Are you a seasoned Consumer Banker seeking a new career path? Discover our professionally built Consumer Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

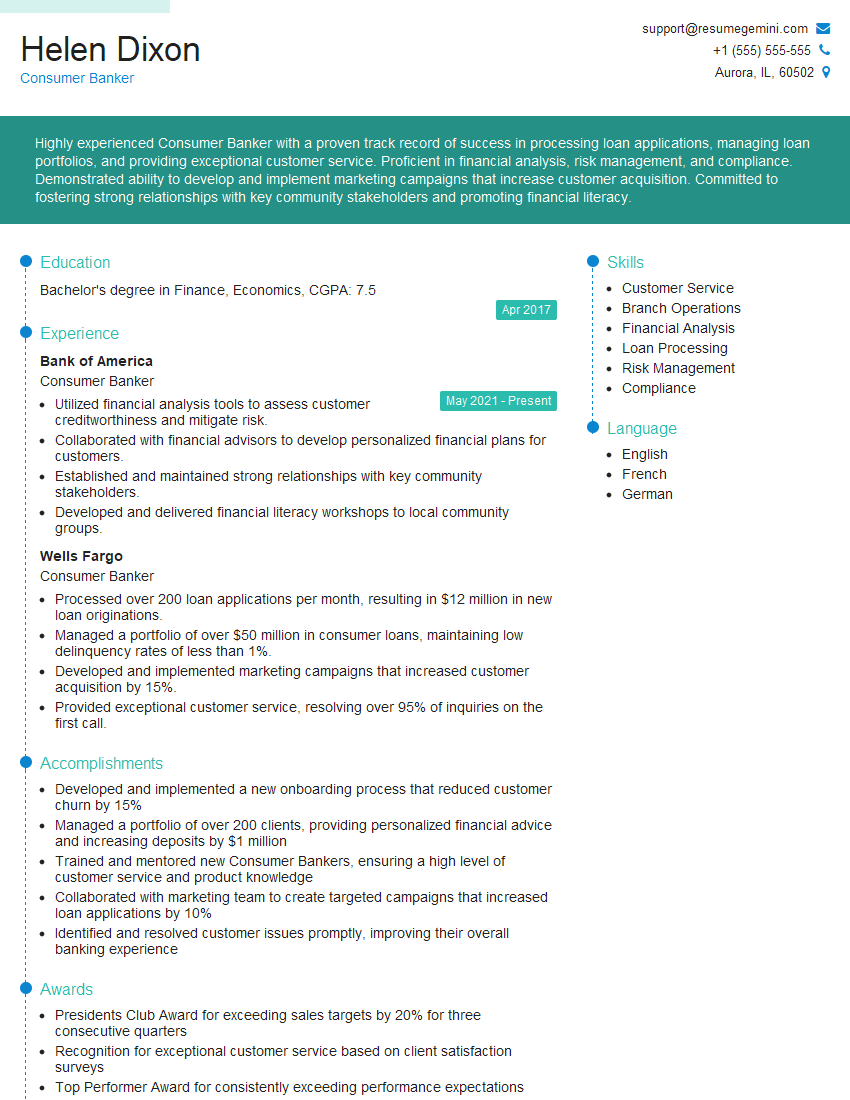

Helen Dixon

Consumer Banker

Summary

Highly experienced Consumer Banker with a proven track record of success in processing loan applications, managing loan portfolios, and providing exceptional customer service. Proficient in financial analysis, risk management, and compliance. Demonstrated ability to develop and implement marketing campaigns that increase customer acquisition. Committed to fostering strong relationships with key community stakeholders and promoting financial literacy.

Education

Bachelor’s degree in Finance, Economics

April 2017

Skills

- Customer Service

- Branch Operations

- Financial Analysis

- Loan Processing

- Risk Management

- Compliance

Work Experience

Consumer Banker

- Utilized financial analysis tools to assess customer creditworthiness and mitigate risk.

- Collaborated with financial advisors to develop personalized financial plans for customers.

- Established and maintained strong relationships with key community stakeholders.

- Developed and delivered financial literacy workshops to local community groups.

Consumer Banker

- Processed over 200 loan applications per month, resulting in $12 million in new loan originations.

- Managed a portfolio of over $50 million in consumer loans, maintaining low delinquency rates of less than 1%.

- Developed and implemented marketing campaigns that increased customer acquisition by 15%.

- Provided exceptional customer service, resolving over 95% of inquiries on the first call.

Accomplishments

- Developed and implemented a new onboarding process that reduced customer churn by 15%

- Managed a portfolio of over 200 clients, providing personalized financial advice and increasing deposits by $1 million

- Trained and mentored new Consumer Bankers, ensuring a high level of customer service and product knowledge

- Collaborated with marketing team to create targeted campaigns that increased loan applications by 10%

- Identified and resolved customer issues promptly, improving their overall banking experience

Awards

- Presidents Club Award for exceeding sales targets by 20% for three consecutive quarters

- Recognition for exceptional customer service based on client satisfaction surveys

- Top Performer Award for consistently exceeding performance expectations

- Branch Manager of the Year Award for outstanding leadership and sales performance

Certificates

- Certified Financial Planner (CFP)

- Certified Banking Professional (CBP)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Consumer Banker

- Highlight your customer service skills and ability to build rapport with clients.

- Quantify your accomplishments with specific metrics to demonstrate your impact.

- Showcase your knowledge of financial products and services, as well as your ability to provide sound financial advice.

- Emphasize your commitment to ethical lending practices and compliance with regulatory guidelines.

Essential Experience Highlights for a Strong Consumer Banker Resume

- Process and evaluate loan applications to determine creditworthiness and mitigate risk.

- Manage a portfolio of consumer loans, ensuring low delinquency rates and maximizing returns.

- Develop and execute marketing strategies to attract new customers and increase customer acquisition.

- Provide exceptional customer service, resolving inquiries promptly and effectively.

- Utilize financial analysis tools to assess customer financial health and make sound lending decisions.

- Collaborate with financial advisors to create personalized financial plans for customers.

- Establish and maintain relationships with community stakeholders to support business development.

Frequently Asked Questions (FAQ’s) For Consumer Banker

What are the key skills required for a Consumer Banker?

Consumer Bankers require a combination of hard skills, such as financial analysis and risk management, and soft skills, such as customer service and communication.

What are the career growth opportunities for a Consumer Banker?

Consumer Bankers can advance to roles such as Branch Manager, Commercial Banker, or Wealth Manager with experience and additional qualifications.

What is the salary range for a Consumer Banker?

The salary range for a Consumer Banker varies depending on experience, location, and company size, but typically falls between $50,000 and $100,000.

What are the challenges faced by Consumer Bankers?

Consumer Bankers face challenges such as managing risk, maintaining compliance, and meeting customer expectations in a competitive market.

How can I prepare for an interview for a Consumer Banker position?

Prepare for an interview by researching the company and the position, practicing your answers to common interview questions, and preparing questions to ask the interviewer.

What are the ethical considerations for Consumer Bankers?

Consumer Bankers have a responsibility to act ethically and in the best interests of their customers, ensuring fair lending practices and protecting customer information.

How does technology impact the role of a Consumer Banker?

Technology is transforming the banking industry, and Consumer Bankers are leveraging technology to streamline processes, improve customer experience, and enhance risk management.