Are you a seasoned Credit Assistant seeking a new career path? Discover our professionally built Credit Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

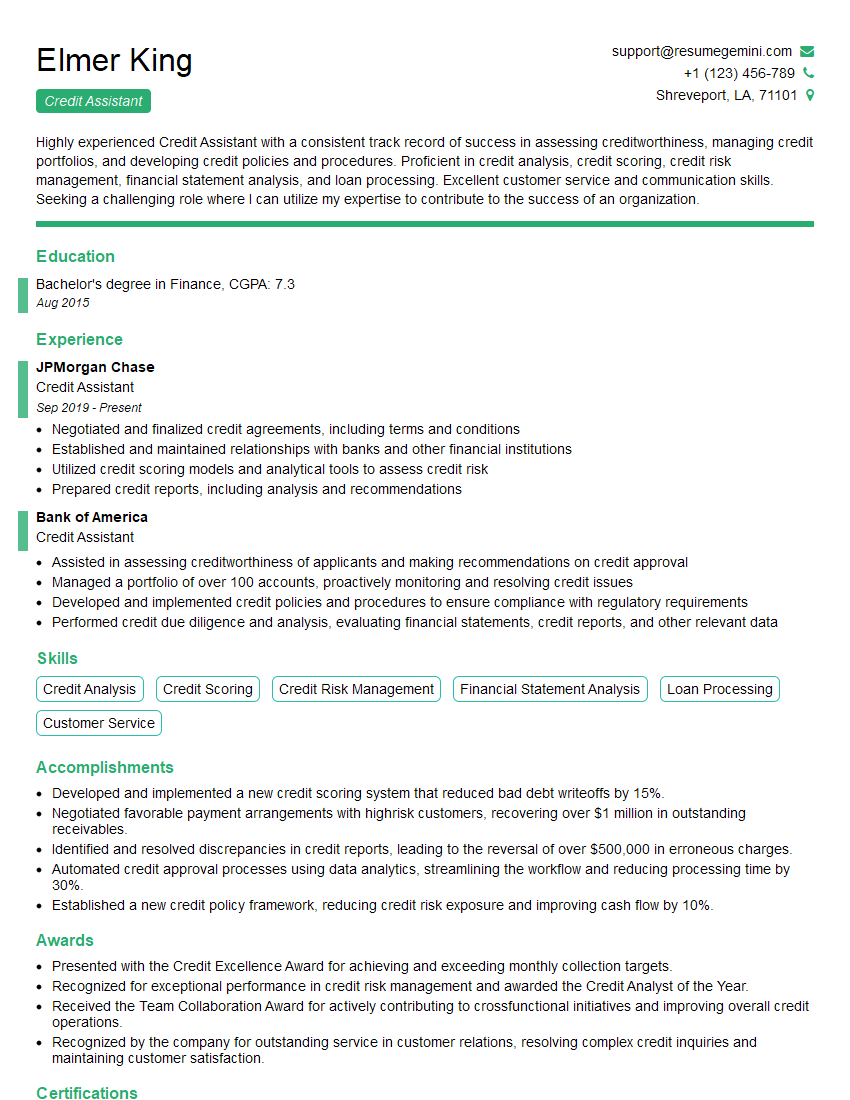

Elmer King

Credit Assistant

Summary

Highly experienced Credit Assistant with a consistent track record of success in assessing creditworthiness, managing credit portfolios, and developing credit policies and procedures. Proficient in credit analysis, credit scoring, credit risk management, financial statement analysis, and loan processing. Excellent customer service and communication skills. Seeking a challenging role where I can utilize my expertise to contribute to the success of an organization.

Education

Bachelor’s degree in Finance

August 2015

Skills

- Credit Analysis

- Credit Scoring

- Credit Risk Management

- Financial Statement Analysis

- Loan Processing

- Customer Service

Work Experience

Credit Assistant

- Negotiated and finalized credit agreements, including terms and conditions

- Established and maintained relationships with banks and other financial institutions

- Utilized credit scoring models and analytical tools to assess credit risk

- Prepared credit reports, including analysis and recommendations

Credit Assistant

- Assisted in assessing creditworthiness of applicants and making recommendations on credit approval

- Managed a portfolio of over 100 accounts, proactively monitoring and resolving credit issues

- Developed and implemented credit policies and procedures to ensure compliance with regulatory requirements

- Performed credit due diligence and analysis, evaluating financial statements, credit reports, and other relevant data

Accomplishments

- Developed and implemented a new credit scoring system that reduced bad debt writeoffs by 15%.

- Negotiated favorable payment arrangements with highrisk customers, recovering over $1 million in outstanding receivables.

- Identified and resolved discrepancies in credit reports, leading to the reversal of over $500,000 in erroneous charges.

- Automated credit approval processes using data analytics, streamlining the workflow and reducing processing time by 30%.

- Established a new credit policy framework, reducing credit risk exposure and improving cash flow by 10%.

Awards

- Presented with the Credit Excellence Award for achieving and exceeding monthly collection targets.

- Recognized for exceptional performance in credit risk management and awarded the Credit Analyst of the Year.

- Received the Team Collaboration Award for actively contributing to crossfunctional initiatives and improving overall credit operations.

- Recognized by the company for outstanding service in customer relations, resolving complex credit inquiries and maintaining customer satisfaction.

Certificates

- Certified Credit Analyst (CCA)

- Certified Credit Risk Analyst (CCRA)

- Certified Financial Analyst (CFA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Assistant

- Highlight your skills in credit analysis and risk management.

- Quantify your accomplishments to demonstrate your impact.

- Use action verbs and specific examples to describe your experience.

- Tailor your resume to the specific job you are applying for.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Credit Assistant Resume

- Assessed creditworthiness of applicants and made recommendations on credit approval.

- Managed a portfolio of over 100 accounts, proactively monitoring and resolving credit issues.

- Developed and implemented credit policies and procedures to ensure compliance with regulatory requirements.

- Performed credit due diligence and analysis, evaluating financial statements, credit reports, and other relevant data.

- Negotiated and finalized credit agreements, including terms and conditions.

- Established and maintained relationships with banks and other financial institutions.

- Utilized credit scoring models and analytical tools to assess credit risk.

- Prepared credit reports, including analysis and recommendations.

Frequently Asked Questions (FAQ’s) For Credit Assistant

What is the role of a Credit Assistant?

A Credit Assistant is responsible for assisting in all aspects of credit management, including assessing creditworthiness, managing credit portfolios, and developing credit policies and procedures.

What are the qualifications for a Credit Assistant?

Typically, a Credit Assistant requires a bachelor’s degree in finance or a related field, as well as 1-3 years of experience in credit analysis or a related role.

What are the key skills for a Credit Assistant?

The key skills for a Credit Assistant include credit analysis, credit scoring, credit risk management, financial statement analysis, and loan processing.

What is the job outlook for a Credit Assistant?

The job outlook for Credit Assistants is expected to grow faster than average in the coming years due to the increasing demand for credit analysis and risk management services.

What is the average salary for a Credit Assistant?

The average salary for a Credit Assistant varies depending on experience and location but typically ranges from $50,000 to $75,000 per year.

What are the career advancement opportunities for a Credit Assistant?

Credit Assistants can advance to roles such as Credit Analyst, Credit Manager, or Vice President of Credit.

What are the challenges of being a Credit Assistant?

The challenges of being a Credit Assistant include dealing with high volumes of work, managing multiple projects simultaneously, and making decisions that can have a significant impact on a company’s financial performance.

What are the rewards of being a Credit Assistant?

The rewards of being a Credit Assistant include the opportunity to work in a dynamic and challenging environment, to make a difference in a company’s financial performance, and to advance to senior-level roles.