Are you a seasoned Credit Analyst seeking a new career path? Discover our professionally built Credit Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

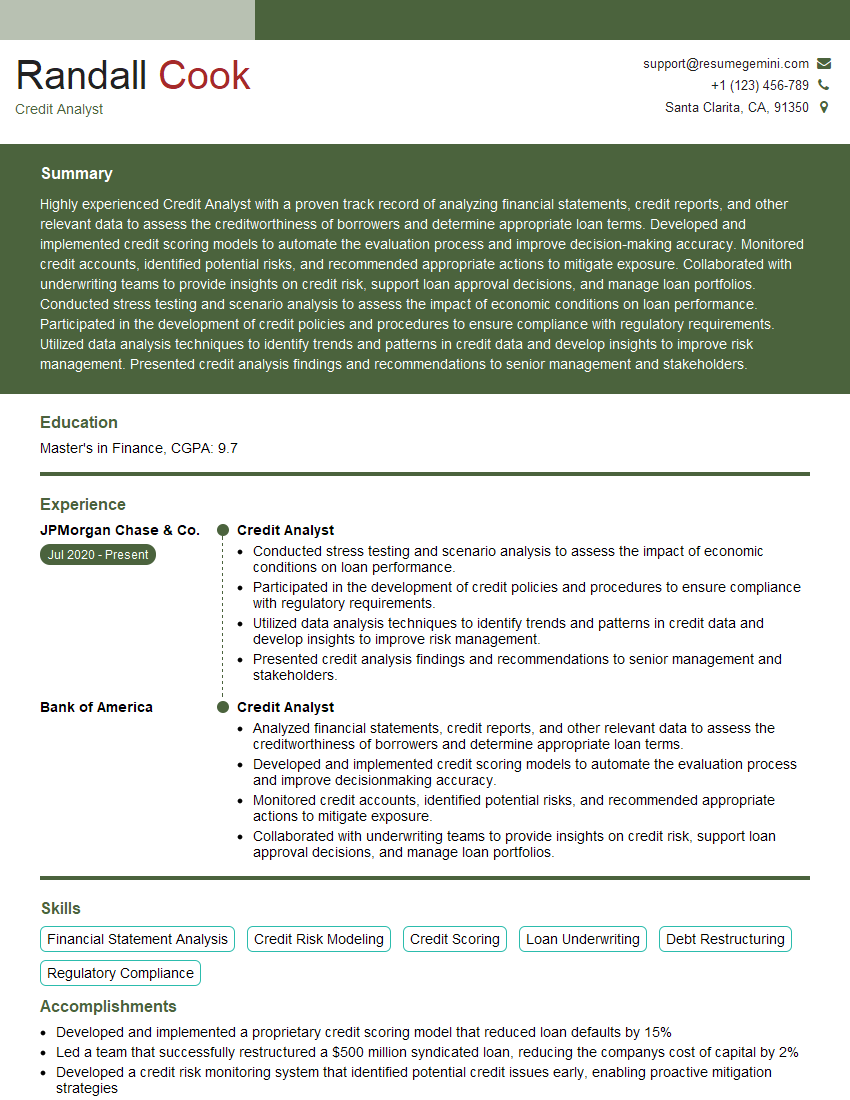

Randall Cook

Credit Analyst

Summary

Highly experienced Credit Analyst with a proven track record of analyzing financial statements, credit reports, and other relevant data to assess the creditworthiness of borrowers and determine appropriate loan terms. Developed and implemented credit scoring models to automate the evaluation process and improve decision-making accuracy. Monitored credit accounts, identified potential risks, and recommended appropriate actions to mitigate exposure. Collaborated with underwriting teams to provide insights on credit risk, support loan approval decisions, and manage loan portfolios. Conducted stress testing and scenario analysis to assess the impact of economic conditions on loan performance. Participated in the development of credit policies and procedures to ensure compliance with regulatory requirements. Utilized data analysis techniques to identify trends and patterns in credit data and develop insights to improve risk management. Presented credit analysis findings and recommendations to senior management and stakeholders.

Education

Master’s in Finance

June 2016

Skills

- Financial Statement Analysis

- Credit Risk Modeling

- Credit Scoring

- Loan Underwriting

- Debt Restructuring

- Regulatory Compliance

Work Experience

Credit Analyst

- Conducted stress testing and scenario analysis to assess the impact of economic conditions on loan performance.

- Participated in the development of credit policies and procedures to ensure compliance with regulatory requirements.

- Utilized data analysis techniques to identify trends and patterns in credit data and develop insights to improve risk management.

- Presented credit analysis findings and recommendations to senior management and stakeholders.

Credit Analyst

- Analyzed financial statements, credit reports, and other relevant data to assess the creditworthiness of borrowers and determine appropriate loan terms.

- Developed and implemented credit scoring models to automate the evaluation process and improve decisionmaking accuracy.

- Monitored credit accounts, identified potential risks, and recommended appropriate actions to mitigate exposure.

- Collaborated with underwriting teams to provide insights on credit risk, support loan approval decisions, and manage loan portfolios.

Accomplishments

- Developed and implemented a proprietary credit scoring model that reduced loan defaults by 15%

- Led a team that successfully restructured a $500 million syndicated loan, reducing the companys cost of capital by 2%

- Developed a credit risk monitoring system that identified potential credit issues early, enabling proactive mitigation strategies

- Negotiated and closed a complex credit facility for a startup technology company, providing the necessary capital for growth

- Provided expert credit analysis and recommendations for investment decisions, resulting in a 10% increase in portfolio value

Awards

- ICAEW Credit Analyst Award for Outstanding Contributions to Credit Risk Management

- M&A Advisor Credit Analyst of the Year Award

- CFA Institute Risk Analyst Recognition Award for Excellence in Credit Analysis

Certificates

- FCCRA Certified

- Credit Analysis and Risk Management Certification (CARM)

- ACCA Qualification

- CIA (Certified Internal Auditor)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Analyst

- Highlight your analytical skills and experience in financial modeling.

- Quantify your accomplishments with specific metrics and results.

- Tailor your resume to the specific requirements of the job you’re applying for.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Credit Analyst Resume

- Analyze financial statements, credit reports, and other relevant data to assess the creditworthiness of borrowers and determine appropriate loan terms

- Develop and implement credit scoring models to automate the evaluation process and improve decision-making accuracy

- Monitor credit accounts, identify potential risks, and recommend appropriate actions to mitigate exposure

- Collaborate with underwriting teams to provide insights on credit risk, support loan approval decisions, and manage loan portfolios

- Conduct stress testing and scenario analysis to assess the impact of economic conditions on loan performance

- Participate in the development of credit policies and procedures to ensure compliance with regulatory requirements

- Utilize data analysis techniques to identify trends and patterns in credit data and develop insights to improve risk management

Frequently Asked Questions (FAQ’s) For Credit Analyst

What is the role of a Credit Analyst?

A Credit Analyst is responsible for assessing the creditworthiness of borrowers and determining appropriate loan terms. They analyze financial statements, credit reports, and other relevant data to make informed decisions about lending.

What skills are required to be a successful Credit Analyst?

Successful Credit Analysts typically have a strong understanding of financial analysis, credit risk modeling, and lending practices. They also have excellent communication and presentation skills.

What is the career path for a Credit Analyst?

Credit Analysts can advance to roles such as Senior Credit Analyst, Portfolio Manager, or Chief Risk Officer. With experience, they can also move into other areas of finance, such as investment banking or private equity.

What is the job outlook for Credit Analysts?

The job outlook for Credit Analysts is expected to be positive in the coming years. As businesses and individuals continue to borrow money, there will be a need for qualified professionals to assess their creditworthiness.

What are the challenges faced by Credit Analysts?

Credit Analysts face a number of challenges, including the need to keep up with changing economic conditions and regulations. They must also be able to make sound judgments in the face of incomplete or inaccurate information.