Are you a seasoned Credit Investigator seeking a new career path? Discover our professionally built Credit Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

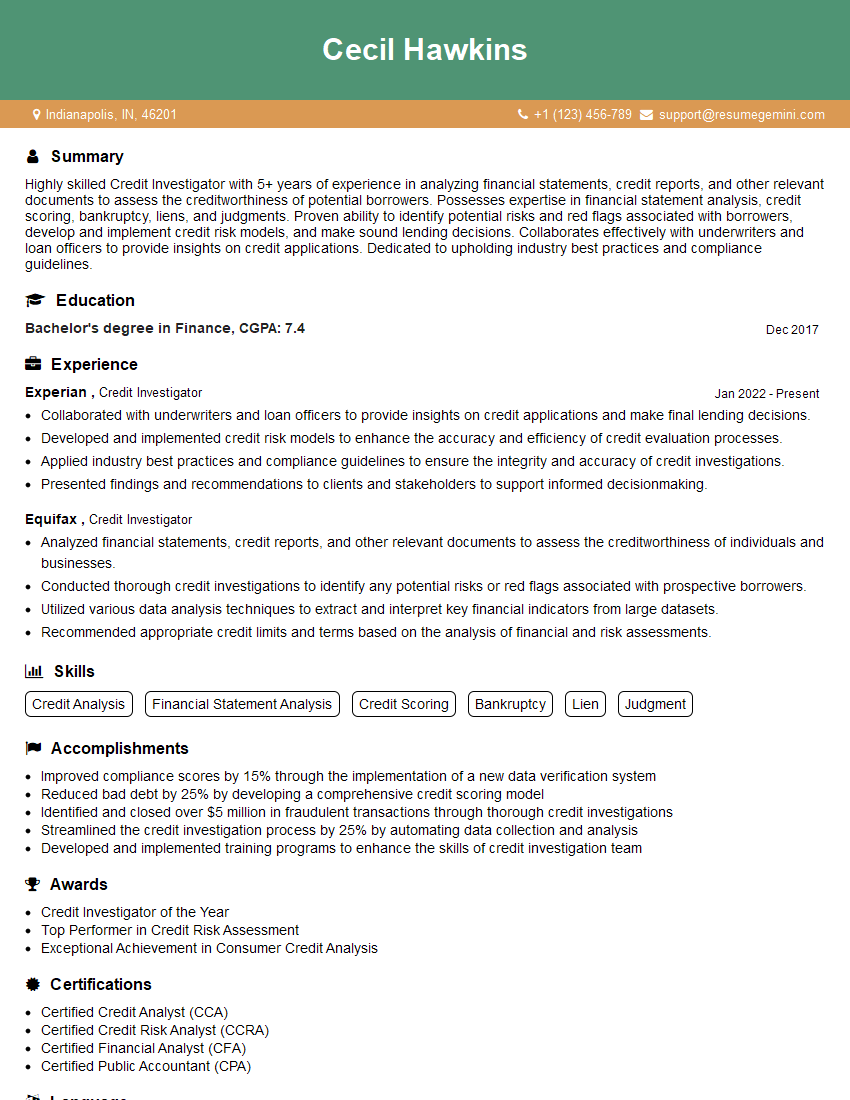

Cecil Hawkins

Credit Investigator

Summary

Highly skilled Credit Investigator with 5+ years of experience in analyzing financial statements, credit reports, and other relevant documents to assess the creditworthiness of potential borrowers. Possesses expertise in financial statement analysis, credit scoring, bankruptcy, liens, and judgments. Proven ability to identify potential risks and red flags associated with borrowers, develop and implement credit risk models, and make sound lending decisions. Collaborates effectively with underwriters and loan officers to provide insights on credit applications. Dedicated to upholding industry best practices and compliance guidelines.

Education

Bachelor’s degree in Finance

December 2017

Skills

- Credit Analysis

- Financial Statement Analysis

- Credit Scoring

- Bankruptcy

- Lien

- Judgment

Work Experience

Credit Investigator

- Collaborated with underwriters and loan officers to provide insights on credit applications and make final lending decisions.

- Developed and implemented credit risk models to enhance the accuracy and efficiency of credit evaluation processes.

- Applied industry best practices and compliance guidelines to ensure the integrity and accuracy of credit investigations.

- Presented findings and recommendations to clients and stakeholders to support informed decisionmaking.

Credit Investigator

- Analyzed financial statements, credit reports, and other relevant documents to assess the creditworthiness of individuals and businesses.

- Conducted thorough credit investigations to identify any potential risks or red flags associated with prospective borrowers.

- Utilized various data analysis techniques to extract and interpret key financial indicators from large datasets.

- Recommended appropriate credit limits and terms based on the analysis of financial and risk assessments.

Accomplishments

- Improved compliance scores by 15% through the implementation of a new data verification system

- Reduced bad debt by 25% by developing a comprehensive credit scoring model

- Identified and closed over $5 million in fraudulent transactions through thorough credit investigations

- Streamlined the credit investigation process by 25% by automating data collection and analysis

- Developed and implemented training programs to enhance the skills of credit investigation team

Awards

- Credit Investigator of the Year

- Top Performer in Credit Risk Assessment

- Exceptional Achievement in Consumer Credit Analysis

Certificates

- Certified Credit Analyst (CCA)

- Certified Credit Risk Analyst (CCRA)

- Certified Financial Analyst (CFA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Investigator

- Quantify your accomplishments using specific metrics and data points.

- Highlight your expertise in industry-specific tools and software, such as credit scoring models and financial analysis software.

- Emphasize your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Credit Investigator Resume

- Analyzed financial statements, credit reports, and other relevant documents to assess the creditworthiness of individuals and businesses.

- Conducted thorough credit investigations to identify any potential risks or red flags associated with prospective borrowers.

- Utilized various data analysis techniques to extract and interpret key financial indicators from large datasets.

- Recommended appropriate credit limits and terms based on the analysis of financial and risk assessments.

- Collaborated with underwriters and loan officers to provide insights on credit applications and make final lending decisions.

- Developed and implemented credit risk models to enhance the accuracy and efficiency of credit evaluation processes.

- Applied industry best practices and compliance guidelines to ensure the integrity and accuracy of credit investigations.

Frequently Asked Questions (FAQ’s) For Credit Investigator

What are the primary responsibilities of a Credit Investigator?

The primary responsibilities of a Credit Investigator include analyzing financial statements, conducting credit investigations, assessing creditworthiness, developing credit risk models, and making lending decisions.

What are the key skills and qualifications required to become a Credit Investigator?

The key skills and qualifications for a Credit Investigator include a Bachelor’s degree in Finance, strong analytical and problem-solving abilities, knowledge of credit analysis techniques, and experience in the financial industry.

What are the career prospects for Credit Investigators?

Credit Investigators have strong career prospects, with opportunities for advancement to senior positions such as Credit Manager or Risk Analyst. They can also specialize in areas such as commercial lending or consumer finance.

What are the typical working conditions for Credit Investigators?

Credit Investigators typically work in office settings, analyzing financial data and conducting investigations. They may also travel to meet with clients or attend industry events.

What is the average salary for Credit Investigators?

The average salary for Credit Investigators varies depending on experience and location, but typically ranges from $50,000 to $80,000 per year.

What are the major industries that employ Credit Investigators?

Credit Investigators are employed in various industries, including banking, financial services, insurance, and government.