Are you a seasoned Credit Department Manager seeking a new career path? Discover our professionally built Credit Department Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

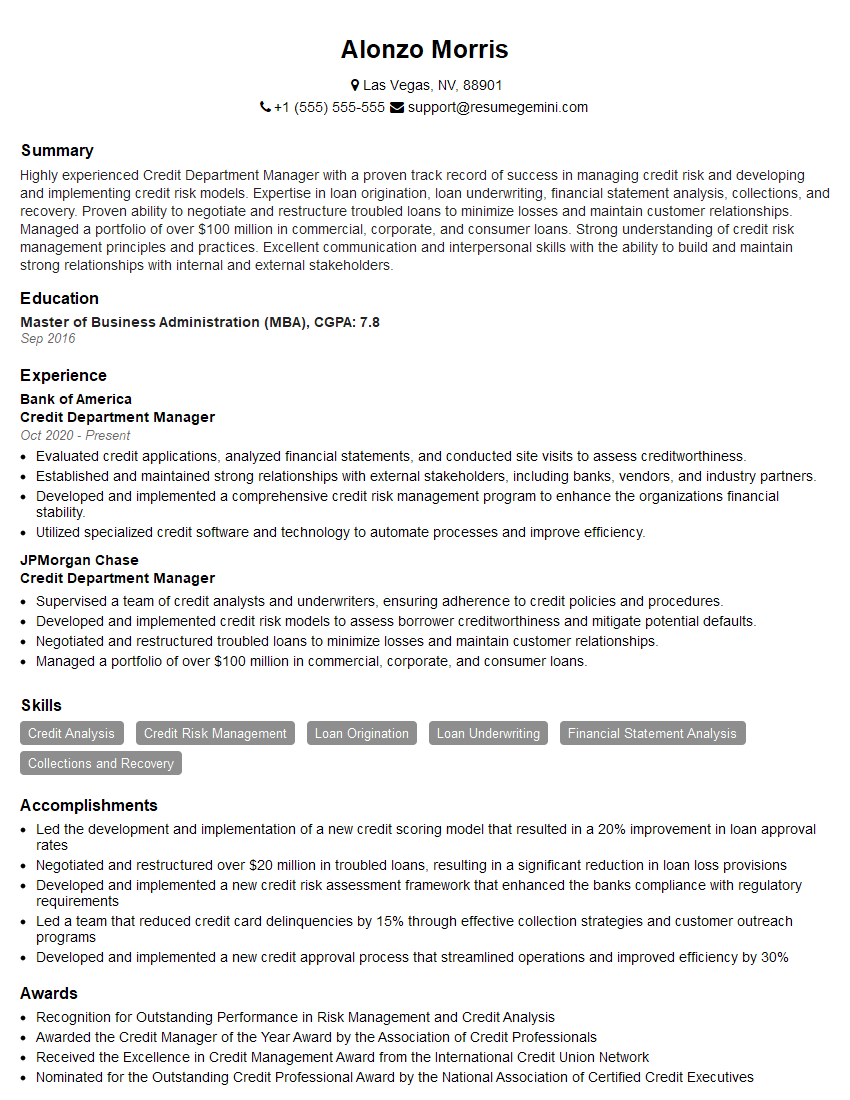

Alonzo Morris

Credit Department Manager

Summary

Highly experienced Credit Department Manager with a proven track record of success in managing credit risk and developing and implementing credit risk models. Expertise in loan origination, loan underwriting, financial statement analysis, collections, and recovery. Proven ability to negotiate and restructure troubled loans to minimize losses and maintain customer relationships. Managed a portfolio of over $100 million in commercial, corporate, and consumer loans. Strong understanding of credit risk management principles and practices. Excellent communication and interpersonal skills with the ability to build and maintain strong relationships with internal and external stakeholders.

Education

Master of Business Administration (MBA)

September 2016

Skills

- Credit Analysis

- Credit Risk Management

- Loan Origination

- Loan Underwriting

- Financial Statement Analysis

- Collections and Recovery

Work Experience

Credit Department Manager

- Evaluated credit applications, analyzed financial statements, and conducted site visits to assess creditworthiness.

- Established and maintained strong relationships with external stakeholders, including banks, vendors, and industry partners.

- Developed and implemented a comprehensive credit risk management program to enhance the organizations financial stability.

- Utilized specialized credit software and technology to automate processes and improve efficiency.

Credit Department Manager

- Supervised a team of credit analysts and underwriters, ensuring adherence to credit policies and procedures.

- Developed and implemented credit risk models to assess borrower creditworthiness and mitigate potential defaults.

- Negotiated and restructured troubled loans to minimize losses and maintain customer relationships.

- Managed a portfolio of over $100 million in commercial, corporate, and consumer loans.

Accomplishments

- Led the development and implementation of a new credit scoring model that resulted in a 20% improvement in loan approval rates

- Negotiated and restructured over $20 million in troubled loans, resulting in a significant reduction in loan loss provisions

- Developed and implemented a new credit risk assessment framework that enhanced the banks compliance with regulatory requirements

- Led a team that reduced credit card delinquencies by 15% through effective collection strategies and customer outreach programs

- Developed and implemented a new credit approval process that streamlined operations and improved efficiency by 30%

Awards

- Recognition for Outstanding Performance in Risk Management and Credit Analysis

- Awarded the Credit Manager of the Year Award by the Association of Credit Professionals

- Received the Excellence in Credit Management Award from the International Credit Union Network

- Nominated for the Outstanding Credit Professional Award by the National Association of Certified Credit Executives

Certificates

- Certified Credit Executive (CCE)

- Certified Financial Analyst (CFA)

- Credit Risk Analyst (CRA)

- Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Department Manager

- Highlight your experience in credit risk management and your ability to develop and implement credit risk models.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the organization.

- Showcase your negotiation and communication skills, emphasizing your ability to build and maintain strong relationships with customers and other stakeholders.

- Be sure to mention any specialized credit software or technology that you have experience with.

- Proofread your resume carefully before submitting it, ensuring that there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Credit Department Manager Resume

- Supervised a team of credit analysts and underwriters, ensuring adherence to credit policies and procedures.

- Developed and implemented credit risk models to assess borrower creditworthiness and mitigate potential defaults.

- Negotiated and restructured troubled loans to minimize losses and maintain customer relationships.

- Managed a portfolio of over $100 million in commercial, corporate, and consumer loans.

- Evaluated credit applications, analyzed financial statements, and conducted site visits to assess creditworthiness.

- Established and maintained strong relationships with external stakeholders, including banks, vendors, and industry partners.

- Developed and implemented a comprehensive credit risk management program to enhance the organization’s financial stability.

- Utilized specialized credit software and technology to automate processes and improve efficiency.

Frequently Asked Questions (FAQ’s) For Credit Department Manager

What are the key responsibilities of a Credit Department Manager?

The key responsibilities of a Credit Department Manager include supervising a team of credit analysts and underwriters, developing and implementing credit risk models, negotiating and restructuring troubled loans, managing a portfolio of loans, and evaluating credit applications.

What are the qualifications for a Credit Department Manager?

The qualifications for a Credit Department Manager typically include a bachelor’s or master’s degree in business or a related field, as well as several years of experience in credit analysis or a related field.

What are the skills required for a Credit Department Manager?

The skills required for a Credit Department Manager include credit analysis, credit risk management, loan origination, loan underwriting, financial statement analysis, collections, and recovery.

What is the salary range for a Credit Department Manager?

The salary range for a Credit Department Manager can vary depending on experience, location, and company size, but typically falls between $70,000 and $120,000 per year.

What is the job outlook for Credit Department Managers?

The job outlook for Credit Department Managers is expected to be good over the next few years, as businesses continue to need to manage their credit risk.

What are the career advancement opportunities for Credit Department Managers?

The career advancement opportunities for Credit Department Managers include positions such as Vice President of Credit, Chief Credit Officer, and Chief Financial Officer.