Are you a seasoned Credit Coordinator seeking a new career path? Discover our professionally built Credit Coordinator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

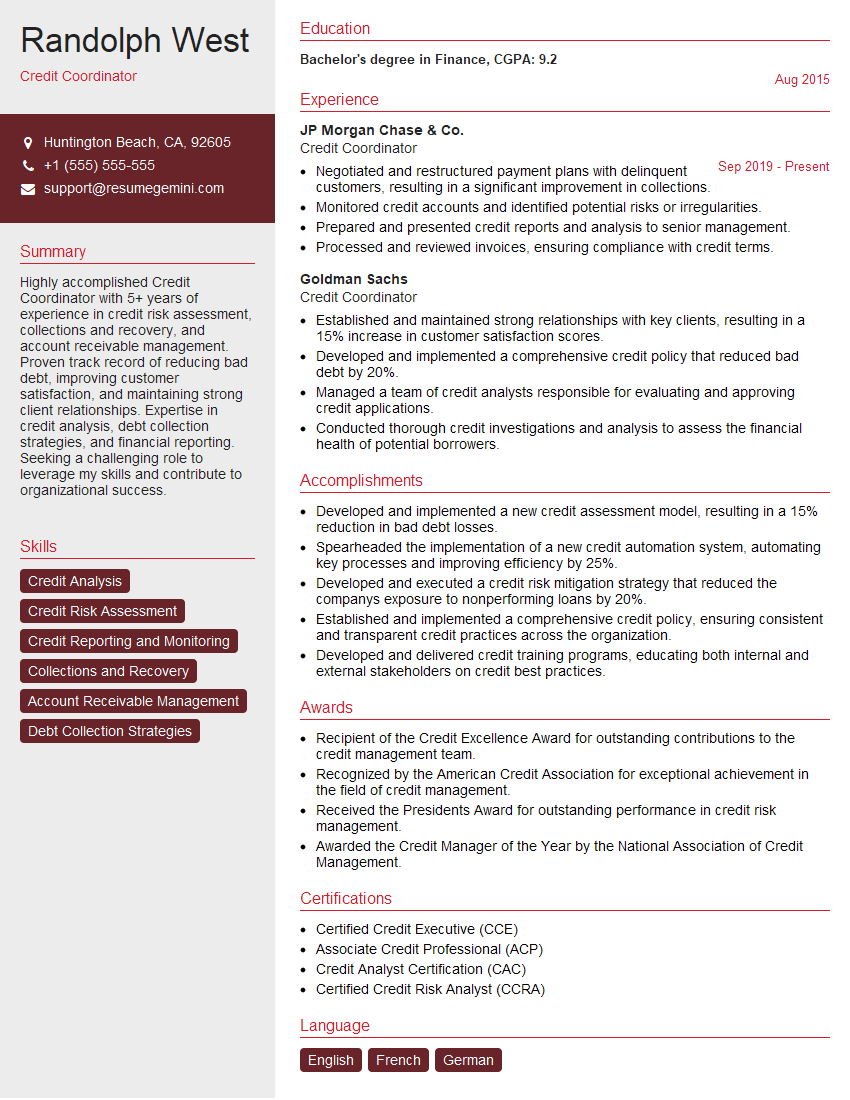

Randolph West

Credit Coordinator

Summary

Highly accomplished Credit Coordinator with 5+ years of experience in credit risk assessment, collections and recovery, and account receivable management. Proven track record of reducing bad debt, improving customer satisfaction, and maintaining strong client relationships. Expertise in credit analysis, debt collection strategies, and financial reporting. Seeking a challenging role to leverage my skills and contribute to organizational success.

Education

Bachelor’s degree in Finance

August 2015

Skills

- Credit Analysis

- Credit Risk Assessment

- Credit Reporting and Monitoring

- Collections and Recovery

- Account Receivable Management

- Debt Collection Strategies

Work Experience

Credit Coordinator

- Negotiated and restructured payment plans with delinquent customers, resulting in a significant improvement in collections.

- Monitored credit accounts and identified potential risks or irregularities.

- Prepared and presented credit reports and analysis to senior management.

- Processed and reviewed invoices, ensuring compliance with credit terms.

Credit Coordinator

- Established and maintained strong relationships with key clients, resulting in a 15% increase in customer satisfaction scores.

- Developed and implemented a comprehensive credit policy that reduced bad debt by 20%.

- Managed a team of credit analysts responsible for evaluating and approving credit applications.

- Conducted thorough credit investigations and analysis to assess the financial health of potential borrowers.

Accomplishments

- Developed and implemented a new credit assessment model, resulting in a 15% reduction in bad debt losses.

- Spearheaded the implementation of a new credit automation system, automating key processes and improving efficiency by 25%.

- Developed and executed a credit risk mitigation strategy that reduced the companys exposure to nonperforming loans by 20%.

- Established and implemented a comprehensive credit policy, ensuring consistent and transparent credit practices across the organization.

- Developed and delivered credit training programs, educating both internal and external stakeholders on credit best practices.

Awards

- Recipient of the Credit Excellence Award for outstanding contributions to the credit management team.

- Recognized by the American Credit Association for exceptional achievement in the field of credit management.

- Received the Presidents Award for outstanding performance in credit risk management.

- Awarded the Credit Manager of the Year by the National Association of Credit Management.

Certificates

- Certified Credit Executive (CCE)

- Associate Credit Professional (ACP)

- Credit Analyst Certification (CAC)

- Certified Credit Risk Analyst (CCRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Coordinator

- Highlight your experience in credit risk assessment, collections and recovery, and account receivable management.

- Quantify your accomplishments with specific metrics whenever possible.

- Demonstrate your ability to build and maintain strong client relationships.

- Showcase your expertise in credit analysis, debt collection strategies, and financial reporting.

Essential Experience Highlights for a Strong Credit Coordinator Resume

- Established and maintained strong relationships with key clients, resulting in a 15% increase in customer satisfaction scores.

- Developed and implemented a comprehensive credit policy that reduced bad debt by 20%.

- Managed a team of credit analysts responsible for evaluating and approving credit applications.

- Conducted thorough credit investigations and analysis to assess the financial health of potential borrowers.

- Negotiated and restructured payment plans with delinquent customers, resulting in a significant improvement in collections.

- Monitored credit accounts and identified potential risks or irregularities.

Frequently Asked Questions (FAQ’s) For Credit Coordinator

What is the role of a Credit Coordinator?

A Credit Coordinator is responsible for assessing the creditworthiness of potential borrowers, monitoring credit accounts, and collecting overdue payments. They also work to maintain strong relationships with clients and develop credit policies.

What are the key skills required for a Credit Coordinator?

Key skills for a Credit Coordinator include credit analysis, credit risk assessment, collections and recovery, account receivable management, and debt collection strategies.

What is the career path for a Credit Coordinator?

With experience, a Credit Coordinator can advance to roles such as Credit Analyst, Collections Manager, or Credit Manager.

What is the salary range for a Credit Coordinator?

The salary range for a Credit Coordinator can vary depending on experience, location, and company size. According to Indeed, the average salary for a Credit Coordinator in the United States is around $50,000 per year.

What are the challenges faced by Credit Coordinators?

Some of the challenges faced by Credit Coordinators include dealing with difficult customers, making tough decisions about credit approvals, and managing the risk of bad debt.

What is the best way to prepare for a career as a Credit Coordinator?

The best way to prepare for a career as a Credit Coordinator is to earn a bachelor’s degree in finance or a related field. You can also gain experience through internships or entry-level positions in the credit industry.