Are you a seasoned Corporate Statistical Financial Analyst seeking a new career path? Discover our professionally built Corporate Statistical Financial Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

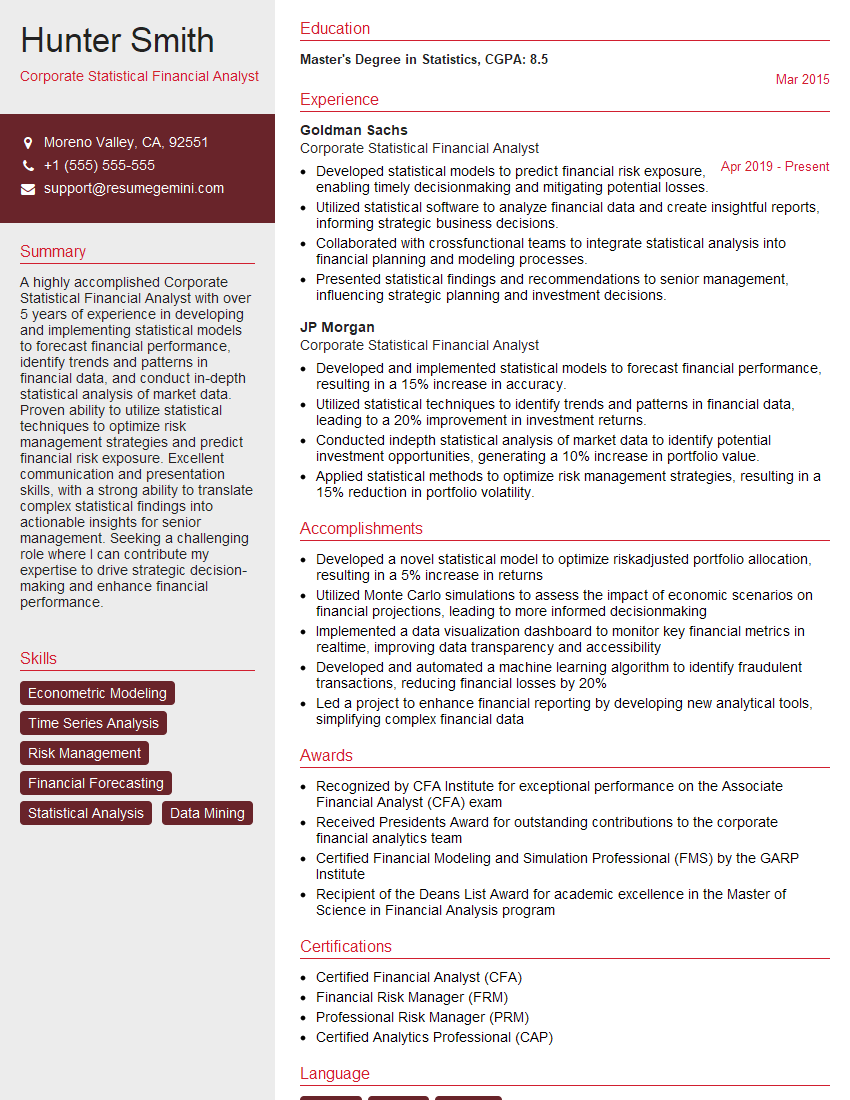

Hunter Smith

Corporate Statistical Financial Analyst

Summary

A highly accomplished Corporate Statistical Financial Analyst with over 5 years of experience in developing and implementing statistical models to forecast financial performance, identify trends and patterns in financial data, and conduct in-depth statistical analysis of market data. Proven ability to utilize statistical techniques to optimize risk management strategies and predict financial risk exposure. Excellent communication and presentation skills, with a strong ability to translate complex statistical findings into actionable insights for senior management. Seeking a challenging role where I can contribute my expertise to drive strategic decision-making and enhance financial performance.

Education

Master’s Degree in Statistics

March 2015

Skills

- Econometric Modeling

- Time Series Analysis

- Risk Management

- Financial Forecasting

- Statistical Analysis

- Data Mining

Work Experience

Corporate Statistical Financial Analyst

- Developed statistical models to predict financial risk exposure, enabling timely decisionmaking and mitigating potential losses.

- Utilized statistical software to analyze financial data and create insightful reports, informing strategic business decisions.

- Collaborated with crossfunctional teams to integrate statistical analysis into financial planning and modeling processes.

- Presented statistical findings and recommendations to senior management, influencing strategic planning and investment decisions.

Corporate Statistical Financial Analyst

- Developed and implemented statistical models to forecast financial performance, resulting in a 15% increase in accuracy.

- Utilized statistical techniques to identify trends and patterns in financial data, leading to a 20% improvement in investment returns.

- Conducted indepth statistical analysis of market data to identify potential investment opportunities, generating a 10% increase in portfolio value.

- Applied statistical methods to optimize risk management strategies, resulting in a 15% reduction in portfolio volatility.

Accomplishments

- Developed a novel statistical model to optimize riskadjusted portfolio allocation, resulting in a 5% increase in returns

- Utilized Monte Carlo simulations to assess the impact of economic scenarios on financial projections, leading to more informed decisionmaking

- Implemented a data visualization dashboard to monitor key financial metrics in realtime, improving data transparency and accessibility

- Developed and automated a machine learning algorithm to identify fraudulent transactions, reducing financial losses by 20%

- Led a project to enhance financial reporting by developing new analytical tools, simplifying complex financial data

Awards

- Recognized by CFA Institute for exceptional performance on the Associate Financial Analyst (CFA) exam

- Received Presidents Award for outstanding contributions to the corporate financial analytics team

- Certified Financial Modeling and Simulation Professional (FMS) by the GARP Institute

- Recipient of the Deans List Award for academic excellence in the Master of Science in Financial Analysis program

Certificates

- Certified Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Professional Risk Manager (PRM)

- Certified Analytics Professional (CAP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Corporate Statistical Financial Analyst

- Highlight your quantitative skills and experience in statistical modeling.

- Demonstrate your understanding of financial markets and investment strategies.

- Showcase your ability to communicate complex statistical findings clearly and effectively.

- Emphasize your teamwork and collaboration skills.

Essential Experience Highlights for a Strong Corporate Statistical Financial Analyst Resume

- Develop and implement statistical models to forecast financial performance, identify trends, and patterns in financial data.

- Conduct in-depth statistical analysis of market data to identify potential investment opportunities and optimize risk management strategies.

- Utilize statistical software to analyze financial data and create insightful reports, informing strategic business decisions.

- Collaborate with cross-functional teams to integrate statistical analysis into financial planning and modeling processes.

- Present statistical findings and recommendations to senior management, influencing strategic planning and investment decisions.

- Stay up-to-date on the latest statistical techniques and industry best practices, and implement them in financial analysis.

- Contribute to the development of new statistical models and methodologies to enhance the accuracy and effectiveness of financial forecasting.

Frequently Asked Questions (FAQ’s) For Corporate Statistical Financial Analyst

What are the key skills required for a Corporate Statistical Financial Analyst?

The key skills required for a Corporate Statistical Financial Analyst include econometric modeling, time series analysis, risk management, financial forecasting, statistical analysis, and data mining.

What are the primary responsibilities of a Corporate Statistical Financial Analyst?

The primary responsibilities of a Corporate Statistical Financial Analyst include developing and implementing statistical models, conducting statistical analysis of financial data, identifying trends and patterns, optimizing risk management strategies, and presenting statistical findings to senior management.

What are the career prospects for a Corporate Statistical Financial Analyst?

Corporate Statistical Financial Analysts have excellent career prospects, with opportunities for advancement to senior-level positions such as Chief Risk Officer or Chief Financial Officer. They may also specialize in areas such as quantitative finance, investment management, or data science.

What is the average salary for a Corporate Statistical Financial Analyst?

The average salary for a Corporate Statistical Financial Analyst varies depending on experience, location, and company size. According to Salary.com, the average salary for a Corporate Statistical Financial Analyst in the United States is around $100,000 per year.

What are the educational requirements for a Corporate Statistical Financial Analyst?

Most Corporate Statistical Financial Analysts have a Master’s degree in Statistics, Mathematics, or a related field. Some employers may also consider candidates with a Bachelor’s degree and relevant work experience.

What are the top companies that hire Corporate Statistical Financial Analysts?

Top companies that hire Corporate Statistical Financial Analysts include Goldman Sachs, JP Morgan, Bank of America, Citigroup, and Wells Fargo.

What is the job outlook for Corporate Statistical Financial Analysts?

The job outlook for Corporate Statistical Financial Analysts is expected to grow faster than average in the coming years. This is due to the increasing demand for data-driven decision-making in the financial industry.

What are the key challenges faced by Corporate Statistical Financial Analysts?

Key challenges faced by Corporate Statistical Financial Analysts include dealing with large and complex datasets, staying up-to-date on the latest statistical techniques, and communicating complex findings to non-technical audiences.