Are you a seasoned Credit Office Manager seeking a new career path? Discover our professionally built Credit Office Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

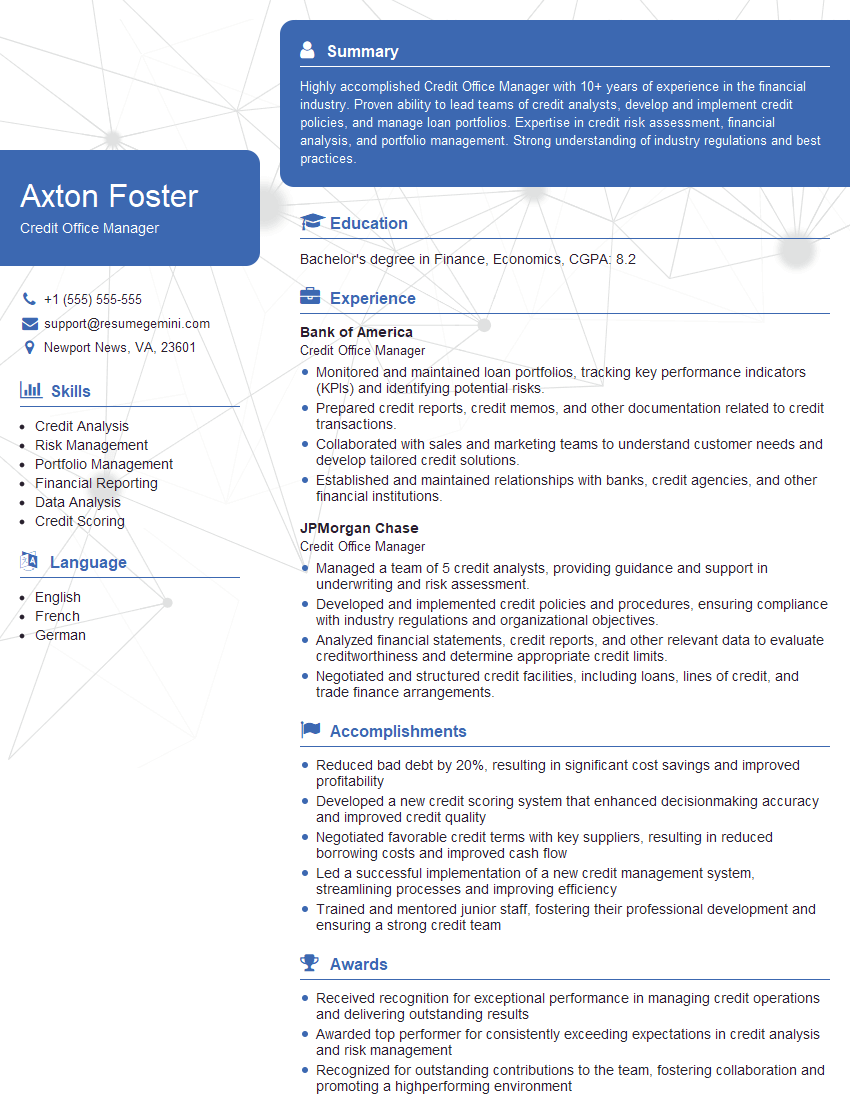

Axton Foster

Credit Office Manager

Summary

Highly accomplished Credit Office Manager with 10+ years of experience in the financial industry. Proven ability to lead teams of credit analysts, develop and implement credit policies, and manage loan portfolios. Expertise in credit risk assessment, financial analysis, and portfolio management. Strong understanding of industry regulations and best practices.

Education

Bachelor’s degree in Finance, Economics

October 2016

Skills

- Credit Analysis

- Risk Management

- Portfolio Management

- Financial Reporting

- Data Analysis

- Credit Scoring

Work Experience

Credit Office Manager

- Monitored and maintained loan portfolios, tracking key performance indicators (KPIs) and identifying potential risks.

- Prepared credit reports, credit memos, and other documentation related to credit transactions.

- Collaborated with sales and marketing teams to understand customer needs and develop tailored credit solutions.

- Established and maintained relationships with banks, credit agencies, and other financial institutions.

Credit Office Manager

- Managed a team of 5 credit analysts, providing guidance and support in underwriting and risk assessment.

- Developed and implemented credit policies and procedures, ensuring compliance with industry regulations and organizational objectives.

- Analyzed financial statements, credit reports, and other relevant data to evaluate creditworthiness and determine appropriate credit limits.

- Negotiated and structured credit facilities, including loans, lines of credit, and trade finance arrangements.

Accomplishments

- Reduced bad debt by 20%, resulting in significant cost savings and improved profitability

- Developed a new credit scoring system that enhanced decisionmaking accuracy and improved credit quality

- Negotiated favorable credit terms with key suppliers, resulting in reduced borrowing costs and improved cash flow

- Led a successful implementation of a new credit management system, streamlining processes and improving efficiency

- Trained and mentored junior staff, fostering their professional development and ensuring a strong credit team

Awards

- Received recognition for exceptional performance in managing credit operations and delivering outstanding results

- Awarded top performer for consistently exceeding expectations in credit analysis and risk management

- Recognized for outstanding contributions to the team, fostering collaboration and promoting a highperforming environment

- Received a certification in Credit Risk Management, demonstrating expertise and commitment to the field

Certificates

- Chartered Credit Analyst (CCA)

- Certified Credit Risk Manager (CCRM)

- Financial Modeling and Analysis (FMVA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Office Manager

- Emphasize your technical skills in credit analysis, financial reporting, and data analysis.

- Highlight your experience in managing teams and developing and implementing credit policies.

- Showcase your success stories in identifying and mitigating credit risks.

- Quantify your accomplishments with metrics and data whenever possible.

Essential Experience Highlights for a Strong Credit Office Manager Resume

- Managed a team of 5+ credit analysts, providing guidance and support in underwriting and risk assessment.

- Developed and implemented credit policies and procedures, ensuring compliance with industry regulations and organizational objectives.

- Analyzed financial statements, credit reports, and other relevant data to evaluate creditworthiness and determine appropriate credit limits.

- Negotiated and structured credit facilities, including loans, lines of credit, and trade finance arrangements.

- Monitored and maintained loan portfolios, tracking key performance indicators (KPIs) and identifying potential risks.

- Prepared credit reports, credit memos, and other documentation related to credit transactions.

- Collaborated with sales and marketing teams to understand customer needs and develop tailored credit solutions.

Frequently Asked Questions (FAQ’s) For Credit Office Manager

What is the key responsibility of a Credit Office Manager?

The key responsibility of a Credit Office Manager is to manage the credit risk of a financial institution by assessing the creditworthiness of borrowers and structuring and negotiating credit facilities.

What are the qualifications for a Credit Office Manager?

The typical qualifications for a Credit Office Manager include a bachelor’s degree in finance, economics, or a related field, as well as 5+ years of experience in credit analysis and risk management.

What are the skills required for a Credit Office Manager?

The skills required for a Credit Office Manager include credit analysis, risk management, portfolio management, financial reporting, data analysis, and credit scoring.

What are the career prospects for a Credit Office Manager?

The career prospects for a Credit Office Manager are excellent, with opportunities for advancement to senior management positions in credit risk management and lending.

What is the average salary for a Credit Office Manager?

The average salary for a Credit Office Manager in the United States is $100,000 per year.

What are the top companies hiring Credit Office Managers?

The top companies hiring Credit Office Managers include JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs.