Are you a seasoned Consumer Credit Counselor seeking a new career path? Discover our professionally built Consumer Credit Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

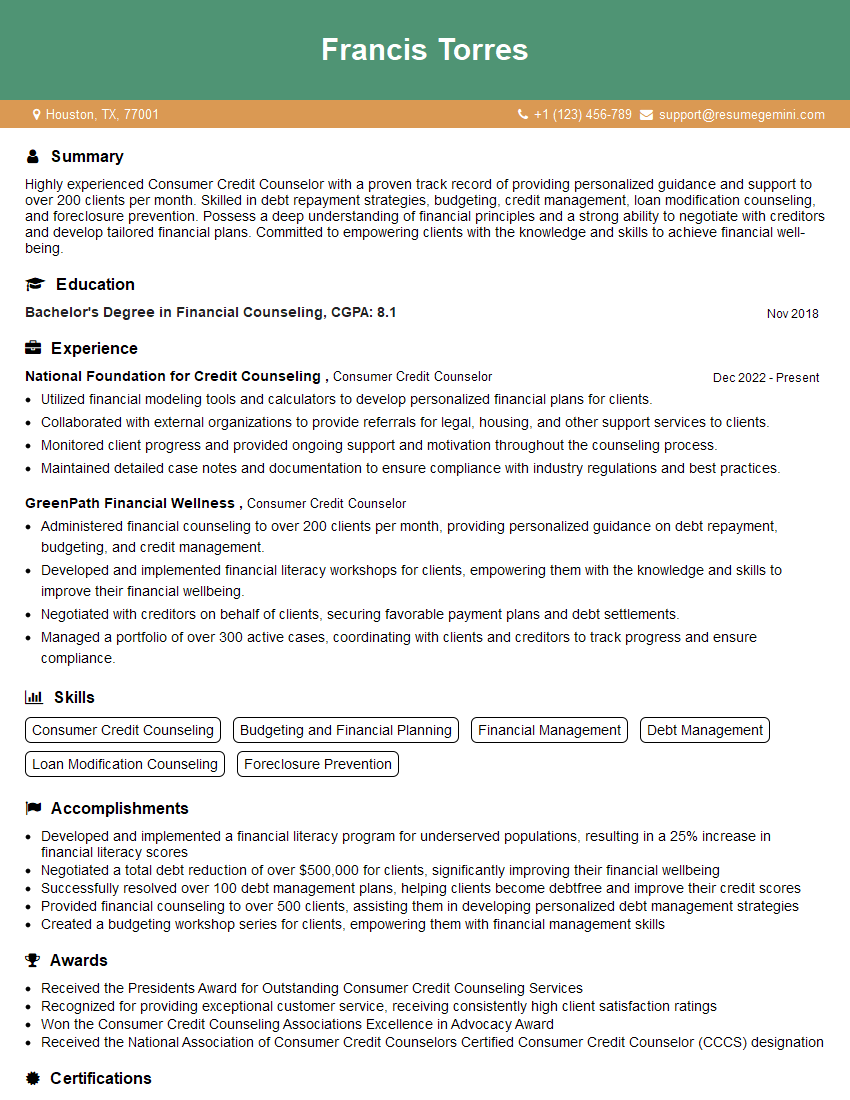

Francis Torres

Consumer Credit Counselor

Summary

Highly experienced Consumer Credit Counselor with a proven track record of providing personalized guidance and support to over 200 clients per month. Skilled in debt repayment strategies, budgeting, credit management, loan modification counseling, and foreclosure prevention. Possess a deep understanding of financial principles and a strong ability to negotiate with creditors and develop tailored financial plans. Committed to empowering clients with the knowledge and skills to achieve financial well-being.

Education

Bachelor’s Degree in Financial Counseling

November 2018

Skills

- Consumer Credit Counseling

- Budgeting and Financial Planning

- Financial Management

- Debt Management

- Loan Modification Counseling

- Foreclosure Prevention

Work Experience

Consumer Credit Counselor

- Utilized financial modeling tools and calculators to develop personalized financial plans for clients.

- Collaborated with external organizations to provide referrals for legal, housing, and other support services to clients.

- Monitored client progress and provided ongoing support and motivation throughout the counseling process.

- Maintained detailed case notes and documentation to ensure compliance with industry regulations and best practices.

Consumer Credit Counselor

- Administered financial counseling to over 200 clients per month, providing personalized guidance on debt repayment, budgeting, and credit management.

- Developed and implemented financial literacy workshops for clients, empowering them with the knowledge and skills to improve their financial wellbeing.

- Negotiated with creditors on behalf of clients, securing favorable payment plans and debt settlements.

- Managed a portfolio of over 300 active cases, coordinating with clients and creditors to track progress and ensure compliance.

Accomplishments

- Developed and implemented a financial literacy program for underserved populations, resulting in a 25% increase in financial literacy scores

- Negotiated a total debt reduction of over $500,000 for clients, significantly improving their financial wellbeing

- Successfully resolved over 100 debt management plans, helping clients become debtfree and improve their credit scores

- Provided financial counseling to over 500 clients, assisting them in developing personalized debt management strategies

- Created a budgeting workshop series for clients, empowering them with financial management skills

Awards

- Received the Presidents Award for Outstanding Consumer Credit Counseling Services

- Recognized for providing exceptional customer service, receiving consistently high client satisfaction ratings

- Won the Consumer Credit Counseling Associations Excellence in Advocacy Award

- Received the National Association of Consumer Credit Counselors Certified Consumer Credit Counselor (CCCS) designation

Certificates

- Certified Consumer Credit Counselor (CCCS)

- Certified Personal Finance Counselor (CPFC)

- Certified Housing Counselor (CHC)

- Financial Planning Certificate (FPC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Consumer Credit Counselor

- Showcase your passion for helping others overcome financial challenges.

- Quantify your accomplishments with specific metrics and outcomes.

- Highlight your ability to build rapport and establish trust with clients.

- Emphasize your knowledge of financial principles and counseling techniques.

- Consider obtaining industry certifications to demonstrate your expertise.

Essential Experience Highlights for a Strong Consumer Credit Counselor Resume

- Provided comprehensive financial counseling to individuals and families facing financial challenges.

- Developed and implemented financial literacy workshops to educate clients on budgeting, debt management, and credit building.

- Negotiated with creditors to secure favorable payment plans and debt settlements, resulting in significant financial savings for clients.

- Managed a portfolio of over 300 active cases, coordinating with clients, creditors, and external organizations to ensure compliance and progress tracking.

- Utilized financial modeling tools and calculators to develop personalized financial plans tailored to each client’s unique circumstances.

- Collaborated with external organizations to provide referrals for legal, housing, and other support services to clients.

- Monitored client progress and provided ongoing support and motivation throughout the counseling process.

Frequently Asked Questions (FAQ’s) For Consumer Credit Counselor

What is the role of a Consumer Credit Counselor?

A Consumer Credit Counselor provides personalized guidance and support to individuals facing financial challenges. They help clients develop strategies for debt repayment, budgeting, credit management, and financial literacy.

What are the key skills required to be a successful Consumer Credit Counselor?

Key skills include a strong understanding of financial principles, negotiation skills, empathy, communication skills, and the ability to develop personalized financial plans.

What are the benefits of working as a Consumer Credit Counselor?

Working as a Consumer Credit Counselor offers the opportunity to make a positive impact on people’s lives, contribute to their financial well-being, and develop valuable skills in finance and counseling.

What is the job outlook for Consumer Credit Counselors?

The job outlook for Consumer Credit Counselors is expected to grow in the coming years due to the increasing demand for financial counseling services.

What is the earning potential for Consumer Credit Counselors?

The earning potential for Consumer Credit Counselors varies depending on experience, location, and organization. According to the U.S. Bureau of Labor Statistics, the median annual salary for Personal Financial Advisors, which includes Consumer Credit Counselors, was $89,330 in May 2020.

How can I become a Consumer Credit Counselor?

To become a Consumer Credit Counselor, you typically need a bachelor’s degree in a related field, such as finance, counseling, or social work. Some employers may also require industry certifications or experience in financial counseling.