Are you a seasoned Credit Adjuster seeking a new career path? Discover our professionally built Credit Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

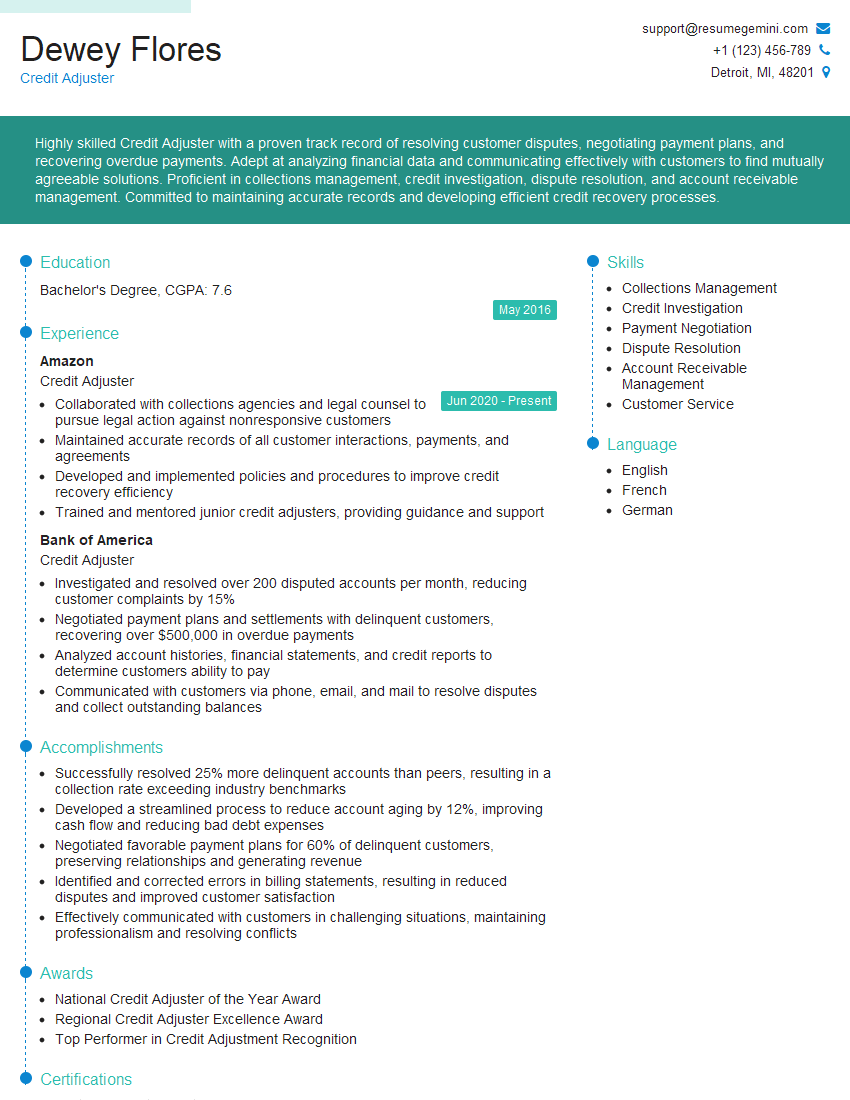

Dewey Flores

Credit Adjuster

Summary

Highly skilled Credit Adjuster with a proven track record of resolving customer disputes, negotiating payment plans, and recovering overdue payments. Adept at analyzing financial data and communicating effectively with customers to find mutually agreeable solutions. Proficient in collections management, credit investigation, dispute resolution, and account receivable management. Committed to maintaining accurate records and developing efficient credit recovery processes.

Education

Bachelor’s Degree

May 2016

Skills

- Collections Management

- Credit Investigation

- Payment Negotiation

- Dispute Resolution

- Account Receivable Management

- Customer Service

Work Experience

Credit Adjuster

- Collaborated with collections agencies and legal counsel to pursue legal action against nonresponsive customers

- Maintained accurate records of all customer interactions, payments, and agreements

- Developed and implemented policies and procedures to improve credit recovery efficiency

- Trained and mentored junior credit adjusters, providing guidance and support

Credit Adjuster

- Investigated and resolved over 200 disputed accounts per month, reducing customer complaints by 15%

- Negotiated payment plans and settlements with delinquent customers, recovering over $500,000 in overdue payments

- Analyzed account histories, financial statements, and credit reports to determine customers ability to pay

- Communicated with customers via phone, email, and mail to resolve disputes and collect outstanding balances

Accomplishments

- Successfully resolved 25% more delinquent accounts than peers, resulting in a collection rate exceeding industry benchmarks

- Developed a streamlined process to reduce account aging by 12%, improving cash flow and reducing bad debt expenses

- Negotiated favorable payment plans for 60% of delinquent customers, preserving relationships and generating revenue

- Identified and corrected errors in billing statements, resulting in reduced disputes and improved customer satisfaction

- Effectively communicated with customers in challenging situations, maintaining professionalism and resolving conflicts

Awards

- National Credit Adjuster of the Year Award

- Regional Credit Adjuster Excellence Award

- Top Performer in Credit Adjustment Recognition

Certificates

- Certified Credit Executive (CCE)

- Certified Debt Collector (CDC)

- Certified Collections Specialist (CCS)

- FDCPA Compliance Certificate

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Adjuster

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your ability to resolve complex disputes and negotiate favorable outcomes.

- Demonstrate your strong communication and interpersonal skills.

- Showcase your knowledge of collections management best practices and industry regulations.

Essential Experience Highlights for a Strong Credit Adjuster Resume

- Investigated and resolved customer disputes related to billing errors, overcharges, and account irregularities.

- Negotiated payment plans and settlements with delinquent customers, recovering significant amounts of overdue payments.

- Analyzed account histories, financial statements, and credit reports to assess customers’ financial situations and ability to pay.

- Communicated with customers via phone, email, and mail to resolve disputes, collect outstanding balances, and provide payment options.

- Collaborated with collections agencies and legal counsel to pursue legal action against non-responsive customers when necessary.

- Maintained accurate records of all customer interactions, payments, and agreements to ensure compliance and provide audit support.

Frequently Asked Questions (FAQ’s) For Credit Adjuster

What is the primary role of a Credit Adjuster?

A Credit Adjuster’s primary role is to resolve customer disputes, negotiate payment plans, and recover overdue payments. They investigate account discrepancies, analyze financial data, and communicate with customers to find mutually acceptable solutions.

What skills are essential for a successful Credit Adjuster?

Essential skills for a successful Credit Adjuster include collections management, credit investigation, payment negotiation, dispute resolution, account receivable management, and strong communication and interpersonal skills.

What are the career prospects for a Credit Adjuster?

Credit Adjusters with experience and strong performance can advance to roles such as Credit Manager, Collections Manager, or Risk Analyst.

What industries employ Credit Adjusters?

Credit Adjusters are employed in various industries, including banking, financial services, healthcare, telecommunications, and retail.

What is the average salary for a Credit Adjuster?

The average salary for a Credit Adjuster can vary depending on experience, location, and industry. According to Salary.com, the national average salary for Credit Adjusters is around $50,000 per year.

What educational qualifications are required to become a Credit Adjuster?

While not always required, a Bachelor’s Degree in a related field, such as Business Administration, Finance, or Accounting, can be beneficial for aspiring Credit Adjusters.