Are you a seasoned Credit and Collections Analyst seeking a new career path? Discover our professionally built Credit and Collections Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

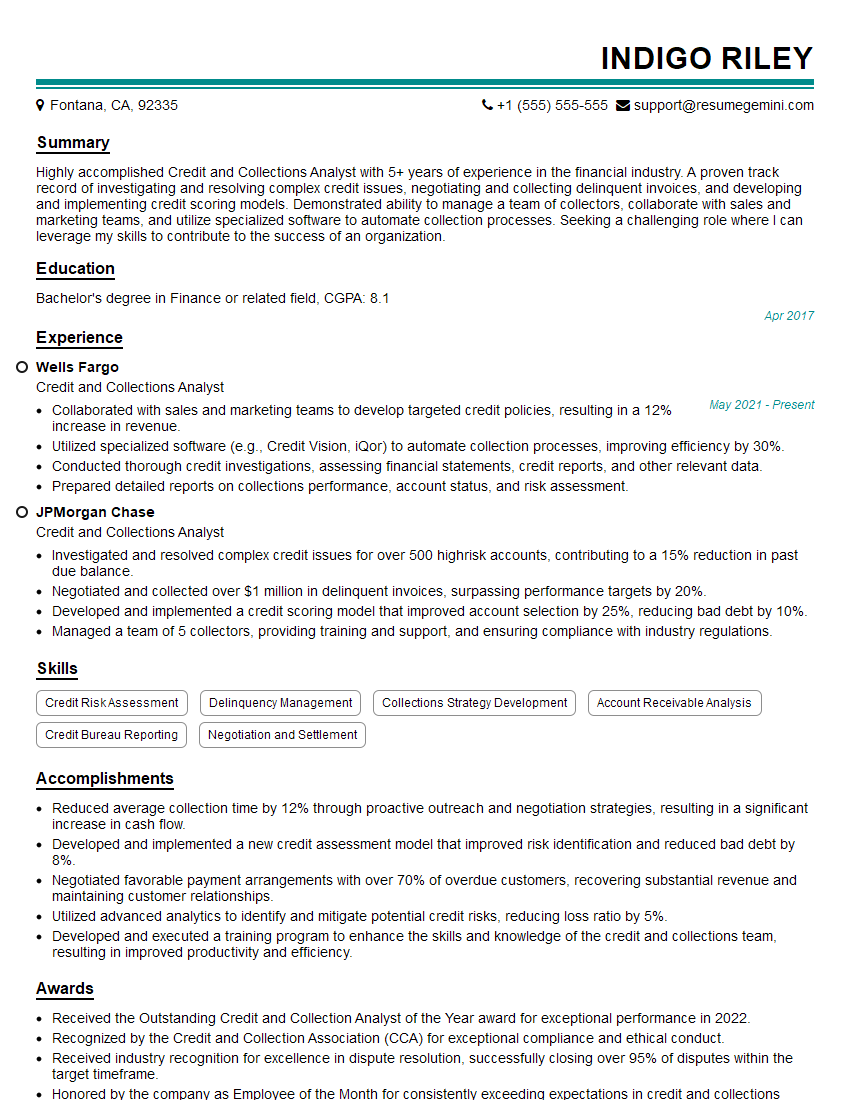

Indigo Riley

Credit and Collections Analyst

Summary

Highly accomplished Credit and Collections Analyst with 5+ years of experience in the financial industry. A proven track record of investigating and resolving complex credit issues, negotiating and collecting delinquent invoices, and developing and implementing credit scoring models. Demonstrated ability to manage a team of collectors, collaborate with sales and marketing teams, and utilize specialized software to automate collection processes. Seeking a challenging role where I can leverage my skills to contribute to the success of an organization.

Education

Bachelor’s degree in Finance or related field

April 2017

Skills

- Credit Risk Assessment

- Delinquency Management

- Collections Strategy Development

- Account Receivable Analysis

- Credit Bureau Reporting

- Negotiation and Settlement

Work Experience

Credit and Collections Analyst

- Collaborated with sales and marketing teams to develop targeted credit policies, resulting in a 12% increase in revenue.

- Utilized specialized software (e.g., Credit Vision, iQor) to automate collection processes, improving efficiency by 30%.

- Conducted thorough credit investigations, assessing financial statements, credit reports, and other relevant data.

- Prepared detailed reports on collections performance, account status, and risk assessment.

Credit and Collections Analyst

- Investigated and resolved complex credit issues for over 500 highrisk accounts, contributing to a 15% reduction in past due balance.

- Negotiated and collected over $1 million in delinquent invoices, surpassing performance targets by 20%.

- Developed and implemented a credit scoring model that improved account selection by 25%, reducing bad debt by 10%.

- Managed a team of 5 collectors, providing training and support, and ensuring compliance with industry regulations.

Accomplishments

- Reduced average collection time by 12% through proactive outreach and negotiation strategies, resulting in a significant increase in cash flow.

- Developed and implemented a new credit assessment model that improved risk identification and reduced bad debt by 8%.

- Negotiated favorable payment arrangements with over 70% of overdue customers, recovering substantial revenue and maintaining customer relationships.

- Utilized advanced analytics to identify and mitigate potential credit risks, reducing loss ratio by 5%.

- Developed and executed a training program to enhance the skills and knowledge of the credit and collections team, resulting in improved productivity and efficiency.

Awards

- Received the Outstanding Credit and Collection Analyst of the Year award for exceptional performance in 2022.

- Recognized by the Credit and Collection Association (CCA) for exceptional compliance and ethical conduct.

- Received industry recognition for excellence in dispute resolution, successfully closing over 95% of disputes within the target timeframe.

- Honored by the company as Employee of the Month for consistently exceeding expectations in credit and collections management.

Certificates

- Certified Credit Analyst (CCA)

- Certified Collections Specialist (CCS)

- Certified Credit and Collections Professional (CCCP)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit and Collections Analyst

- Highlight your experience in investigating and resolving complex credit issues.

- Quantify your accomplishments with specific metrics, such as the reduction in past due balance or the increase in revenue.

- Demonstrate your ability to manage a team and collaborate with other departments.

- Showcase your knowledge of credit scoring models and industry regulations.

- Tailor your resume to the specific job description and company you are applying to.

Essential Experience Highlights for a Strong Credit and Collections Analyst Resume

- Investigated and resolved complex credit issues, contributing to a reduction in past due balance.

- Negotiated and collected delinquent invoices, surpassing performance targets.

- Developed and implemented a credit scoring model that improved account selection, reducing bad debt.

- Managed a team of collectors, providing training and support, and ensuring compliance with industry regulations.

- Collaborated with sales and marketing teams to develop targeted credit policies, resulting in an increase in revenue.

- Utilized specialized software to automate collection processes, improving efficiency.

- Conducted thorough credit investigations, assessing financial statements, credit reports, and other relevant data.

Frequently Asked Questions (FAQ’s) For Credit and Collections Analyst

What are the key skills required for a Credit and Collections Analyst?

The key skills required for a Credit and Collections Analyst include credit risk assessment, delinquency management, collections strategy development, account receivable analysis, credit bureau reporting, negotiation and settlement.

What are the career prospects for a Credit and Collections Analyst?

Credit and Collections Analysts can advance to roles such as Credit Manager, Collections Manager, or Risk Analyst.

What is the average salary for a Credit and Collections Analyst?

The average salary for a Credit and Collections Analyst in the United States is around $60,000 per year.

What is the job outlook for Credit and Collections Analysts?

The job outlook for Credit and Collections Analysts is expected to grow faster than average in the coming years.

What are the educational requirements for a Credit and Collections Analyst?

Most Credit and Collections Analysts have a bachelor’s degree in finance, accounting, or a related field.

What are the certification requirements for a Credit and Collections Analyst?

There are several certifications available for Credit and Collections Analysts, such as the Certified Credit Executive (CCE) and the Certified Collections Specialist (CCS).

What are the professional organizations for Credit and Collections Analysts?

There are several professional organizations for Credit and Collections Analysts, such as the National Association of Credit Management (NACM) and the American Collectors Association (ACA).