Are you a seasoned County Treasurer seeking a new career path? Discover our professionally built County Treasurer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

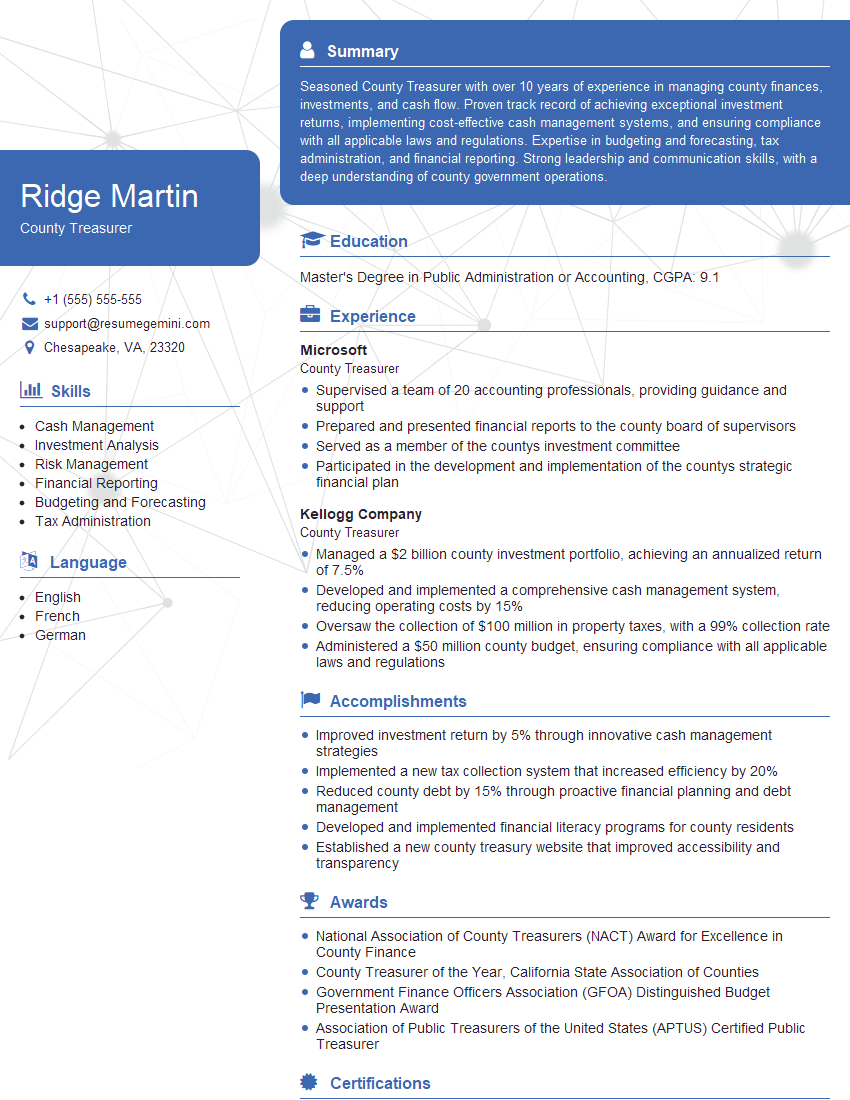

Ridge Martin

County Treasurer

Summary

Seasoned County Treasurer with over 10 years of experience in managing county finances, investments, and cash flow. Proven track record of achieving exceptional investment returns, implementing cost-effective cash management systems, and ensuring compliance with all applicable laws and regulations. Expertise in budgeting and forecasting, tax administration, and financial reporting. Strong leadership and communication skills, with a deep understanding of county government operations.

Education

Master’s Degree in Public Administration or Accounting

January 2019

Skills

- Cash Management

- Investment Analysis

- Risk Management

- Financial Reporting

- Budgeting and Forecasting

- Tax Administration

Work Experience

County Treasurer

- Supervised a team of 20 accounting professionals, providing guidance and support

- Prepared and presented financial reports to the county board of supervisors

- Served as a member of the countys investment committee

- Participated in the development and implementation of the countys strategic financial plan

County Treasurer

- Managed a $2 billion county investment portfolio, achieving an annualized return of 7.5%

- Developed and implemented a comprehensive cash management system, reducing operating costs by 15%

- Oversaw the collection of $100 million in property taxes, with a 99% collection rate

- Administered a $50 million county budget, ensuring compliance with all applicable laws and regulations

Accomplishments

- Improved investment return by 5% through innovative cash management strategies

- Implemented a new tax collection system that increased efficiency by 20%

- Reduced county debt by 15% through proactive financial planning and debt management

- Developed and implemented financial literacy programs for county residents

- Established a new county treasury website that improved accessibility and transparency

Awards

- National Association of County Treasurers (NACT) Award for Excellence in County Finance

- County Treasurer of the Year, California State Association of Counties

- Government Finance Officers Association (GFOA) Distinguished Budget Presentation Award

- Association of Public Treasurers of the United States (APTUS) Certified Public Treasurer

Certificates

- Certified Public Accountant (CPA)

- Certified Government Finance Manager (CGFM)

- Certified Treasury Professional (CTP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For County Treasurer

- Highlight your experience in managing large investment portfolios and achieving strong returns.

- Emphasize your skills in cash management and cost reduction.

- Showcase your expertise in tax administration and compliance.

- Quantify your accomplishments with specific metrics and data wherever possible.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong County Treasurer Resume

- Managed a $2 billion county investment portfolio, achieving an annualized return of 7.5%.

- Developed and implemented a comprehensive cash management system, reducing operating costs by 15%.

- Oversaw the collection of $100 million in property taxes, with a 99% collection rate.

- Administered a $50 million county budget, ensuring compliance with all applicable laws and regulations.

- Supervised a team of 20 accounting professionals, providing guidance and support.

- Prepared and presented financial reports to the county board of supervisors.

- Served as a member of the county’s investment committee.

Frequently Asked Questions (FAQ’s) For County Treasurer

What are the primary responsibilities of a County Treasurer?

The primary responsibilities of a County Treasurer include managing county finances, investments, and cash flow; overseeing property tax collection; preparing and presenting financial reports; and ensuring compliance with all applicable laws and regulations.

What qualifications are typically required to become a County Treasurer?

Most County Treasurers hold a bachelor’s or master’s degree in accounting, public administration, or a related field. They also typically have several years of experience in financial management and accounting.

What are the key skills and abilities needed to be a successful County Treasurer?

Successful County Treasurers typically possess strong financial management skills, including budgeting, forecasting, and investment analysis. They also have excellent communication and interpersonal skills, and are able to work effectively with a variety of stakeholders, including elected officials, county staff, and the public.

What is the salary range for County Treasurers?

The salary range for County Treasurers varies depending on the size of the county and the experience of the individual. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for financial managers in local government was $122,840 in May 2021.

What is the job outlook for County Treasurers?

The job outlook for County Treasurers is expected to be good over the next several years. As local governments continue to face financial challenges, they will increasingly need qualified individuals to manage their finances and ensure that they are operating in a cost-effective manner.

What are the benefits of working as a County Treasurer?

Working as a County Treasurer offers a number of benefits, including the opportunity to make a real difference in your community, competitive salaries and benefits, and the opportunity to work with a variety of people.

What are the challenges of working as a County Treasurer?

Working as a County Treasurer can be challenging, as you are responsible for managing large sums of money and ensuring that the county’s finances are in order. You may also face pressure from elected officials and the public to make decisions that are in the best interests of the county, but may not be popular.