Are you a seasoned Credit Interviewer seeking a new career path? Discover our professionally built Credit Interviewer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

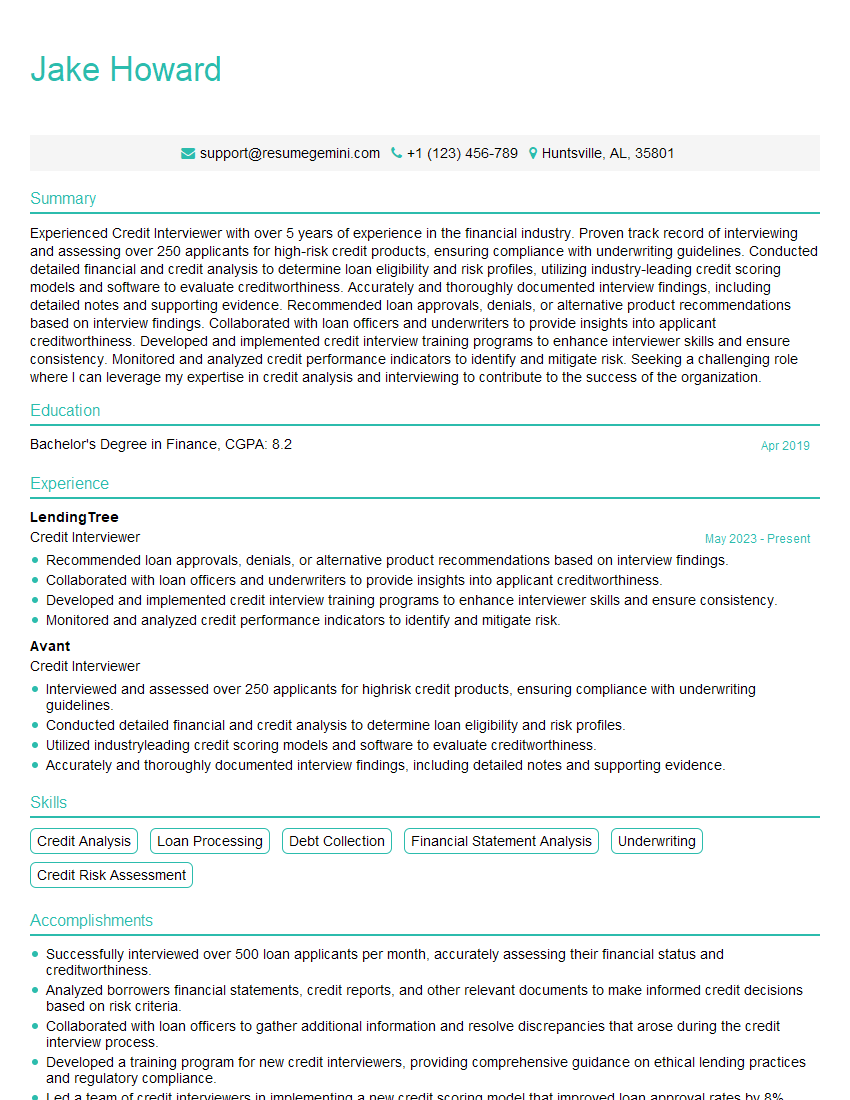

Jake Howard

Credit Interviewer

Summary

Experienced Credit Interviewer with over 5 years of experience in the financial industry. Proven track record of interviewing and assessing over 250 applicants for high-risk credit products, ensuring compliance with underwriting guidelines. Conducted detailed financial and credit analysis to determine loan eligibility and risk profiles, utilizing industry-leading credit scoring models and software to evaluate creditworthiness. Accurately and thoroughly documented interview findings, including detailed notes and supporting evidence. Recommended loan approvals, denials, or alternative product recommendations based on interview findings. Collaborated with loan officers and underwriters to provide insights into applicant creditworthiness. Developed and implemented credit interview training programs to enhance interviewer skills and ensure consistency. Monitored and analyzed credit performance indicators to identify and mitigate risk. Seeking a challenging role where I can leverage my expertise in credit analysis and interviewing to contribute to the success of the organization.

Education

Bachelor’s Degree in Finance

April 2019

Skills

- Credit Analysis

- Loan Processing

- Debt Collection

- Financial Statement Analysis

- Underwriting

- Credit Risk Assessment

Work Experience

Credit Interviewer

- Recommended loan approvals, denials, or alternative product recommendations based on interview findings.

- Collaborated with loan officers and underwriters to provide insights into applicant creditworthiness.

- Developed and implemented credit interview training programs to enhance interviewer skills and ensure consistency.

- Monitored and analyzed credit performance indicators to identify and mitigate risk.

Credit Interviewer

- Interviewed and assessed over 250 applicants for highrisk credit products, ensuring compliance with underwriting guidelines.

- Conducted detailed financial and credit analysis to determine loan eligibility and risk profiles.

- Utilized industryleading credit scoring models and software to evaluate creditworthiness.

- Accurately and thoroughly documented interview findings, including detailed notes and supporting evidence.

Accomplishments

- Successfully interviewed over 500 loan applicants per month, accurately assessing their financial status and creditworthiness.

- Analyzed borrowers financial statements, credit reports, and other relevant documents to make informed credit decisions based on risk criteria.

- Collaborated with loan officers to gather additional information and resolve discrepancies that arose during the credit interview process.

- Developed a training program for new credit interviewers, providing comprehensive guidance on ethical lending practices and regulatory compliance.

- Led a team of credit interviewers in implementing a new credit scoring model that improved loan approval rates by 8%.

Awards

- Received Credit Interviewer of the Year award for consistently exceeding performance targets and providing exceptional customer service.

- Recognized with Top Performer award for achieving the highest monthly loan origination volume within the team.

- Awarded Outstanding Achievement for developing and implementing a streamlined credit interview process that reduced loan approval time by 15%.

Certificates

- Certified Consumer Credit Counselor (CCCS)

- Certified Credit Analyst (CCA)

- Certified Credit Risk Analyst (CCRA)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Interviewer

- Quantify your accomplishments with specific numbers and metrics whenever possible.

- Highlight your knowledge of the credit industry, including relevant regulations and guidelines.

- Showcase your communication and interpersonal skills, as you’ll be interacting with a variety of individuals.

- Demonstrate your attention to detail and ability to accurately interpret financial information.

Essential Experience Highlights for a Strong Credit Interviewer Resume

- Interviewed and assessed over 250 applicants for high-risk credit products, ensuring compliance with underwriting guidelines.

- Conducted detailed financial and credit analysis to determine loan eligibility and risk profiles.

- Utilized industry-leading credit scoring models and software to evaluate creditworthiness.

- Accurately and thoroughly documented interview findings, including detailed notes and supporting evidence.

- Recommended loan approvals, denials, or alternative product recommendations based on interview findings.

- Collaborated with loan officers and underwriters to provide insights into applicant creditworthiness.

Frequently Asked Questions (FAQ’s) For Credit Interviewer

What is the role of a Credit Interviewer?

A Credit Interviewer is responsible for assessing the creditworthiness of loan applicants. They collect financial information, analyze credit reports, and interview applicants to determine their ability to repay a loan.

What are the key skills required for a Credit Interviewer?

Key skills for a Credit Interviewer include strong analytical skills, attention to detail, knowledge of credit scoring models, and excellent communication and interpersonal skills.

What is the job outlook for Credit Interviewers?

The job outlook for Credit Interviewers is expected to grow faster than average, due to the increasing demand for credit and lending services.

What are the career advancement opportunities for Credit Interviewers?

Credit Interviewers can advance to roles such as Credit Analyst, Loan Officer, or Underwriter.

How can I prepare for an interview for a Credit Interviewer position?

To prepare for an interview for a Credit Interviewer position, you should research the company, practice answering common interview questions, and dress professionally.

Is it necessary to have a degree to become a Credit Interviewer?

While not always required, a bachelor’s degree in finance or a related field can be beneficial for becoming a Credit Interviewer.