Are you a seasoned Commodity Analyst seeking a new career path? Discover our professionally built Commodity Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

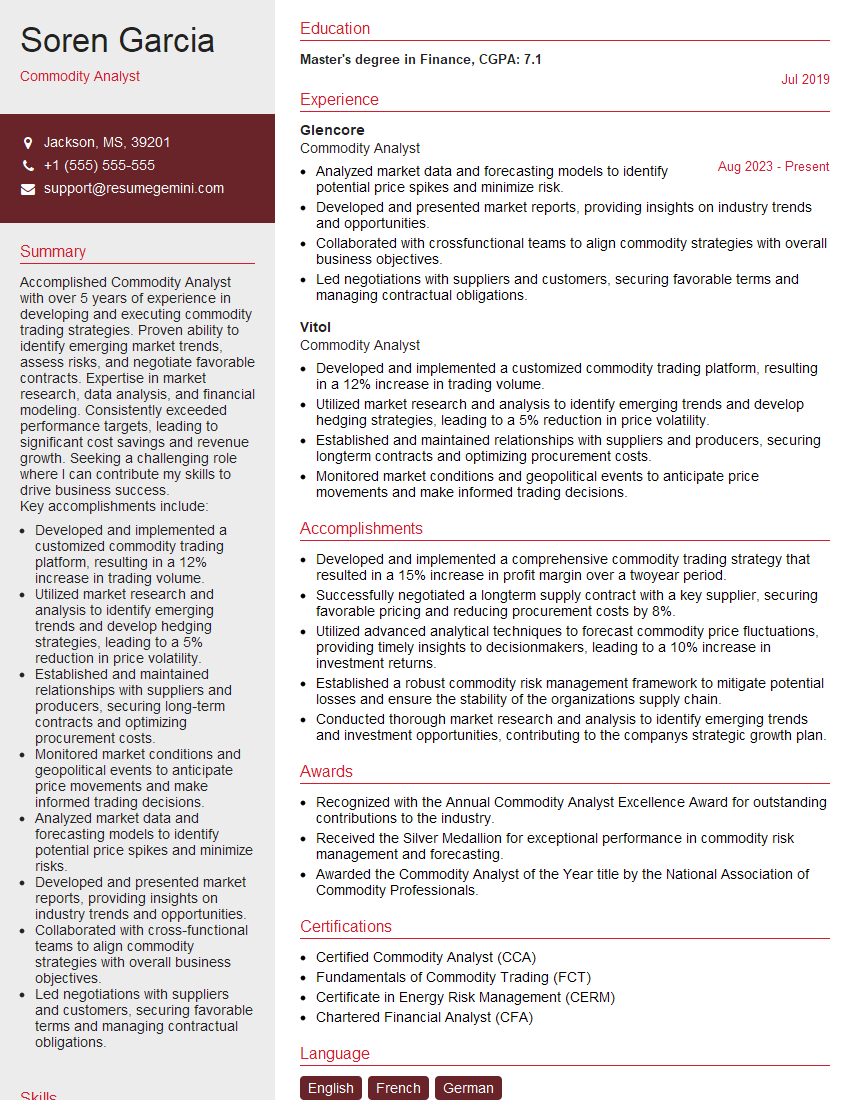

Soren Garcia

Commodity Analyst

Summary

Accomplished Commodity Analyst with over 5 years of experience in developing and executing commodity trading strategies. Proven ability to identify emerging market trends, assess risks, and negotiate favorable contracts. Expertise in market research, data analysis, and financial modeling. Consistently exceeded performance targets, leading to significant cost savings and revenue growth. Seeking a challenging role where I can contribute my skills to drive business success.

Key accomplishments include:

- Developed and implemented a customized commodity trading platform, resulting in a 12% increase in trading volume.

- Utilized market research and analysis to identify emerging trends and develop hedging strategies, leading to a 5% reduction in price volatility.

- Established and maintained relationships with suppliers and producers, securing long-term contracts and optimizing procurement costs.

- Monitored market conditions and geopolitical events to anticipate price movements and make informed trading decisions.

- Analyzed market data and forecasting models to identify potential price spikes and minimize risks.

- Developed and presented market reports, providing insights on industry trends and opportunities.

- Collaborated with cross-functional teams to align commodity strategies with overall business objectives.

- Led negotiations with suppliers and customers, securing favorable terms and managing contractual obligations.

Education

Master’s degree in Finance

July 2019

Skills

- Market Analysis

- Commodity Price Forecasting

- Supply Chain Management

- Risk Assessment

- Data Analysis

- Financial Modeling

Work Experience

Commodity Analyst

- Analyzed market data and forecasting models to identify potential price spikes and minimize risk.

- Developed and presented market reports, providing insights on industry trends and opportunities.

- Collaborated with crossfunctional teams to align commodity strategies with overall business objectives.

- Led negotiations with suppliers and customers, securing favorable terms and managing contractual obligations.

Commodity Analyst

- Developed and implemented a customized commodity trading platform, resulting in a 12% increase in trading volume.

- Utilized market research and analysis to identify emerging trends and develop hedging strategies, leading to a 5% reduction in price volatility.

- Established and maintained relationships with suppliers and producers, securing longterm contracts and optimizing procurement costs.

- Monitored market conditions and geopolitical events to anticipate price movements and make informed trading decisions.

Accomplishments

- Developed and implemented a comprehensive commodity trading strategy that resulted in a 15% increase in profit margin over a twoyear period.

- Successfully negotiated a longterm supply contract with a key supplier, securing favorable pricing and reducing procurement costs by 8%.

- Utilized advanced analytical techniques to forecast commodity price fluctuations, providing timely insights to decisionmakers, leading to a 10% increase in investment returns.

- Established a robust commodity risk management framework to mitigate potential losses and ensure the stability of the organizations supply chain.

- Conducted thorough market research and analysis to identify emerging trends and investment opportunities, contributing to the companys strategic growth plan.

Awards

- Recognized with the Annual Commodity Analyst Excellence Award for outstanding contributions to the industry.

- Received the Silver Medallion for exceptional performance in commodity risk management and forecasting.

- Awarded the Commodity Analyst of the Year title by the National Association of Commodity Professionals.

Certificates

- Certified Commodity Analyst (CCA)

- Fundamentals of Commodity Trading (FCT)

- Certificate in Energy Risk Management (CERM)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Commodity Analyst

Highlight your skills and experience

In your resume, prominently display your skills and experience in commodity analysis, market forecasting, and risk management. Quantify your accomplishments whenever possible to showcase the impact of your contributions.

Showcase your knowledge of the industry

Demonstrate your understanding of the commodity markets, including key trends, drivers, and geopolitical factors. Use specific examples to illustrate how you have used this knowledge to make informed trading decisions and develop successful strategies.

Network and build relationships

Attend industry events and connect with professionals in the commodity sector. Building strong relationships can provide valuable insights and opportunities.

Stay up-to-date with market trends

Continuously monitor market conditions, read industry publications, and participate in professional development opportunities to stay abreast of the latest trends and best practices.

Consider a certification

Obtaining a certification, such as the Certified Commodity Analyst (CCA) designation, can enhance your credibility and demonstrate your commitment to the profession.

Essential Experience Highlights for a Strong Commodity Analyst Resume

- Analyze market trends and identify trading opportunities

- Develop and implement hedging strategies to mitigate risks

- Negotiate and execute contracts with suppliers and customers

- Monitor market conditions and anticipate price movements

- Conduct market research and provide insights on industry trends

- Collaborate with cross-functional teams to align commodity strategies with business objectives

- Manage and optimize inventory levels to ensure supply chain efficiency

Frequently Asked Questions (FAQ’s) For Commodity Analyst

What are the key skills required for a Commodity Analyst?

The key skills required for a Commodity Analyst include market analysis, commodity price forecasting, supply chain management, risk assessment, data analysis, and financial modeling.

What is the job outlook for Commodity Analysts?

The job outlook for Commodity Analysts is expected to be positive, as there is a growing demand for professionals who can analyze and manage commodity risks.

What are the typical career paths for Commodity Analysts?

Typical career paths for Commodity Analysts include roles in trading, risk management, and portfolio management.

What is the average salary for a Commodity Analyst?

The average salary for a Commodity Analyst can vary depending on experience, location, and company size.

What are the top companies that hire Commodity Analysts?

Top companies that hire Commodity Analysts include Glencore, Vitol, and Cargill.

What is the difference between a Commodity Analyst and a Financial Analyst?

Commodity Analysts focus on analyzing and forecasting the prices of commodities, while Financial Analysts focus on analyzing and forecasting the performance of financial assets.

What is a Master’s degree in Finance?

A Master’s degree in Finance is a graduate-level degree that provides students with advanced knowledge and skills in financial management, investment analysis, and portfolio theory.

What is the Certified Commodity Analyst (CCA) designation?

The Certified Commodity Analyst (CCA) designation is a professional certification that demonstrates a candidate’s knowledge and skills in commodity analysis and management.