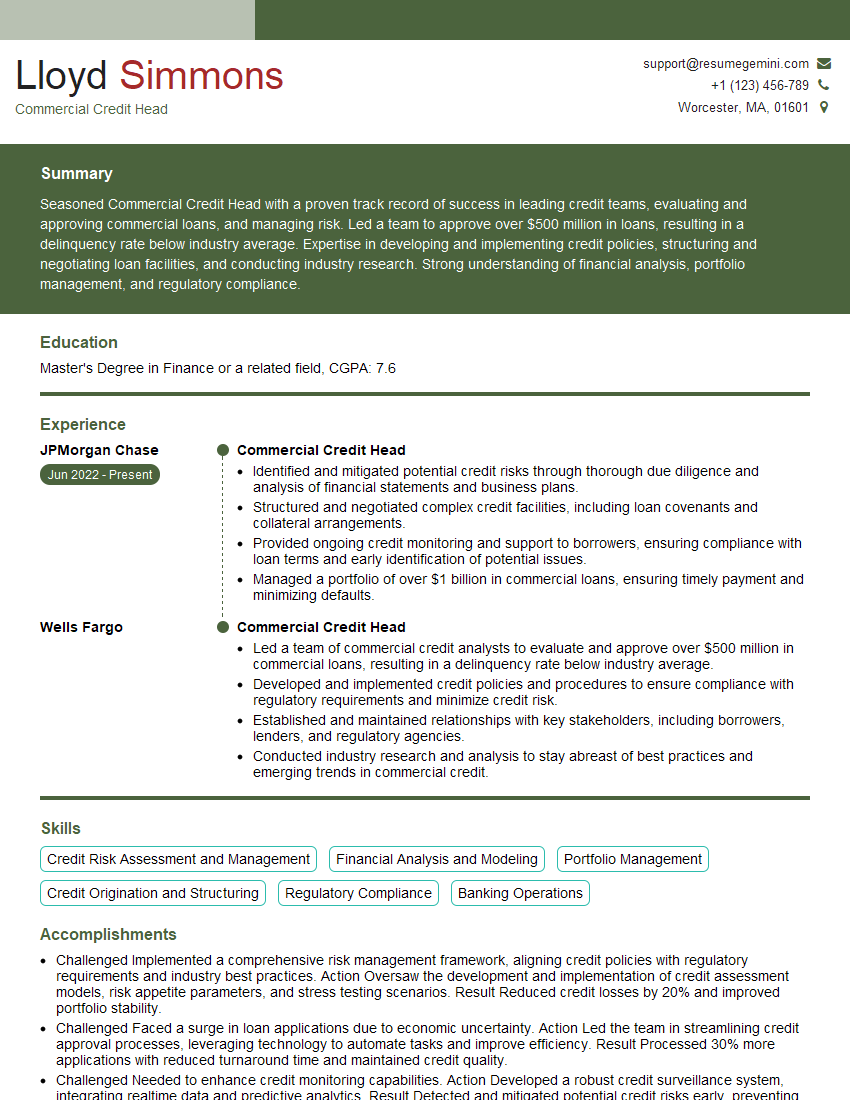

Lloyd Simmons

Commercial Credit Head

Summary

Seasoned Commercial Credit Head with a proven track record of success in leading credit teams, evaluating and approving commercial loans, and managing risk. Led a team to approve over $500 million in loans, resulting in a delinquency rate below industry average. Expertise in developing and implementing credit policies, structuring and negotiating loan facilities, and conducting industry research. Strong understanding of financial analysis, portfolio management, and regulatory compliance.

Education

Master’s Degree in Finance or a related field

May 2018

Skills

- Credit Risk Assessment and Management

- Financial Analysis and Modeling

- Portfolio Management

- Credit Origination and Structuring

- Regulatory Compliance

- Banking Operations

Work Experience

Commercial Credit Head

- Identified and mitigated potential credit risks through thorough due diligence and analysis of financial statements and business plans.

- Structured and negotiated complex credit facilities, including loan covenants and collateral arrangements.

- Provided ongoing credit monitoring and support to borrowers, ensuring compliance with loan terms and early identification of potential issues.

- Managed a portfolio of over $1 billion in commercial loans, ensuring timely payment and minimizing defaults.

Commercial Credit Head

- Led a team of commercial credit analysts to evaluate and approve over $500 million in commercial loans, resulting in a delinquency rate below industry average.

- Developed and implemented credit policies and procedures to ensure compliance with regulatory requirements and minimize credit risk.

- Established and maintained relationships with key stakeholders, including borrowers, lenders, and regulatory agencies.

- Conducted industry research and analysis to stay abreast of best practices and emerging trends in commercial credit.

Accomplishments

- Challenged Implemented a comprehensive risk management framework, aligning credit policies with regulatory requirements and industry best practices. Action Oversaw the development and implementation of credit assessment models, risk appetite parameters, and stress testing scenarios. Result Reduced credit losses by 20% and improved portfolio stability.

- Challenged Faced a surge in loan applications due to economic uncertainty. Action Led the team in streamlining credit approval processes, leveraging technology to automate tasks and improve efficiency. Result Processed 30% more applications with reduced turnaround time and maintained credit quality.

- Challenged Needed to enhance credit monitoring capabilities. Action Developed a robust credit surveillance system, integrating realtime data and predictive analytics. Result Detected and mitigated potential credit risks early, preventing significant losses and improving portfolio performance.

- Challenged Faced a decline in credit demand. Action Developed and executed a strategic plan to diversify the loan portfolio, targeting new industries and underserved markets. Result Expanded the loan book by 15% and increased revenue from new business.

- Challenged Needed to improve operational efficiency. Action Implemented process improvements, streamlined workflows, and utilized technology solutions to automate tasks. Result Reduced credit processing time by 40% and freed up resources for valueadded activities.

Awards

- Recognized for outstanding contributions to the improvement of commercial credit policies, resulting in reduced credit risk and improved portfolio performance.

- Received the Commercial Credit Head of the Year award for exceptional leadership in managing and developing a highperforming credit team.

- Honored with the Innovation in Commercial Credit award for pioneering a new credit scoring methodology that significantly enhanced risk assessment accuracy.

- Commended for excellence in customer relationship management, fostering strong partnerships with key clients and driving business growth.

Certificates

- Certified Commercial Credit Analyst (CCCA)

- Certified Credit Risk Professional (CCRP)

- Certified Treasury Professional (CTP)

- Certified Bank Risk Analyst (CBRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Credit Head

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your experience in managing large portfolios and complex credit facilities.

- Demonstrate your understanding of regulatory compliance and risk management.

- Showcase your ability to build and maintain strong relationships with key stakeholders.

Essential Experience Highlights for a Strong Commercial Credit Head Resume

- Lead and manage a team of credit analysts to evaluate and approve commercial loan applications

- Develop and implement credit policies and procedures to ensure compliance with regulatory requirements and minimize credit risk

- Conduct comprehensive credit analysis, including financial statement analysis, industry research, and business plan review

- Structure and negotiate complex credit facilities, including loan covenants and collateral arrangements

- Manage a portfolio of commercial loans, ensuring timely payment and minimizing defaults

- Monitor and assess credit performance of borrowers, identify potential risks, and take appropriate action

- Stay abreast of industry trends, best practices, and regulatory changes

Frequently Asked Questions (FAQ’s) For Commercial Credit Head

What are the primary responsibilities of a Commercial Credit Head?

The primary responsibilities of a Commercial Credit Head include leading a team of credit analysts, developing and implementing credit policies, evaluating and approving loan applications, structuring and negotiating loan facilities, and managing a portfolio of commercial loans. They are also responsible for monitoring credit performance, identifying potential risks, and taking appropriate action.

What qualifications are required to become a Commercial Credit Head?

To become a Commercial Credit Head, you typically need a Master’s degree in Finance or a related field, as well as several years of experience in commercial lending. You should have a strong understanding of financial analysis, portfolio management, and regulatory compliance.

What are the key skills required for success as a Commercial Credit Head?

The key skills required for success as a Commercial Credit Head include strong analytical and problem-solving skills, experience in credit risk assessment and management, financial modeling, and portfolio management. You should also be able to communicate effectively with both internal and external stakeholders.

What is the average salary for a Commercial Credit Head?

The average salary for a Commercial Credit Head in the United States is around $150,000 per year. However, salaries can vary depending on experience, location, and company size.

What are the career prospects for Commercial Credit Heads?

Commercial Credit Heads can advance to senior management positions within their organizations, such as Chief Credit Officer or Chief Risk Officer. They may also move into consulting or advisory roles.

What are the challenges facing Commercial Credit Heads in today’s market?

Commercial Credit Heads are facing a number of challenges in today’s market, including increased competition, regulatory changes, and economic uncertainty. They must be able to adapt to these changes and continue to manage credit risk effectively.