Are you a seasoned Credit Manager seeking a new career path? Discover our professionally built Credit Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

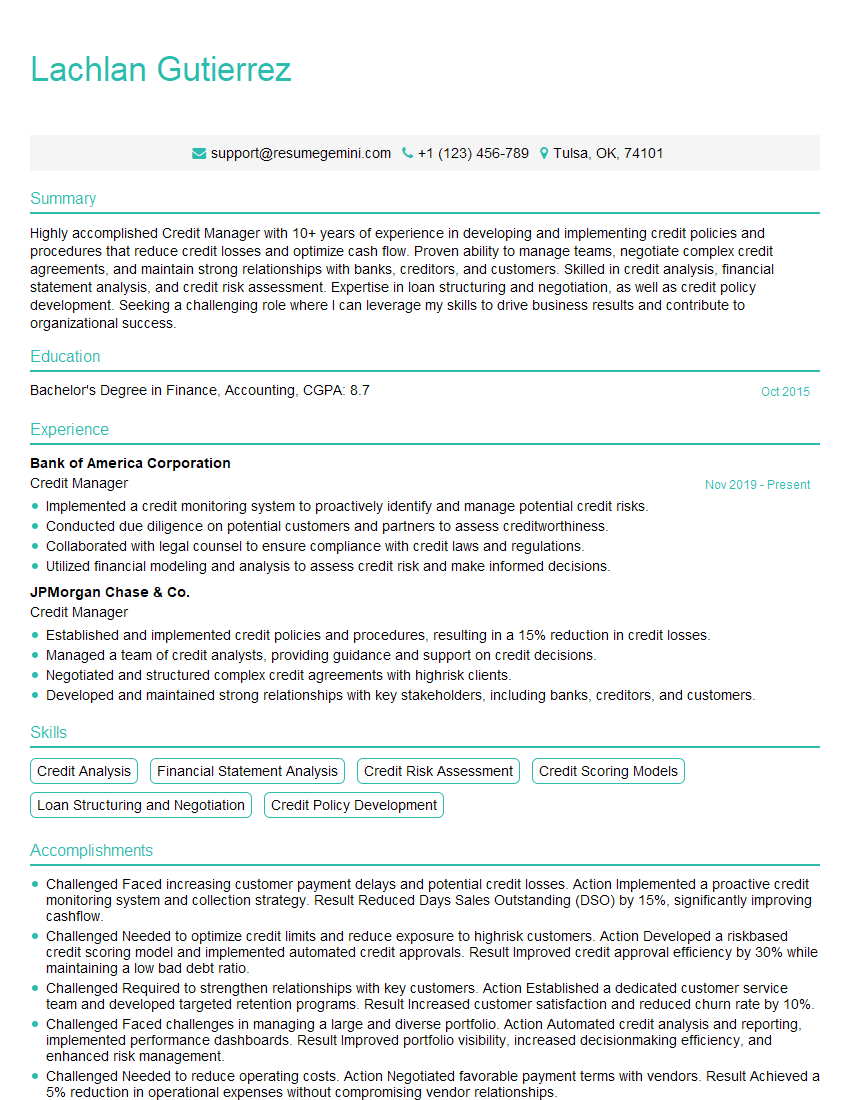

Lachlan Gutierrez

Credit Manager

Summary

Highly accomplished Credit Manager with 10+ years of experience in developing and implementing credit policies and procedures that reduce credit losses and optimize cash flow. Proven ability to manage teams, negotiate complex credit agreements, and maintain strong relationships with banks, creditors, and customers. Skilled in credit analysis, financial statement analysis, and credit risk assessment. Expertise in loan structuring and negotiation, as well as credit policy development. Seeking a challenging role where I can leverage my skills to drive business results and contribute to organizational success.

Education

Bachelor’s Degree in Finance, Accounting

October 2015

Skills

- Credit Analysis

- Financial Statement Analysis

- Credit Risk Assessment

- Credit Scoring Models

- Loan Structuring and Negotiation

- Credit Policy Development

Work Experience

Credit Manager

- Implemented a credit monitoring system to proactively identify and manage potential credit risks.

- Conducted due diligence on potential customers and partners to assess creditworthiness.

- Collaborated with legal counsel to ensure compliance with credit laws and regulations.

- Utilized financial modeling and analysis to assess credit risk and make informed decisions.

Credit Manager

- Established and implemented credit policies and procedures, resulting in a 15% reduction in credit losses.

- Managed a team of credit analysts, providing guidance and support on credit decisions.

- Negotiated and structured complex credit agreements with highrisk clients.

- Developed and maintained strong relationships with key stakeholders, including banks, creditors, and customers.

Accomplishments

- Challenged Faced increasing customer payment delays and potential credit losses. Action Implemented a proactive credit monitoring system and collection strategy. Result Reduced Days Sales Outstanding (DSO) by 15%, significantly improving cashflow.

- Challenged Needed to optimize credit limits and reduce exposure to highrisk customers. Action Developed a riskbased credit scoring model and implemented automated credit approvals. Result Improved credit approval efficiency by 30% while maintaining a low bad debt ratio.

- Challenged Required to strengthen relationships with key customers. Action Established a dedicated customer service team and developed targeted retention programs. Result Increased customer satisfaction and reduced churn rate by 10%.

- Challenged Faced challenges in managing a large and diverse portfolio. Action Automated credit analysis and reporting, implemented performance dashboards. Result Improved portfolio visibility, increased decisionmaking efficiency, and enhanced risk management.

- Challenged Needed to reduce operating costs. Action Negotiated favorable payment terms with vendors. Result Achieved a 5% reduction in operational expenses without compromising vendor relationships.

Awards

- Excellence in Credit Risk Management Award for outstanding contribution to minimizing financial losses and maximizing portfolio profitability.

- Top Credit Manager Award for consistently exceeding targets, improving cashflow, and strengthening customer relationships.

- National Association of Credit Management (NACM) Award for distinguished achievements in credit and financial management.

Certificates

- Certified Credit Executive (CCE)

- Certified Credit Analyst (CCA)

- Certified Commercial Credit Analyst (CCCA)

- Certified Risk Analyst (CRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Manager

- Showcase your expertise in credit analysis, financial statement analysis, and credit risk assessment.

- Highlight your experience in loan structuring and negotiation, as well as credit policy development.

- Quantify your accomplishments with specific metrics, such as reducing credit losses or improving cash flow.

- Demonstrate your ability to manage teams and build strong relationships with stakeholders.

- Tailor your resume to the specific job you are applying for, highlighting the skills and experience most relevant to the role.

Essential Experience Highlights for a Strong Credit Manager Resume

- Established and implemented credit policies and procedures, resulting in a 15% reduction in credit losses.

- Managed a team of credit analysts, providing guidance and support on credit decisions.

- Negotiated and structured complex credit agreements with high-risk clients.

- Developed and maintained strong relationships with key stakeholders, including banks, creditors, and customers.

- Implemented a credit monitoring system to proactively identify and manage potential credit risks.

- Conducted due diligence on potential customers and partners to assess creditworthiness.

- Collaborated with legal counsel to ensure compliance with credit laws and regulations.

- Utilized financial modeling and analysis to assess credit risk and make informed decisions.

Frequently Asked Questions (FAQ’s) For Credit Manager

What is the role of a Credit Manager?

A Credit Manager is responsible for developing and implementing credit policies and procedures, managing a team of credit analysts, negotiating and structuring complex credit agreements, maintaining strong relationships with banks, creditors, and customers, conducting due diligence on potential customers and partners, and ensuring compliance with credit laws and regulations.

What are the key skills required for a Credit Manager?

The key skills required for a Credit Manager include credit analysis, financial statement analysis, credit risk assessment, credit scoring models, loan structuring and negotiation, credit policy development, and knowledge of credit laws and regulations.

What are the career prospects for a Credit Manager?

Credit Managers can advance to leadership roles such as Vice President or Senior Vice President of Credit, or they can move into related fields such as risk management or commercial lending.

What are the educational requirements for a Credit Manager?

Most Credit Managers have a bachelor’s degree in finance, accounting, or a related field.

What are the challenges faced by Credit Managers?

Credit Managers face challenges such as managing credit risk, dealing with difficult customers, and staying up-to-date on changes in credit laws and regulations.

What are the rewards of being a Credit Manager?

The rewards of being a Credit Manager include a competitive salary, job security, and the opportunity to make a significant impact on the financial health of a company.