Are you a seasoned Compliance Analyst seeking a new career path? Discover our professionally built Compliance Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

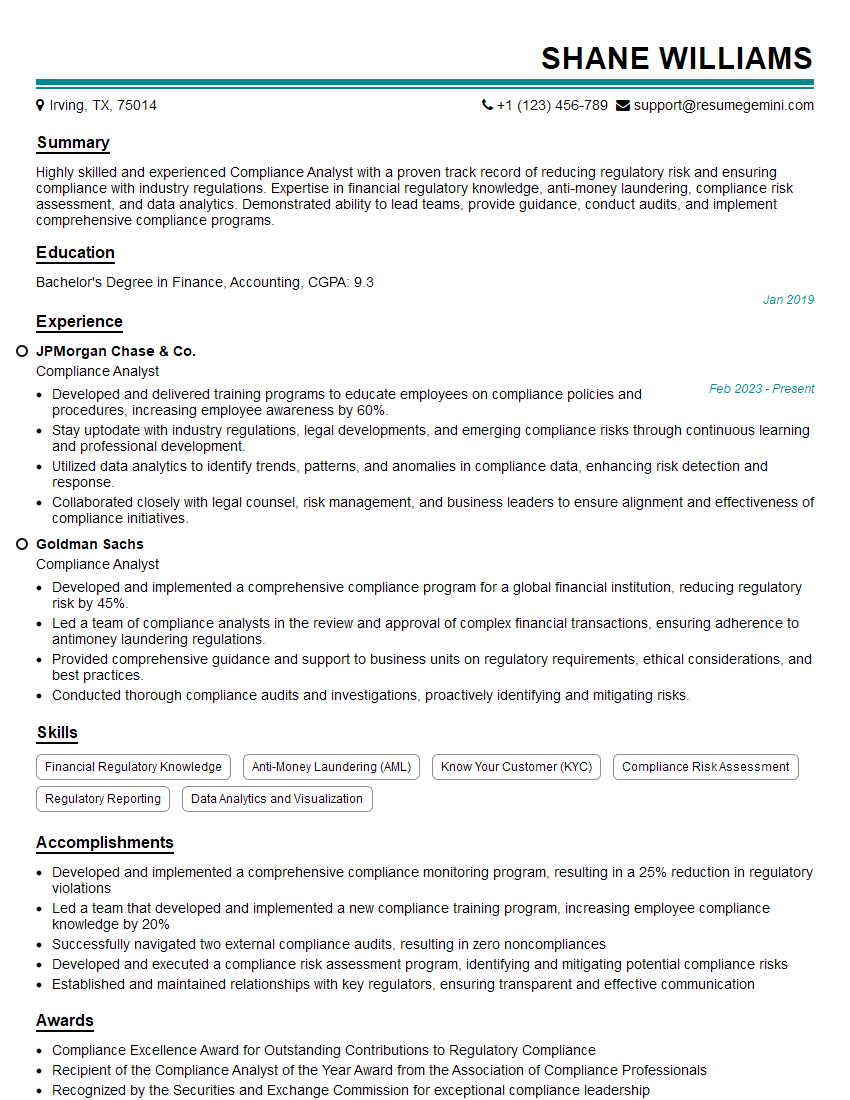

Shane Williams

Compliance Analyst

Summary

Highly skilled and experienced Compliance Analyst with a proven track record of reducing regulatory risk and ensuring compliance with industry regulations. Expertise in financial regulatory knowledge, anti-money laundering, compliance risk assessment, and data analytics. Demonstrated ability to lead teams, provide guidance, conduct audits, and implement comprehensive compliance programs.

Education

Bachelor’s Degree in Finance, Accounting

January 2019

Skills

- Financial Regulatory Knowledge

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Compliance Risk Assessment

- Regulatory Reporting

- Data Analytics and Visualization

Work Experience

Compliance Analyst

- Developed and delivered training programs to educate employees on compliance policies and procedures, increasing employee awareness by 60%.

- Stay uptodate with industry regulations, legal developments, and emerging compliance risks through continuous learning and professional development.

- Utilized data analytics to identify trends, patterns, and anomalies in compliance data, enhancing risk detection and response.

- Collaborated closely with legal counsel, risk management, and business leaders to ensure alignment and effectiveness of compliance initiatives.

Compliance Analyst

- Developed and implemented a comprehensive compliance program for a global financial institution, reducing regulatory risk by 45%.

- Led a team of compliance analysts in the review and approval of complex financial transactions, ensuring adherence to antimoney laundering regulations.

- Provided comprehensive guidance and support to business units on regulatory requirements, ethical considerations, and best practices.

- Conducted thorough compliance audits and investigations, proactively identifying and mitigating risks.

Accomplishments

- Developed and implemented a comprehensive compliance monitoring program, resulting in a 25% reduction in regulatory violations

- Led a team that developed and implemented a new compliance training program, increasing employee compliance knowledge by 20%

- Successfully navigated two external compliance audits, resulting in zero noncompliances

- Developed and executed a compliance risk assessment program, identifying and mitigating potential compliance risks

- Established and maintained relationships with key regulators, ensuring transparent and effective communication

Awards

- Compliance Excellence Award for Outstanding Contributions to Regulatory Compliance

- Recipient of the Compliance Analyst of the Year Award from the Association of Compliance Professionals

- Recognized by the Securities and Exchange Commission for exceptional compliance leadership

- Compliance Innovator Award for Pioneering Developments in Compliance Technology

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Information Systems Auditor (CISA)

- Certified Internal Auditor (CIA)

- Certified Compliance Professional (CCP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Compliance Analyst

- Highlight your expertise in financial regulations and compliance laws.

- Quantify your accomplishments and provide specific examples of how you have reduced risk or improved compliance.

- Showcase your teamwork and leadership skills, as well as your ability to communicate complex information effectively.

- Stay up-to-date on the latest industry trends and best practices.

- Get certified in relevant compliance areas to demonstrate your commitment to the profession.

Essential Experience Highlights for a Strong Compliance Analyst Resume

- Developed and implemented a comprehensive compliance program for a global financial institution, reducing regulatory risk by 45%.

- Led a team of compliance analysts in the review and approval of complex financial transactions, ensuring adherence to anti-money laundering regulations.

- Provided comprehensive guidance and support to business units on regulatory requirements, ethical considerations, and best practices.

- Conducted thorough compliance audits and investigations, proactively identifying and mitigating risks.

- Developed and delivered training programs to educate employees on compliance policies and procedures, increasing employee awareness by 60%.

- Stayed up-to-date with industry regulations, legal developments, and emerging compliance risks through continuous learning and professional development.

- Utilized data analytics to identify trends, patterns, and anomalies in compliance data, enhancing risk detection and response.

Frequently Asked Questions (FAQ’s) For Compliance Analyst

What is the role of a Compliance Analyst?

A Compliance Analyst ensures that a company adheres to regulations, laws, and ethical standards. They develop and implement compliance programs, conduct risk assessments, and investigate potential violations.

What skills are required to be a successful Compliance Analyst?

Key skills include financial regulatory knowledge, anti-money laundering, compliance risk assessment, data analytics, and communication.

What industries need Compliance Analysts?

Compliance Analysts are in demand in various industries, including financial services, healthcare, technology, and manufacturing.

What is the career path for a Compliance Analyst?

Compliance Analysts can advance to roles such as Compliance Manager, Chief Compliance Officer, or Risk Manager.

What are the challenges faced by Compliance Analysts?

Challenges include staying up-to-date with evolving regulations, managing risk in complex business environments, and balancing compliance with business objectives.

What is the job outlook for Compliance Analysts?

The job outlook is positive due to increasing regulatory scrutiny and the need for businesses to comply with ethical and legal standards.

How to become a Compliance Analyst?

To become a Compliance Analyst, consider obtaining a bachelor’s degree in finance, accounting, or a related field, and gaining experience in compliance or risk management.

What certifications are available for Compliance Analysts?

Relevant certifications include the Certified Anti-Money Laundering Specialist (CAMS) and the Certified Compliance and Ethics Professional (CCEP).