Are you a seasoned Compliance Representative Dealer seeking a new career path? Discover our professionally built Compliance Representative Dealer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

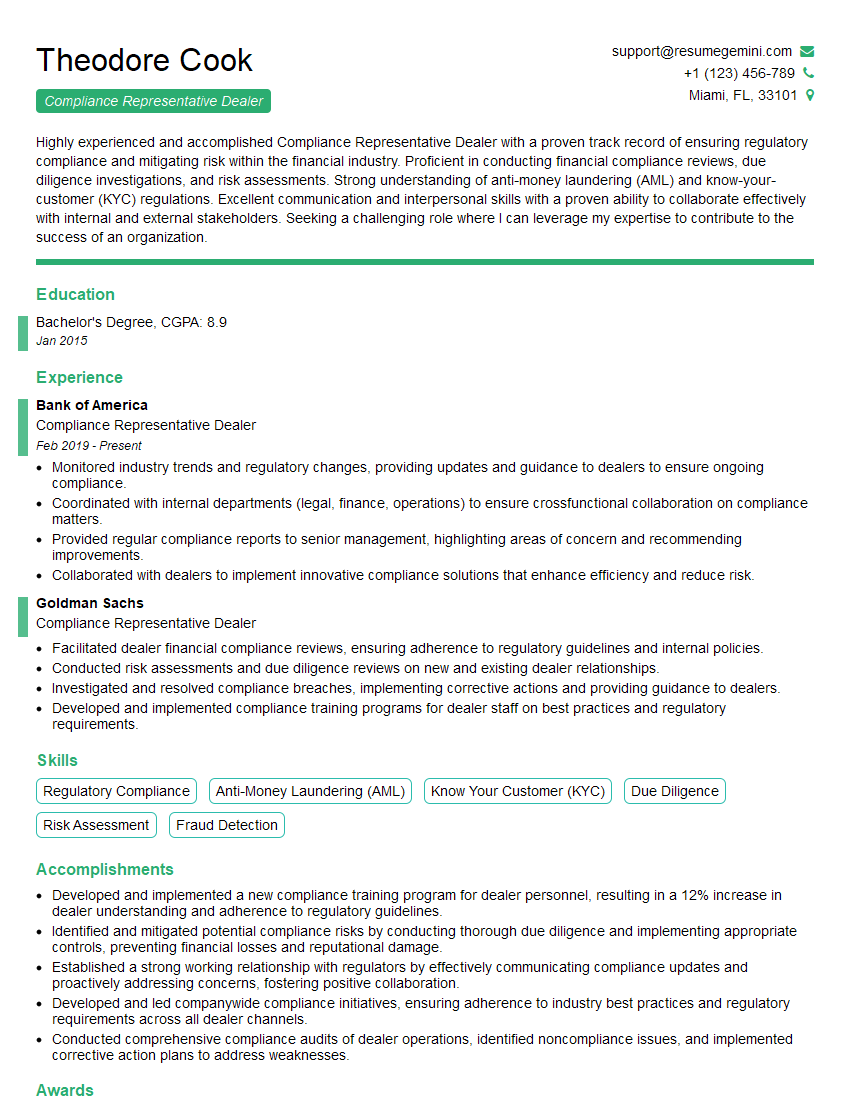

Theodore Cook

Compliance Representative Dealer

Summary

Highly experienced and accomplished Compliance Representative Dealer with a proven track record of ensuring regulatory compliance and mitigating risk within the financial industry. Proficient in conducting financial compliance reviews, due diligence investigations, and risk assessments. Strong understanding of anti-money laundering (AML) and know-your-customer (KYC) regulations. Excellent communication and interpersonal skills with a proven ability to collaborate effectively with internal and external stakeholders. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s Degree

January 2015

Skills

- Regulatory Compliance

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Due Diligence

- Risk Assessment

- Fraud Detection

Work Experience

Compliance Representative Dealer

- Monitored industry trends and regulatory changes, providing updates and guidance to dealers to ensure ongoing compliance.

- Coordinated with internal departments (legal, finance, operations) to ensure crossfunctional collaboration on compliance matters.

- Provided regular compliance reports to senior management, highlighting areas of concern and recommending improvements.

- Collaborated with dealers to implement innovative compliance solutions that enhance efficiency and reduce risk.

Compliance Representative Dealer

- Facilitated dealer financial compliance reviews, ensuring adherence to regulatory guidelines and internal policies.

- Conducted risk assessments and due diligence reviews on new and existing dealer relationships.

- Investigated and resolved compliance breaches, implementing corrective actions and providing guidance to dealers.

- Developed and implemented compliance training programs for dealer staff on best practices and regulatory requirements.

Accomplishments

- Developed and implemented a new compliance training program for dealer personnel, resulting in a 12% increase in dealer understanding and adherence to regulatory guidelines.

- Identified and mitigated potential compliance risks by conducting thorough due diligence and implementing appropriate controls, preventing financial losses and reputational damage.

- Established a strong working relationship with regulators by effectively communicating compliance updates and proactively addressing concerns, fostering positive collaboration.

- Developed and led companywide compliance initiatives, ensuring adherence to industry best practices and regulatory requirements across all dealer channels.

- Conducted comprehensive compliance audits of dealer operations, identified noncompliance issues, and implemented corrective action plans to address weaknesses.

Awards

- Recognized as Regional Compliance Representative Dealer of the Year for exceeding performance expectations and contributing to regulatory compliance.

- Received the Compliance Excellence Award for consistently exceeding regulatory expectations and maintaining high ethical standards in dealer operations.

- Awarded the Presidents Award for Outstanding Achievement in Compliance for exemplary leadership and innovation in dealer compliance.

- Honored with the Regulatory Excellence Award for developing innovative solutions to complex compliance challenges.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Certified Compliance and Ethics Professional (CCEP)

- Certified Regulatory Compliance Manager (CRCM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Compliance Representative Dealer

- Highlight your experience and expertise in regulatory compliance, specifically in the dealer industry.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Showcase your strong communication and interpersonal skills, as they are essential for this role.

- Emphasize your proactive approach to risk management and your ability to develop innovative compliance solutions.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Compliance Representative Dealer Resume

- Assessed dealer financial compliance, ensuring adherence to regulatory guidelines and internal policies

- Conducted risk assessments and due diligence reviews on dealer relationships

- Investigated and resolved compliance breaches, implementing corrective actions

- Developed and implemented compliance training programs for dealer staff

- Monitored industry trends and regulatory changes, providing updates to dealers

- Coordinated with internal departments to ensure cross-functional collaboration

- Provided regular compliance reports to senior management, highlighting areas of concern and improvement

Frequently Asked Questions (FAQ’s) For Compliance Representative Dealer

What are the key responsibilities of a Compliance Representative Dealer?

The primary responsibilities of a Compliance Representative Dealer include ensuring adherence to regulatory guidelines, conducting risk assessments, investigating and resolving compliance breaches, developing and implementing compliance training programs, monitoring industry trends and regulatory changes, coordinating with internal departments, and providing regular compliance reports to senior management.

What qualifications are needed to become a Compliance Representative Dealer?

Typically, a Bachelor’s Degree in a related field, such as finance, accounting, or business administration, is required to become a Compliance Representative Dealer. Additionally, strong knowledge of regulatory compliance, risk management, anti-money laundering (AML), and know-your-customer (KYC) regulations is essential.

What industries hire Compliance Representative Dealers?

Compliance Representative Dealers are primarily employed by financial institutions, such as banks, investment firms, and broker-dealers. They may also work for regulatory agencies or compliance consulting firms.

What is the career outlook for Compliance Representative Dealers?

The career outlook for Compliance Representative Dealers is expected to be positive due to the increasing focus on regulatory compliance and risk management within the financial industry. The demand for qualified professionals in this field is expected to grow as regulations become more complex and enforcement efforts increase.

What are the key skills needed to be a successful Compliance Representative Dealer?

Strong analytical, problem-solving, and communication skills, as well as a deep understanding of regulatory compliance and risk management principles, are essential for success as a Compliance Representative Dealer. Additionally, proficiency in data analysis and investigation techniques is highly valuable.

How can I prepare for a career as a Compliance Representative Dealer?

To prepare for a career as a Compliance Representative Dealer, consider pursuing a Bachelor’s Degree in a related field, such as finance, accounting, or business administration. Additionally, gaining experience in regulatory compliance, risk management, or auditing can be beneficial. Obtaining industry certifications, such as the Certified Anti-Money Laundering Specialist (CAMS) or the Certified Regulatory Compliance Manager (CRCM), can also enhance your qualifications.

What is the earning potential for Compliance Representative Dealers?

The earning potential for Compliance Representative Dealers varies depending on experience, qualifications, and the size and location of the organization. According to Salary.com, the median annual salary for Compliance Officers in the United States is around $75,000. However, experienced professionals with advanced certifications and specialized expertise may earn significantly more.

Can Compliance Representative Dealers work remotely?

While some Compliance Representative Dealers may have the opportunity to work remotely, it is not as common as in other fields due to the sensitive nature of their work. Many compliance professionals are required to be physically present in the office or at client sites to conduct audits, investigations, and other compliance-related activities.