Are you a seasoned Commercial Credit Reviewer seeking a new career path? Discover our professionally built Commercial Credit Reviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

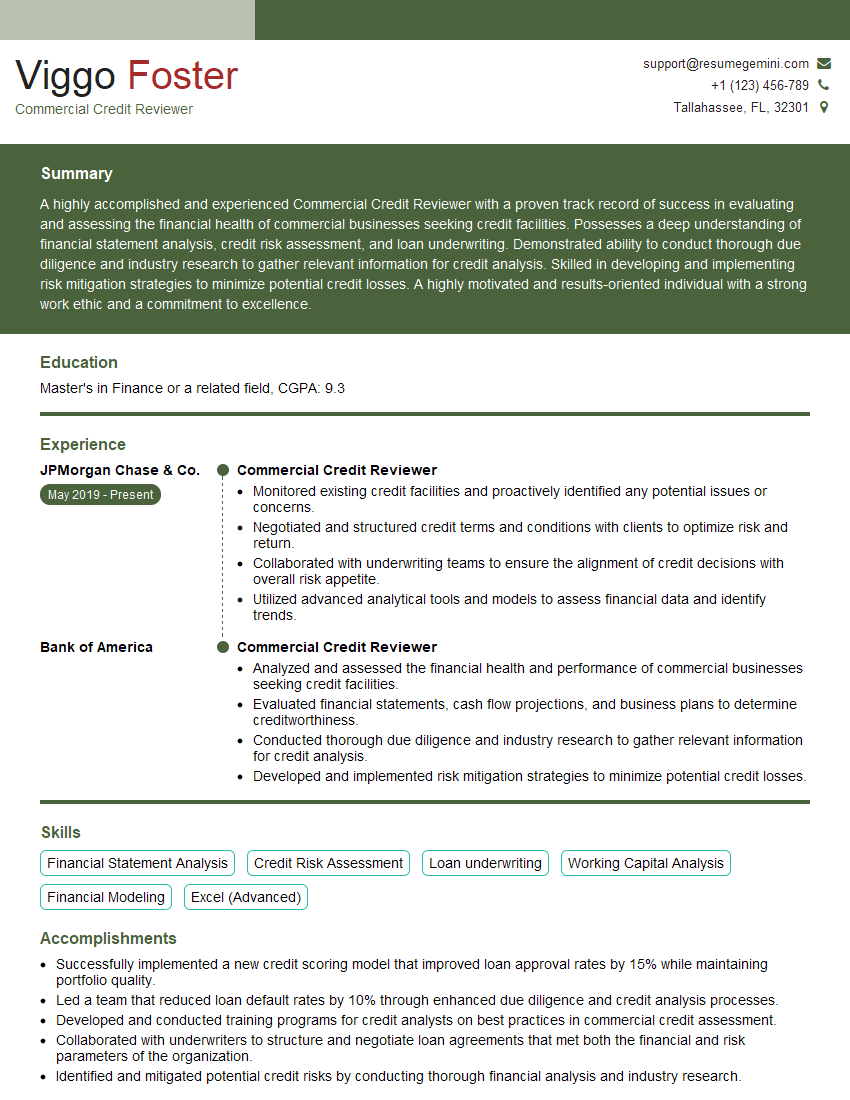

Viggo Foster

Commercial Credit Reviewer

Summary

A highly accomplished and experienced Commercial Credit Reviewer with a proven track record of success in evaluating and assessing the financial health of commercial businesses seeking credit facilities. Possesses a deep understanding of financial statement analysis, credit risk assessment, and loan underwriting. Demonstrated ability to conduct thorough due diligence and industry research to gather relevant information for credit analysis. Skilled in developing and implementing risk mitigation strategies to minimize potential credit losses. A highly motivated and results-oriented individual with a strong work ethic and a commitment to excellence.

Education

Master’s in Finance or a related field

April 2015

Skills

- Financial Statement Analysis

- Credit Risk Assessment

- Loan underwriting

- Working Capital Analysis

- Financial Modeling

- Excel (Advanced)

Work Experience

Commercial Credit Reviewer

- Monitored existing credit facilities and proactively identified any potential issues or concerns.

- Negotiated and structured credit terms and conditions with clients to optimize risk and return.

- Collaborated with underwriting teams to ensure the alignment of credit decisions with overall risk appetite.

- Utilized advanced analytical tools and models to assess financial data and identify trends.

Commercial Credit Reviewer

- Analyzed and assessed the financial health and performance of commercial businesses seeking credit facilities.

- Evaluated financial statements, cash flow projections, and business plans to determine creditworthiness.

- Conducted thorough due diligence and industry research to gather relevant information for credit analysis.

- Developed and implemented risk mitigation strategies to minimize potential credit losses.

Accomplishments

- Successfully implemented a new credit scoring model that improved loan approval rates by 15% while maintaining portfolio quality.

- Led a team that reduced loan default rates by 10% through enhanced due diligence and credit analysis processes.

- Developed and conducted training programs for credit analysts on best practices in commercial credit assessment.

- Collaborated with underwriters to structure and negotiate loan agreements that met both the financial and risk parameters of the organization.

- Identified and mitigated potential credit risks by conducting thorough financial analysis and industry research.

Awards

- Recipient of the Credit Analyst of the Year award for consistent outstanding performance in credit risk assessment and underwriting.

- Recognized with the Excellence in Credit Risk Management award for exceptional contributions to the development and implementation of risk mitigation strategies.

- Received the Top Performer award for consistently exceeding credit review targets and maintaining high accuracy levels.

- Recognized for Exceptional Contribution to Credit Risk Management for developing innovative risk assessment tools and strategies.

Certificates

- Certified Commercial Credit Analyst (CCCA)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- Master of Business Administration (MBA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commercial Credit Reviewer

- Highlight your analytical skills and ability to interpret financial data.

- Showcase your experience in credit risk assessment and loan underwriting.

- Demonstrate your knowledge of industry-specific risks and regulations.

- Quantify your accomplishments and provide specific examples of how you have contributed to the success of your organization.

- Be sure to tailor your resume to the specific job you are applying for.

Essential Experience Highlights for a Strong Commercial Credit Reviewer Resume

- Analyze and assess the financial health and performance of commercial businesses seeking credit facilities.

- Evaluate financial statements, cash flow projections, and business plans to determine creditworthiness.

- Conduct thorough due diligence and industry research to gather relevant information for credit analysis.

- Develop and implement risk mitigation strategies to minimize potential credit losses.

- Monitor existing credit facilities and proactively identify any potential issues or concerns.

- Negotiate and structure credit terms and conditions with clients to optimize risk and return.

- Collaborate with underwriting teams to ensure the alignment of credit decisions with overall risk appetite.

Frequently Asked Questions (FAQ’s) For Commercial Credit Reviewer

What is the role of a Commercial Credit Reviewer?

A Commercial Credit Reviewer is responsible for evaluating and assessing the financial health of commercial businesses seeking credit facilities. They analyze financial statements, conduct due diligence, and develop risk mitigation strategies to determine the creditworthiness of potential borrowers.

What are the key skills required for a Commercial Credit Reviewer?

The key skills required for a Commercial Credit Reviewer include financial statement analysis, credit risk assessment, loan underwriting, and industry knowledge. They should also have strong analytical and communication skills.

What is the career path for a Commercial Credit Reviewer?

The career path for a Commercial Credit Reviewer can lead to roles such as Senior Credit Analyst, Credit Manager, or Vice President of Credit. With experience and expertise, they can also move into leadership positions in banking or finance.

What is the job outlook for Commercial Credit Reviewers?

The job outlook for Commercial Credit Reviewers is expected to be positive in the coming years due to the increasing demand for credit from businesses of all sizes.

What are the salary expectations for Commercial Credit Reviewers?

The salary expectations for Commercial Credit Reviewers vary depending on experience, location, and company size. However, the median salary for this role is around $75,000 per year.

What are the benefits of working as a Commercial Credit Reviewer?

The benefits of working as a Commercial Credit Reviewer include a competitive salary, opportunities for career advancement, and the chance to make a real impact on the success of businesses.