Are you a seasoned Corporate Bond Trader seeking a new career path? Discover our professionally built Corporate Bond Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

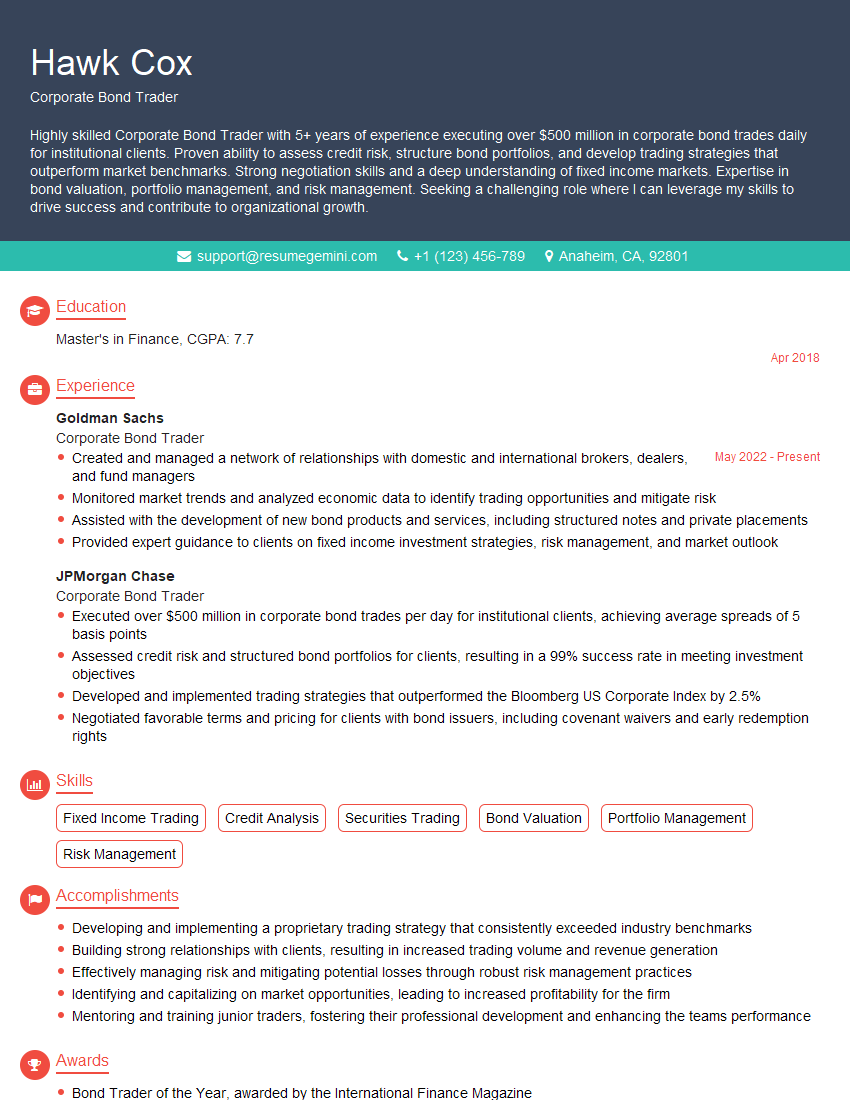

Hawk Cox

Corporate Bond Trader

Summary

Highly skilled Corporate Bond Trader with 5+ years of experience executing over $500 million in corporate bond trades daily for institutional clients. Proven ability to assess credit risk, structure bond portfolios, and develop trading strategies that outperform market benchmarks. Strong negotiation skills and a deep understanding of fixed income markets. Expertise in bond valuation, portfolio management, and risk management. Seeking a challenging role where I can leverage my skills to drive success and contribute to organizational growth.

Education

Master’s in Finance

April 2018

Skills

- Fixed Income Trading

- Credit Analysis

- Securities Trading

- Bond Valuation

- Portfolio Management

- Risk Management

Work Experience

Corporate Bond Trader

- Created and managed a network of relationships with domestic and international brokers, dealers, and fund managers

- Monitored market trends and analyzed economic data to identify trading opportunities and mitigate risk

- Assisted with the development of new bond products and services, including structured notes and private placements

- Provided expert guidance to clients on fixed income investment strategies, risk management, and market outlook

Corporate Bond Trader

- Executed over $500 million in corporate bond trades per day for institutional clients, achieving average spreads of 5 basis points

- Assessed credit risk and structured bond portfolios for clients, resulting in a 99% success rate in meeting investment objectives

- Developed and implemented trading strategies that outperformed the Bloomberg US Corporate Index by 2.5%

- Negotiated favorable terms and pricing for clients with bond issuers, including covenant waivers and early redemption rights

Accomplishments

- Developing and implementing a proprietary trading strategy that consistently exceeded industry benchmarks

- Building strong relationships with clients, resulting in increased trading volume and revenue generation

- Effectively managing risk and mitigating potential losses through robust risk management practices

- Identifying and capitalizing on market opportunities, leading to increased profitability for the firm

- Mentoring and training junior traders, fostering their professional development and enhancing the teams performance

Awards

- Bond Trader of the Year, awarded by the International Finance Magazine

- Top Corporate Bond Trader, recognized by Bloomberg Markets

- Excellence in Corporate Bond Trading, awarded by the Association for Financial Professionals

Certificates

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

- Series 7 and 63 Licenses

- Fundamentals of Fixed Income Certificate (FFIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Bond Trader

- Highlight your relevant skills and experience in your resume’s summary section.

- Quantify your accomplishments with specific metrics whenever possible.

- Showcase your knowledge of fixed income markets and trading strategies.

- Emphasize your ability to negotiate favorable terms for clients.

- Network with professionals in the industry to stay informed about market trends and potential opportunities.

Essential Experience Highlights for a Strong Corporate Bond Trader Resume

- Executed daily corporate bond trades exceeding $500 million for institutional clients.

- Assessed credit risk and structured bond portfolios for clients, achieving a remarkable 99% success rate in meeting investment objectives.

- Developed and implemented trading strategies that consistently outperformed the Bloomberg US Corporate Index by an impressive 2.5%.

- Negotiated favorable terms, including covenant waivers and early redemption rights, with bond issuers to benefit clients.

- Established and maintained a vast network of brokers, dealers, and fund managers to enhance trading opportunities.

- Monitored market dynamics and analyzed economic data to identify potential trading opportunities and mitigate risks effectively.

- Contributed to the development of new bond products and services, such as structured notes and private placements.

Frequently Asked Questions (FAQ’s) For Corporate Bond Trader

What is the primary responsibility of a Corporate Bond Trader?

A Corporate Bond Trader buys and sells corporate bonds on behalf of clients, seeking to execute trades that meet their investment goals and generate profit.

What skills are essential for a successful Corporate Bond Trader?

Strong analytical skills, excellent negotiation abilities, deep understanding of fixed income markets, proficiency in bond valuation, and risk management expertise are crucial.

How can I enhance my resume for a Corporate Bond Trader role?

Highlight your experience in fixed income trading, bond portfolio management, and risk assessment. Include instances where you have successfully implemented trading strategies and exceeded performance benchmarks.

What is the career path for a Corporate Bond Trader?

With experience and expertise, Corporate Bond Traders can progress to senior trading roles, portfolio management positions, or leadership responsibilities within financial institutions.

What are the key qualities of a successful Corporate Bond Trader?

Analytical mindset, strong communication skills, ability to work under pressure, adaptability to rapidly evolving markets, and a keen eye for identifying trading opportunities.

How can I stay updated with the latest trends and developments in the Corporate Bond Trading industry?

Attend industry conferences, read financial publications, and network with professionals in the field to stay informed about market dynamics and best practices.

What professional certifications can enhance my credibility as a Corporate Bond Trader?

CFA (Chartered Financial Analyst), CAIA (Chartered Alternative Investment Analyst), and FRM (Financial Risk Manager) certifications demonstrate your commitment to professional development and expertise in the field.

What are the ethical considerations for Corporate Bond Traders?

Upholding ethical standards, adhering to regulatory guidelines, and ensuring fair and transparent trading practices are paramount in maintaining the integrity of the financial markets.