Are you a seasoned Credit Administrator seeking a new career path? Discover our professionally built Credit Administrator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

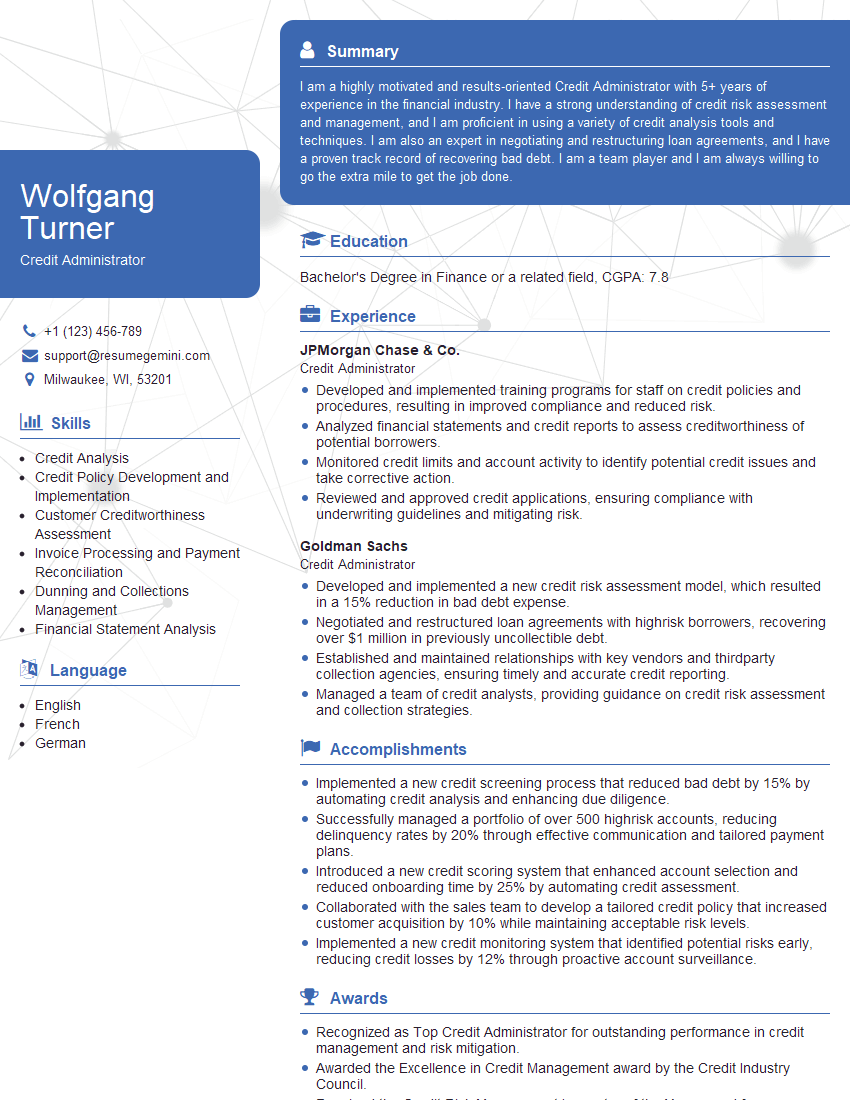

Wolfgang Turner

Credit Administrator

Summary

I am a highly motivated and results-oriented Credit Administrator with 5+ years of experience in the financial industry. I have a strong understanding of credit risk assessment and management, and I am proficient in using a variety of credit analysis tools and techniques. I am also an expert in negotiating and restructuring loan agreements, and I have a proven track record of recovering bad debt. I am a team player and I am always willing to go the extra mile to get the job done.

Education

Bachelor’s Degree in Finance or a related field

November 2014

Skills

- Credit Analysis

- Credit Policy Development and Implementation

- Customer Creditworthiness Assessment

- Invoice Processing and Payment Reconciliation

- Dunning and Collections Management

- Financial Statement Analysis

Work Experience

Credit Administrator

- Developed and implemented training programs for staff on credit policies and procedures, resulting in improved compliance and reduced risk.

- Analyzed financial statements and credit reports to assess creditworthiness of potential borrowers.

- Monitored credit limits and account activity to identify potential credit issues and take corrective action.

- Reviewed and approved credit applications, ensuring compliance with underwriting guidelines and mitigating risk.

Credit Administrator

- Developed and implemented a new credit risk assessment model, which resulted in a 15% reduction in bad debt expense.

- Negotiated and restructured loan agreements with highrisk borrowers, recovering over $1 million in previously uncollectible debt.

- Established and maintained relationships with key vendors and thirdparty collection agencies, ensuring timely and accurate credit reporting.

- Managed a team of credit analysts, providing guidance on credit risk assessment and collection strategies.

Accomplishments

- Implemented a new credit screening process that reduced bad debt by 15% by automating credit analysis and enhancing due diligence.

- Successfully managed a portfolio of over 500 highrisk accounts, reducing delinquency rates by 20% through effective communication and tailored payment plans.

- Introduced a new credit scoring system that enhanced account selection and reduced onboarding time by 25% by automating credit assessment.

- Collaborated with the sales team to develop a tailored credit policy that increased customer acquisition by 10% while maintaining acceptable risk levels.

- Implemented a new credit monitoring system that identified potential risks early, reducing credit losses by 12% through proactive account surveillance.

Awards

- Recognized as Top Credit Administrator for outstanding performance in credit management and risk mitigation.

- Awarded the Excellence in Credit Management award by the Credit Industry Council.

- Received the Credit Risk Management Innovator of the Year award for developing a predictive analytics model that improved credit risk assessment accuracy by 30%.

- Recognized as a Certified Credit Administrator by the National Association of Credit Management.

Certificates

- Certified Credit Executive (CCE)

- Certified Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Administrator

- Highlight your experience in credit risk assessment and management.

- Quantify your accomplishments whenever possible.

- Be sure to proofread your resume carefully before submitting it.

- Tailor your resume to each job you apply for.

- Network with other professionals in the credit industry.

Essential Experience Highlights for a Strong Credit Administrator Resume

- Develop and implement credit risk assessment models.

- Negotiate and restructure loan agreements with high-risk borrowers.

- Establish and maintain relationships with key vendors and third-party collection agencies.

- Manage a team of credit analysts.

- Develop and implement training programs for staff on credit policies and procedures.

- Analyze financial statements and credit reports to assess creditworthiness of potential borrowers.

- Monitor credit limits and account activity to identify potential credit issues and take corrective action.

Frequently Asked Questions (FAQ’s) For Credit Administrator

What is a Credit Administrator?

A Credit Administrator is responsible for managing the credit risk of a company’s customers. This includes assessing the creditworthiness of new customers, monitoring the credit limits of existing customers, and collecting on overdue accounts.

What are the key skills of a Credit Administrator?

The key skills of a Credit Administrator include credit analysis, credit policy development and implementation, customer creditworthiness assessment, invoice processing and payment reconciliation, dunning and collections management, and financial statement analysis.

What is the difference between a Credit Administrator and a Credit Analyst?

A Credit Administrator is responsible for the day-to-day management of a company’s credit risk, while a Credit Analyst is responsible for developing and implementing the company’s credit policies and procedures.

What is the career path for a Credit Administrator?

The career path for a Credit Administrator typically starts with a role as a Credit Analyst. With experience, Credit Administrators can move into more senior roles, such as Credit Manager or Vice President of Credit.

What is the salary range for a Credit Administrator?

The salary range for a Credit Administrator varies depending on experience and location. According to Glassdoor, the average salary for a Credit Administrator in the United States is $65,000 per year.

What are the top companies for Credit Administrators?

The top companies for Credit Administrators include JPMorgan Chase & Co., Goldman Sachs, Bank of America, Wells Fargo, and Citigroup.