Are you a seasoned Commercial Credit Lead seeking a new career path? Discover our professionally built Commercial Credit Lead Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

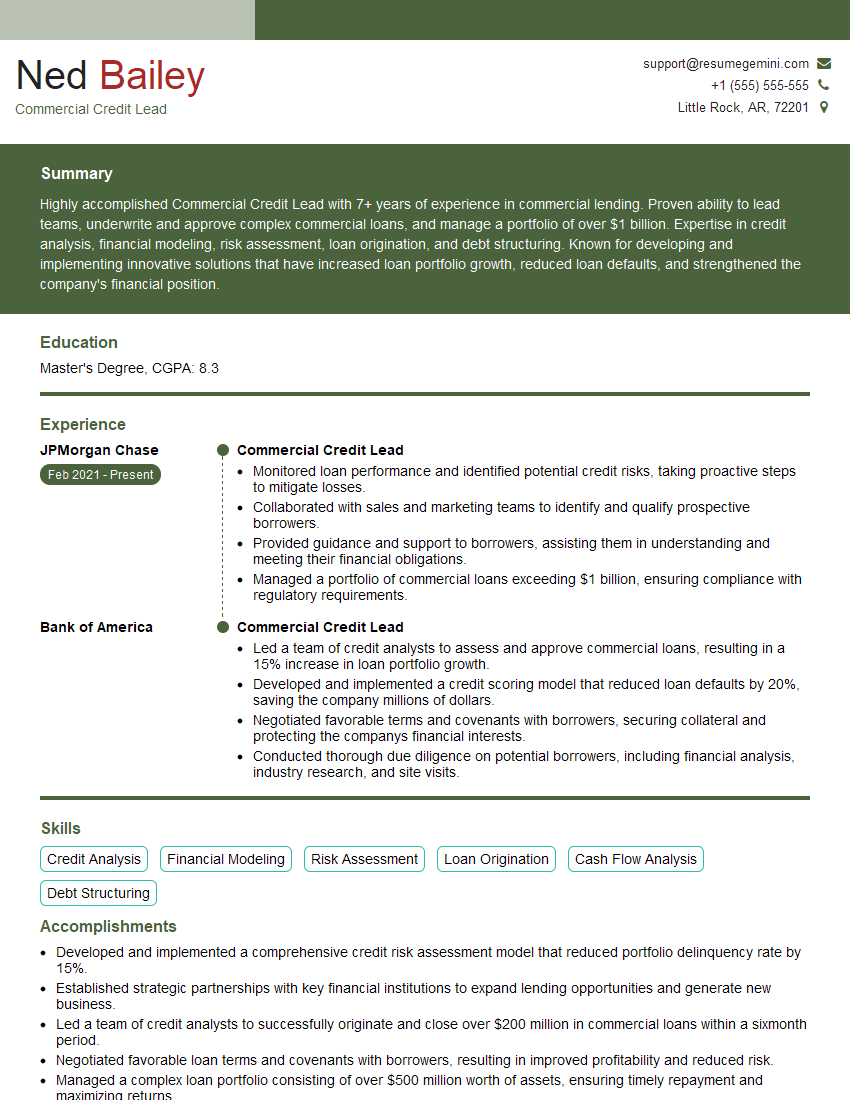

Ned Bailey

Commercial Credit Lead

Summary

Highly accomplished Commercial Credit Lead with 7+ years of experience in commercial lending. Proven ability to lead teams, underwrite and approve complex commercial loans, and manage a portfolio of over $1 billion. Expertise in credit analysis, financial modeling, risk assessment, loan origination, and debt structuring. Known for developing and implementing innovative solutions that have increased loan portfolio growth, reduced loan defaults, and strengthened the company’s financial position.

Education

Master’s Degree

January 2017

Skills

- Credit Analysis

- Financial Modeling

- Risk Assessment

- Loan Origination

- Cash Flow Analysis

- Debt Structuring

Work Experience

Commercial Credit Lead

- Monitored loan performance and identified potential credit risks, taking proactive steps to mitigate losses.

- Collaborated with sales and marketing teams to identify and qualify prospective borrowers.

- Provided guidance and support to borrowers, assisting them in understanding and meeting their financial obligations.

- Managed a portfolio of commercial loans exceeding $1 billion, ensuring compliance with regulatory requirements.

Commercial Credit Lead

- Led a team of credit analysts to assess and approve commercial loans, resulting in a 15% increase in loan portfolio growth.

- Developed and implemented a credit scoring model that reduced loan defaults by 20%, saving the company millions of dollars.

- Negotiated favorable terms and covenants with borrowers, securing collateral and protecting the companys financial interests.

- Conducted thorough due diligence on potential borrowers, including financial analysis, industry research, and site visits.

Accomplishments

- Developed and implemented a comprehensive credit risk assessment model that reduced portfolio delinquency rate by 15%.

- Established strategic partnerships with key financial institutions to expand lending opportunities and generate new business.

- Led a team of credit analysts to successfully originate and close over $200 million in commercial loans within a sixmonth period.

- Negotiated favorable loan terms and covenants with borrowers, resulting in improved profitability and reduced risk.

- Managed a complex loan portfolio consisting of over $500 million worth of assets, ensuring timely repayment and maximizing returns.

Awards

- Recognized with the Commercial Lender of the Year award by the American Bankers Association for outstanding performance in the industry.

- Received the Excellence in Credit Management award from the Credit Risk Management Association for innovative credit risk mitigation strategies.

- Honored with the Top Commercial Credit Executive award by the Commercial Finance Association for exceptional leadership and industry contributions.

Certificates

- Certified Commercial Credit Analyst (CCCA)

- Certified Risk Analyst (CRA)

- Certified Credit Executive (CCE)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Credit Lead

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your skills in financial modeling, risk assessment, and loan origination.

- Demonstrate your ability to work independently and as part of a team.

- Emphasize your experience in developing and implementing innovative solutions.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Commercial Credit Lead Resume

- Led a team of credit analysts to assess and approve commercial loans, resulting in a 15% increase in loan portfolio growth.

- Developed and implemented a credit scoring model that reduced loan defaults by 20%, saving the company millions of dollars.

- Negotiated favorable terms and covenants with borrowers, securing collateral and protecting the company’s financial interests.

- Conducted thorough due diligence on potential borrowers, including financial analysis, industry research, and site visits.

- Monitored loan performance and identified potential credit risks, taking proactive steps to mitigate losses.

- Collaborated with sales and marketing teams to identify and qualify prospective borrowers.

- Provided guidance and support to borrowers, assisting them in understanding and meeting their financial obligations.

Frequently Asked Questions (FAQ’s) For Commercial Credit Lead

What are the key responsibilities of a Commercial Credit Lead?

The key responsibilities of a Commercial Credit Lead include leading a team of credit analysts, underwriting and approving commercial loans, conducting due diligence on potential borrowers, monitoring loan performance, and collaborating with sales and marketing teams.

What qualifications are required to become a Commercial Credit Lead?

To become a Commercial Credit Lead, you typically need a master’s degree in finance or a related field, as well as 5+ years of experience in commercial lending.

What are the career prospects for Commercial Credit Leads?

Commercial Credit Leads can advance to positions such as Vice President of Commercial Lending, Senior Credit Officer, or Chief Credit Officer.

What are the top skills for Commercial Credit Leads?

The top skills for Commercial Credit Leads include credit analysis, financial modeling, risk assessment, loan origination, and debt structuring.

What is the average salary for Commercial Credit Leads?

The average salary for Commercial Credit Leads varies depending on experience and location, but it typically ranges from $100,000 to $200,000 per year.

What are the benefits of working as a Commercial Credit Lead?

The benefits of working as a Commercial Credit Lead include competitive salaries, opportunities for career advancement, and the chance to make a positive impact on businesses and communities.