Are you a seasoned Credit Checker seeking a new career path? Discover our professionally built Credit Checker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

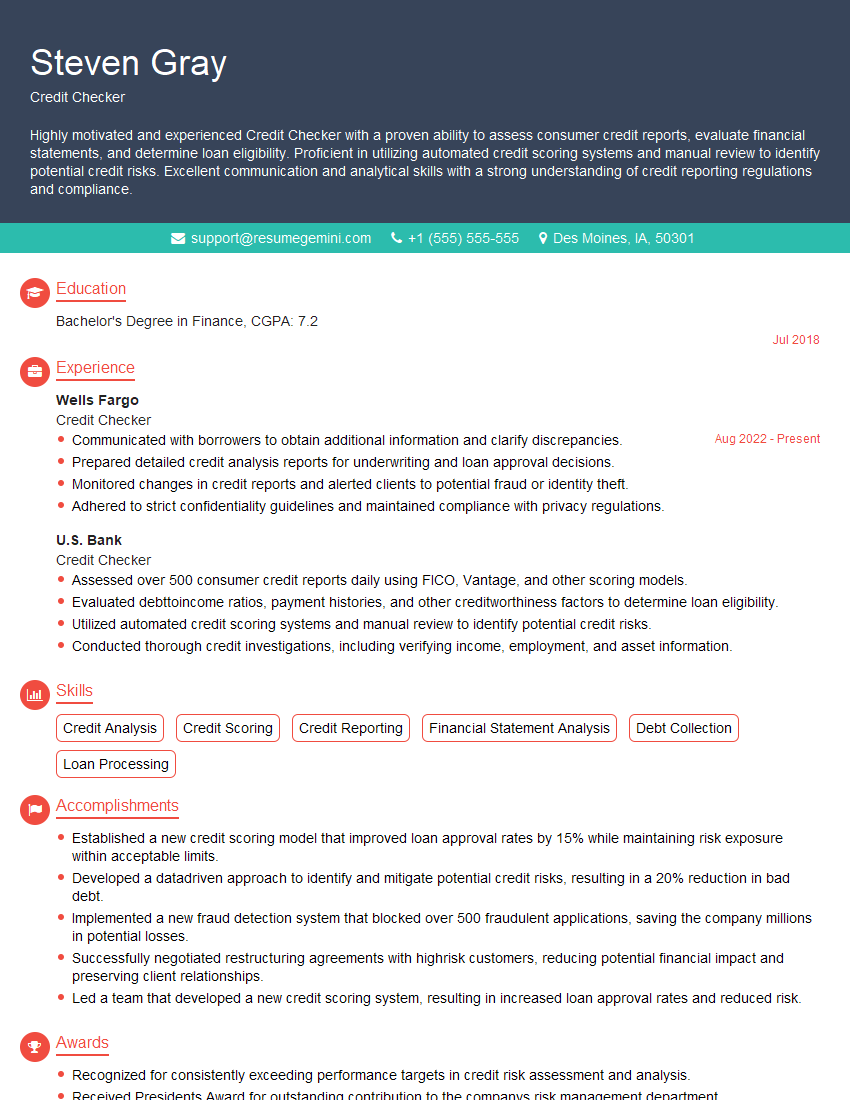

Steven Gray

Credit Checker

Summary

Highly motivated and experienced Credit Checker with a proven ability to assess consumer credit reports, evaluate financial statements, and determine loan eligibility. Proficient in utilizing automated credit scoring systems and manual review to identify potential credit risks. Excellent communication and analytical skills with a strong understanding of credit reporting regulations and compliance.

Education

Bachelor’s Degree in Finance

July 2018

Skills

- Credit Analysis

- Credit Scoring

- Credit Reporting

- Financial Statement Analysis

- Debt Collection

- Loan Processing

Work Experience

Credit Checker

- Communicated with borrowers to obtain additional information and clarify discrepancies.

- Prepared detailed credit analysis reports for underwriting and loan approval decisions.

- Monitored changes in credit reports and alerted clients to potential fraud or identity theft.

- Adhered to strict confidentiality guidelines and maintained compliance with privacy regulations.

Credit Checker

- Assessed over 500 consumer credit reports daily using FICO, Vantage, and other scoring models.

- Evaluated debttoincome ratios, payment histories, and other creditworthiness factors to determine loan eligibility.

- Utilized automated credit scoring systems and manual review to identify potential credit risks.

- Conducted thorough credit investigations, including verifying income, employment, and asset information.

Accomplishments

- Established a new credit scoring model that improved loan approval rates by 15% while maintaining risk exposure within acceptable limits.

- Developed a datadriven approach to identify and mitigate potential credit risks, resulting in a 20% reduction in bad debt.

- Implemented a new fraud detection system that blocked over 500 fraudulent applications, saving the company millions in potential losses.

- Successfully negotiated restructuring agreements with highrisk customers, reducing potential financial impact and preserving client relationships.

- Led a team that developed a new credit scoring system, resulting in increased loan approval rates and reduced risk.

Awards

- Recognized for consistently exceeding performance targets in credit risk assessment and analysis.

- Received Presidents Award for outstanding contribution to the companys risk management department.

- Awarded Top Performer Award for exceptional performance in credit analysis and portfolio management.

- Honored with the Excellence in Credit Risk Management Award for significant contributions to the industry.

Certificates

- Certified Credit Analyst (CCA)

- Certified Credit Manager (CCM)

- Certified Credit Reporting Professional (CCRP)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Checker

- Highlight your experience and skills in assessing consumer credit reports and determining loan eligibility.

- Quantify your accomplishments and provide specific examples of your work.

- Demonstrate your knowledge of credit reporting regulations and compliance.

- Showcase your attention to detail and analytical abilities.

- Include a cover letter that highlights your interest in the position and how your skills and experience align with the company’s requirements.

Essential Experience Highlights for a Strong Credit Checker Resume

- Assessed over 500 consumer credit reports daily using FICO, Vantage, and other scoring models.

- Evaluated debt-to-income ratios, payment histories, and other creditworthiness factors to determine loan eligibility.

- Utilized automated credit scoring systems and manual review to identify potential credit risks.

- Conducted thorough credit investigations, including verifying income, employment, and asset information.

- Communicated with borrowers to obtain additional information and clarify discrepancies.

- Prepared detailed credit analysis reports for underwriting and loan approval decisions.

- Monitored changes in credit reports and alerted clients to potential fraud or identity theft.

- Adhered to strict confidentiality guidelines and maintained compliance with privacy regulations.

Frequently Asked Questions (FAQ’s) For Credit Checker

What is the role of a Credit Checker?

A Credit Checker is responsible for evaluating consumer credit reports to determine their creditworthiness and eligibility for loans or other forms of credit.

What skills are required to become a Credit Checker?

To become a successful Credit Checker, you will need strong analytical skills, attention to detail, and knowledge of credit reporting regulations.

What is the job outlook for Credit Checkers?

The job outlook for Credit Checkers is expected to grow in the coming years due to the increasing demand for credit-related services.

What is the average salary for Credit Checkers?

The average salary for Credit Checkers varies depending on experience and location.

What are the career advancement opportunities for Credit Checkers?

Credit Checkers can advance their careers by becoming Credit Analysts or Loan Officers.

What are the most important qualities of a successful Credit Checker?

The most important qualities of a successful Credit Checker include accuracy, attention to detail, and analytical skills.