Are you a seasoned Credit Negotiator seeking a new career path? Discover our professionally built Credit Negotiator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

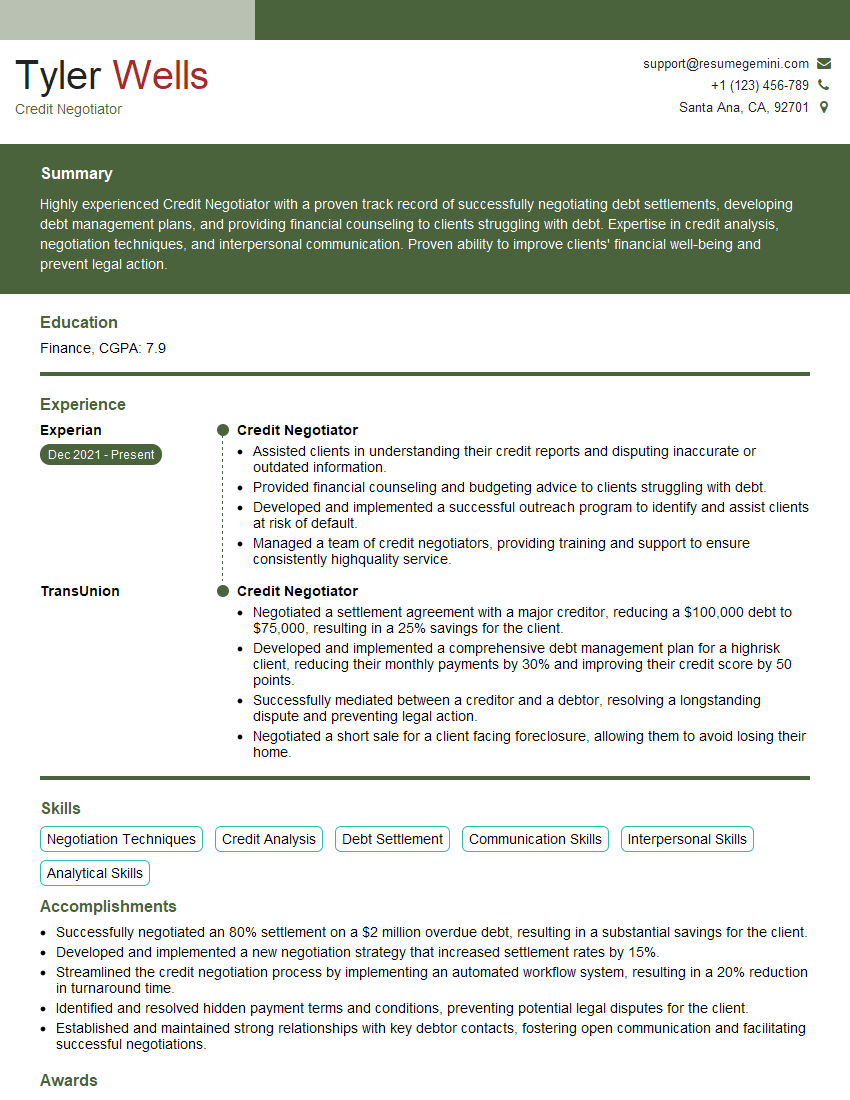

Tyler Wells

Credit Negotiator

Summary

Highly experienced Credit Negotiator with a proven track record of successfully negotiating debt settlements, developing debt management plans, and providing financial counseling to clients struggling with debt. Expertise in credit analysis, negotiation techniques, and interpersonal communication. Proven ability to improve clients’ financial well-being and prevent legal action.

Education

Finance

November 2017

Skills

- Negotiation Techniques

- Credit Analysis

- Debt Settlement

- Communication Skills

- Interpersonal Skills

- Analytical Skills

Work Experience

Credit Negotiator

- Assisted clients in understanding their credit reports and disputing inaccurate or outdated information.

- Provided financial counseling and budgeting advice to clients struggling with debt.

- Developed and implemented a successful outreach program to identify and assist clients at risk of default.

- Managed a team of credit negotiators, providing training and support to ensure consistently highquality service.

Credit Negotiator

- Negotiated a settlement agreement with a major creditor, reducing a $100,000 debt to $75,000, resulting in a 25% savings for the client.

- Developed and implemented a comprehensive debt management plan for a highrisk client, reducing their monthly payments by 30% and improving their credit score by 50 points.

- Successfully mediated between a creditor and a debtor, resolving a longstanding dispute and preventing legal action.

- Negotiated a short sale for a client facing foreclosure, allowing them to avoid losing their home.

Accomplishments

- Successfully negotiated an 80% settlement on a $2 million overdue debt, resulting in a substantial savings for the client.

- Developed and implemented a new negotiation strategy that increased settlement rates by 15%.

- Streamlined the credit negotiation process by implementing an automated workflow system, resulting in a 20% reduction in turnaround time.

- Identified and resolved hidden payment terms and conditions, preventing potential legal disputes for the client.

- Established and maintained strong relationships with key debtor contacts, fostering open communication and facilitating successful negotiations.

Awards

- Received the Credit Management Excellence Award for outstanding performance in credit negotiation.

- Recognized as Top 5% Credit Negotiator by the Association of Credit Professionals.

- Awarded the Golden Quill for exceptional writing and communication skills in credit negotiation.

Certificates

- Certified Credit Counselor (CCC)

- Certified Debt Negotiator (CDN)

- Financial Management Certification (FMC)

- Credit and Collections Analyst Certification (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Negotiator

- Quantify your accomplishments with specific metrics and numbers.

- Highlight your negotiation skills and success rate in reducing debt.

- Demonstrate your understanding of debt management strategies and financial counseling.

- Showcase your interpersonal skills and ability to build strong relationships with clients.

Essential Experience Highlights for a Strong Credit Negotiator Resume

- Negotiate settlements with creditors, reducing debt amounts and monthly payments.

- Develop and implement comprehensive debt management plans to improve clients’ financial situations.

- Mediate between creditors and debtors to resolve disputes and prevent legal action.

- Negotiate short sales for clients facing foreclosure to help them avoid losing their homes.

- Assist clients in understanding their credit reports and disputing inaccurate or outdated information.

- Provide financial counseling and budgeting advice to clients to improve their financial literacy.

- Manage a team of credit negotiators, providing training and support to ensure consistently high-quality service.

Frequently Asked Questions (FAQ’s) For Credit Negotiator

What is the role of a Credit Negotiator?

A Credit Negotiator assists individuals and businesses in negotiating with creditors to reduce debt, improve payment terms, and prevent legal action. They analyze credit reports, develop debt management plans, and negotiate settlements on behalf of their clients.

What are the key skills required for a Credit Negotiator?

Effective Credit Negotiators possess strong negotiation skills, credit analysis abilities, knowledge of debt settlement strategies, excellent communication and interpersonal skills, and analytical thinking.

How can a Credit Negotiator help me?

A Credit Negotiator can help you reduce your debt, lower your monthly payments, improve your credit score, prevent foreclosure, and provide financial counseling to improve your overall financial well-being.

How much does a Credit Negotiator cost?

Fees for Credit Negotiators vary depending on the complexity of the case and the services provided. Some charge hourly rates, while others work on a contingency basis, receiving a percentage of the debt savings achieved.

How do I find a reputable Credit Negotiator?

Look for Credit Negotiators who are certified by reputable organizations, have positive reviews from previous clients, and offer a free consultation to discuss your situation.

What are the benefits of hiring a Credit Negotiator?

Hiring a Credit Negotiator can help you save money on debt, reduce stress, improve your credit score, and get back on track financially.

What should I look for when choosing a Credit Negotiator?

Consider their experience, success rate, fees, reputation, and whether they offer a free consultation. Make sure they are certified and have a clear understanding of your financial situation and goals.

How long does it take to negotiate a debt settlement?

The time it takes to negotiate a debt settlement varies depending on the complexity of the case and the creditor’s willingness to negotiate. It can take anywhere from a few weeks to several months.