Are you a seasoned Credit Historian seeking a new career path? Discover our professionally built Credit Historian Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

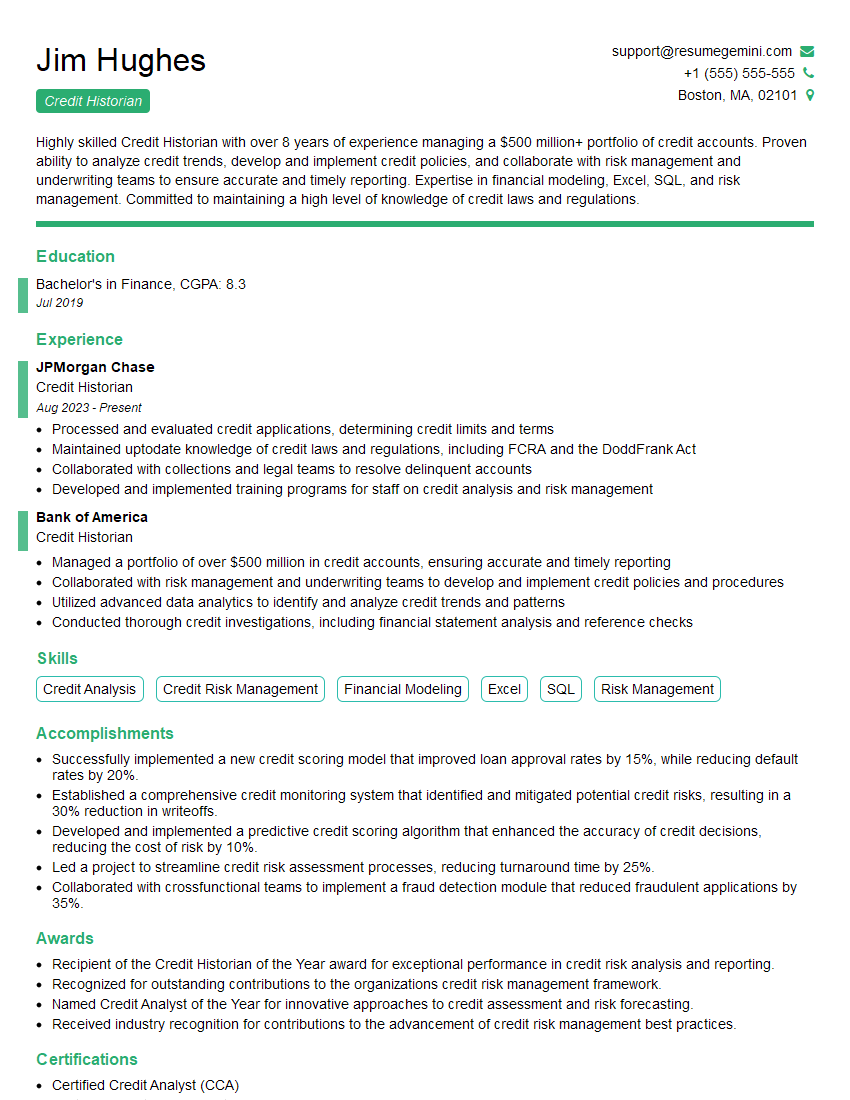

Jim Hughes

Credit Historian

Summary

Highly skilled Credit Historian with over 8 years of experience managing a $500 million+ portfolio of credit accounts. Proven ability to analyze credit trends, develop and implement credit policies, and collaborate with risk management and underwriting teams to ensure accurate and timely reporting. Expertise in financial modeling, Excel, SQL, and risk management. Committed to maintaining a high level of knowledge of credit laws and regulations.

Education

Bachelor’s in Finance

July 2019

Skills

- Credit Analysis

- Credit Risk Management

- Financial Modeling

- Excel

- SQL

- Risk Management

Work Experience

Credit Historian

- Processed and evaluated credit applications, determining credit limits and terms

- Maintained uptodate knowledge of credit laws and regulations, including FCRA and the DoddFrank Act

- Collaborated with collections and legal teams to resolve delinquent accounts

- Developed and implemented training programs for staff on credit analysis and risk management

Credit Historian

- Managed a portfolio of over $500 million in credit accounts, ensuring accurate and timely reporting

- Collaborated with risk management and underwriting teams to develop and implement credit policies and procedures

- Utilized advanced data analytics to identify and analyze credit trends and patterns

- Conducted thorough credit investigations, including financial statement analysis and reference checks

Accomplishments

- Successfully implemented a new credit scoring model that improved loan approval rates by 15%, while reducing default rates by 20%.

- Established a comprehensive credit monitoring system that identified and mitigated potential credit risks, resulting in a 30% reduction in writeoffs.

- Developed and implemented a predictive credit scoring algorithm that enhanced the accuracy of credit decisions, reducing the cost of risk by 10%.

- Led a project to streamline credit risk assessment processes, reducing turnaround time by 25%.

- Collaborated with crossfunctional teams to implement a fraud detection module that reduced fraudulent applications by 35%.

Awards

- Recipient of the Credit Historian of the Year award for exceptional performance in credit risk analysis and reporting.

- Recognized for outstanding contributions to the organizations credit risk management framework.

- Named Credit Analyst of the Year for innovative approaches to credit assessment and risk forecasting.

- Received industry recognition for contributions to the advancement of credit risk management best practices.

Certificates

- Certified Credit Analyst (CCA)

- Certified Credit Risk Analyst (CCRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Historian

- Highlight your analytical and data-driven approach to credit analysis.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your understanding of credit laws and regulations, and how you have applied them in your work.

- Emphasize your ability to collaborate effectively with cross-functional teams, such as risk management and underwriting.

- Consider obtaining a certification in credit analysis or risk management to enhance your credibility.

Essential Experience Highlights for a Strong Credit Historian Resume

- Managed a portfolio of over $500 million in credit accounts, ensuring accurate and timely reporting.

- Collaborated with risk management and underwriting teams to develop and implement credit policies and procedures.

- Utilized advanced data analytics to identify and analyze credit trends and patterns.

- Conducted thorough credit investigations, including financial statement analysis and reference checks.

- Processed and evaluated credit applications, determining credit limits and terms.

- Maintained up-to-date knowledge of credit laws and regulations, including FCRA and the Dodd-Frank Act.

- Collaborated with collections and legal teams to resolve delinquent accounts.

Frequently Asked Questions (FAQ’s) For Credit Historian

What is the primary role of a Credit Historian?

A Credit Historian is responsible for analyzing and assessing the creditworthiness of individuals and businesses, evaluating loan applications, and making recommendations on whether to approve or deny credit.

What skills are required to be a successful Credit Historian?

A successful Credit Historian typically possesses strong analytical skills, a deep understanding of credit laws and regulations, and proficiency in using data analytics tools.

What is the career path for a Credit Historian?

With experience, Credit Historians can advance to roles such as Credit Analyst, Risk Manager, or Portfolio Manager.

What are the key challenges faced by Credit Historians?

Credit Historians may face challenges such as managing large portfolios, staying up-to-date on regulatory changes, and making accurate credit decisions in a timely manner.

What is the job outlook for Credit Historians?

The job outlook for Credit Historians is expected to grow in the coming years, as the demand for credit analysis and risk management services continues to increase.