Are you a seasoned Cost Accountant seeking a new career path? Discover our professionally built Cost Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

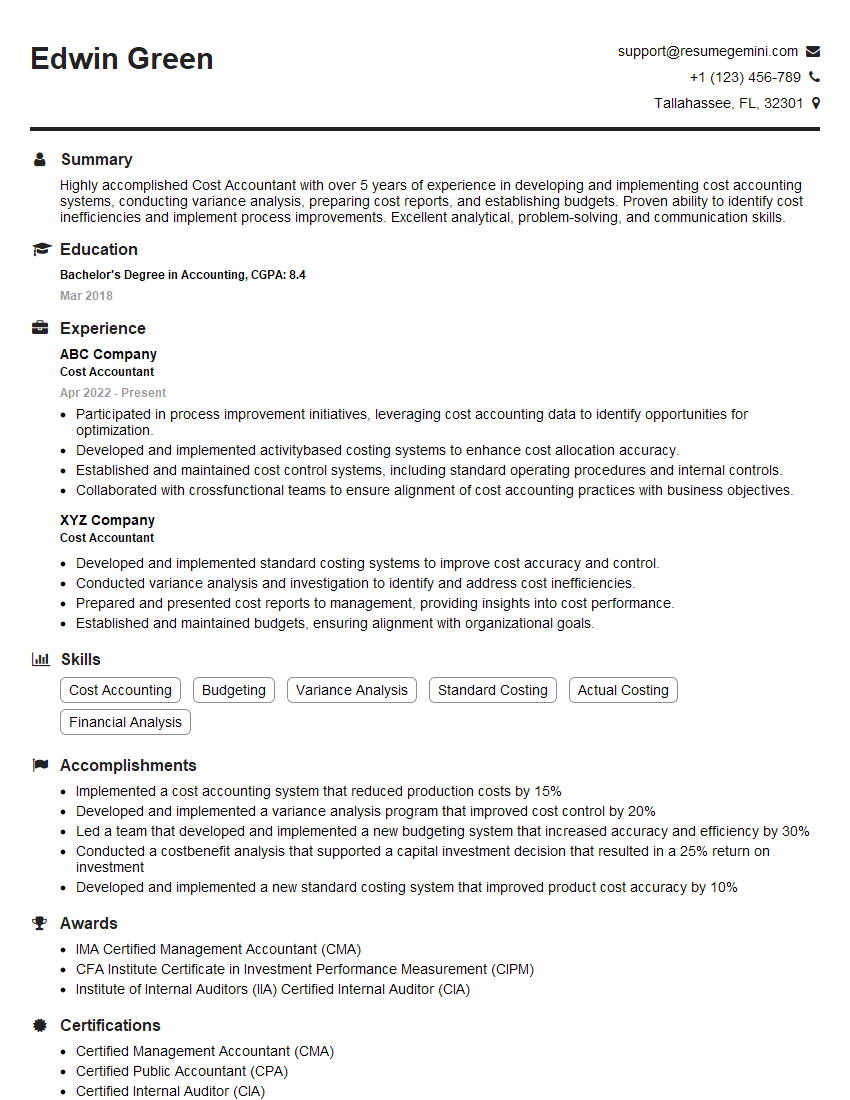

Edwin Green

Cost Accountant

Summary

Highly accomplished Cost Accountant with over 5 years of experience in developing and implementing cost accounting systems, conducting variance analysis, preparing cost reports, and establishing budgets. Proven ability to identify cost inefficiencies and implement process improvements. Excellent analytical, problem-solving, and communication skills.

Education

Bachelor’s Degree in Accounting

March 2018

Skills

- Cost Accounting

- Budgeting

- Variance Analysis

- Standard Costing

- Actual Costing

- Financial Analysis

Work Experience

Cost Accountant

- Participated in process improvement initiatives, leveraging cost accounting data to identify opportunities for optimization.

- Developed and implemented activitybased costing systems to enhance cost allocation accuracy.

- Established and maintained cost control systems, including standard operating procedures and internal controls.

- Collaborated with crossfunctional teams to ensure alignment of cost accounting practices with business objectives.

Cost Accountant

- Developed and implemented standard costing systems to improve cost accuracy and control.

- Conducted variance analysis and investigation to identify and address cost inefficiencies.

- Prepared and presented cost reports to management, providing insights into cost performance.

- Established and maintained budgets, ensuring alignment with organizational goals.

Accomplishments

- Implemented a cost accounting system that reduced production costs by 15%

- Developed and implemented a variance analysis program that improved cost control by 20%

- Led a team that developed and implemented a new budgeting system that increased accuracy and efficiency by 30%

- Conducted a costbenefit analysis that supported a capital investment decision that resulted in a 25% return on investment

- Developed and implemented a new standard costing system that improved product cost accuracy by 10%

Awards

- IMA Certified Management Accountant (CMA)

- CFA Institute Certificate in Investment Performance Measurement (CIPM)

- Institute of Internal Auditors (IIA) Certified Internal Auditor (CIA)

Certificates

- Certified Management Accountant (CMA)

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Cost Accountant

- Highlight your experience in developing and implementing cost accounting systems.

- Quantify your accomplishments, using specific metrics to demonstrate your impact on the organization.

- Showcase your analytical and problem-solving skills, highlighting your ability to identify and address cost inefficiencies.

- Emphasize your communication skills, including your ability to present cost reports and insights to management.

Essential Experience Highlights for a Strong Cost Accountant Resume

- Developed and implemented standard costing systems to improve cost accuracy and control.

- Conducted variance analysis and investigation to identify and address cost inefficiencies.

- Prepared and presented cost reports to management, providing insights into cost performance.

- Established and maintained budgets, ensuring alignment with organizational goals.

- Participated in process improvement initiatives, leveraging cost accounting data to identify opportunities for optimization.

- Developed and implemented activity-based costing systems to enhance cost allocation accuracy.

- Established and maintained cost control systems, including standard operating procedures and internal controls.

- Collaborated with cross-functional teams to ensure alignment of cost accounting practices with business objectives.

Frequently Asked Questions (FAQ’s) For Cost Accountant

What are the key skills required for a Cost Accountant?

Key skills for a Cost Accountant include cost accounting, budgeting, variance analysis, standard costing, actual costing, and financial analysis.

What are the career opportunities for Cost Accountants?

Cost Accountants can advance to roles such as Senior Cost Accountant, Cost Accounting Manager, and Controller.

What is the job outlook for Cost Accountants?

The job outlook for Cost Accountants is expected to grow faster than average, due to the increasing demand for cost optimization and analysis.

What are the salary expectations for Cost Accountants?

The salary expectations for Cost Accountants vary depending on experience, location, and industry, but typically range from $60,000 to $100,000 per year.

What are the educational requirements for Cost Accountants?

Cost Accountants typically need a bachelor’s degree in accounting or a related field.

What are the certification options for Cost Accountants?

Cost Accountants can obtain certification from organizations such as the Institute of Certified Management Accountants (ICMA) or the American Institute of Certified Public Accountants (AICPA).