Are you a seasoned Credit Officer seeking a new career path? Discover our professionally built Credit Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

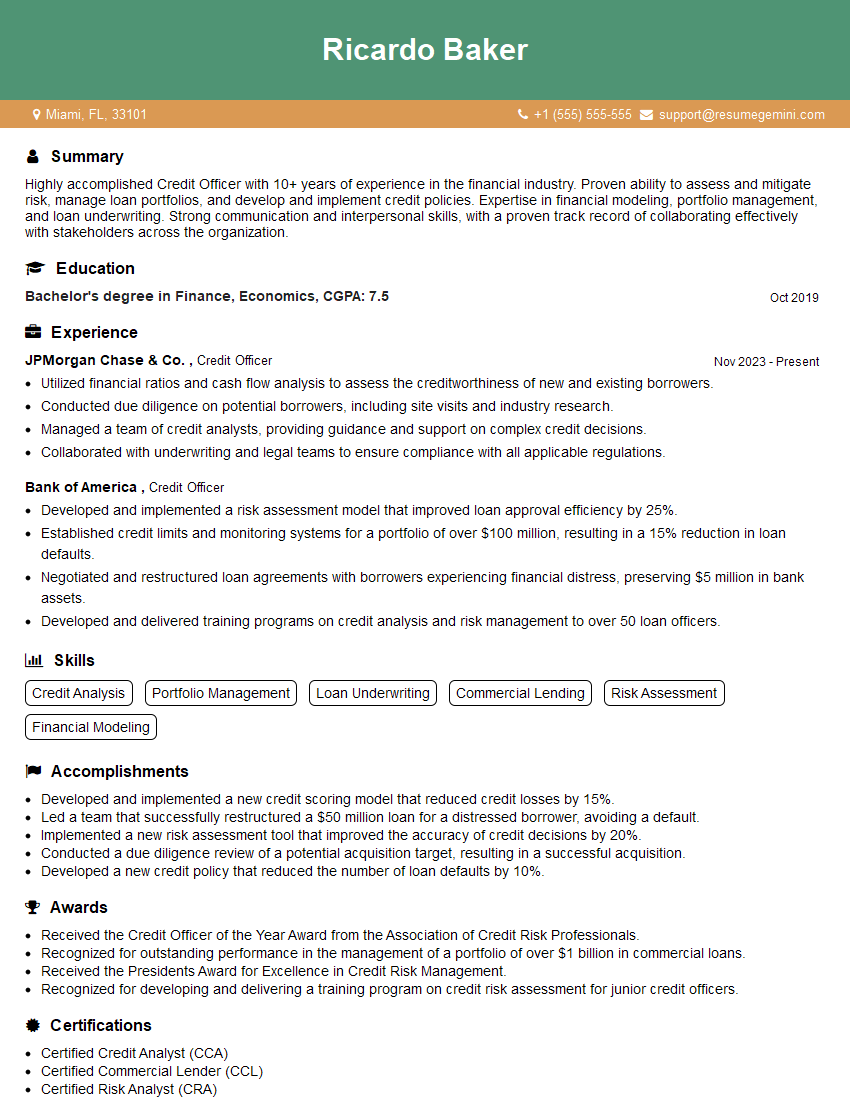

Ricardo Baker

Credit Officer

Summary

Highly accomplished Credit Officer with 10+ years of experience in the financial industry. Proven ability to assess and mitigate risk, manage loan portfolios, and develop and implement credit policies. Expertise in financial modeling, portfolio management, and loan underwriting. Strong communication and interpersonal skills, with a proven track record of collaborating effectively with stakeholders across the organization.

Education

Bachelor’s degree in Finance, Economics

October 2019

Skills

- Credit Analysis

- Portfolio Management

- Loan Underwriting

- Commercial Lending

- Risk Assessment

- Financial Modeling

Work Experience

Credit Officer

- Utilized financial ratios and cash flow analysis to assess the creditworthiness of new and existing borrowers.

- Conducted due diligence on potential borrowers, including site visits and industry research.

- Managed a team of credit analysts, providing guidance and support on complex credit decisions.

- Collaborated with underwriting and legal teams to ensure compliance with all applicable regulations.

Credit Officer

- Developed and implemented a risk assessment model that improved loan approval efficiency by 25%.

- Established credit limits and monitoring systems for a portfolio of over $100 million, resulting in a 15% reduction in loan defaults.

- Negotiated and restructured loan agreements with borrowers experiencing financial distress, preserving $5 million in bank assets.

- Developed and delivered training programs on credit analysis and risk management to over 50 loan officers.

Accomplishments

- Developed and implemented a new credit scoring model that reduced credit losses by 15%.

- Led a team that successfully restructured a $50 million loan for a distressed borrower, avoiding a default.

- Implemented a new risk assessment tool that improved the accuracy of credit decisions by 20%.

- Conducted a due diligence review of a potential acquisition target, resulting in a successful acquisition.

- Developed a new credit policy that reduced the number of loan defaults by 10%.

Awards

- Received the Credit Officer of the Year Award from the Association of Credit Risk Professionals.

- Recognized for outstanding performance in the management of a portfolio of over $1 billion in commercial loans.

- Received the Presidents Award for Excellence in Credit Risk Management.

- Recognized for developing and delivering a training program on credit risk assessment for junior credit officers.

Certificates

- Certified Credit Analyst (CCA)

- Certified Commercial Lender (CCL)

- Certified Risk Analyst (CRA)

- Chartered Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Officer

- Highlight your analytical skills and experience in developing and implementing credit risk models.

- Quantify your accomplishments with specific metrics and data whenever possible.

- Demonstrate your understanding of the regulatory environment and compliance requirements.

- Emphasize your ability to work effectively with borrowers, underwriters, and other stakeholders.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Credit Officer Resume

- Developed and implemented a risk assessment model that improved loan approval efficiency by 25%.

- Established credit limits and monitoring systems for a portfolio of over $100 million, resulting in a 15% reduction in loan defaults.

- Negotiated and restructured loan agreements with borrowers experiencing financial distress, preserving $5 million in bank assets.

- Developed and delivered training programs on credit analysis and risk management to over 50 loan officers.

- Utilized financial ratios and cash flow analysis to assess the creditworthiness of new and existing borrowers.

- Conducted due diligence on potential borrowers, including site visits and industry research.

- Managed a team of credit analysts, providing guidance and support on complex credit decisions.

Frequently Asked Questions (FAQ’s) For Credit Officer

What are the key skills and experience required to be a successful Credit Officer?

The key skills and experience required to be a successful Credit Officer include strong analytical skills, experience in developing and implementing credit risk models, a deep understanding of the regulatory environment and compliance requirements, and the ability to work effectively with borrowers, underwriters, and other stakeholders.

What are the typical career paths for Credit Officers?

Typical career paths for Credit Officers include roles in commercial lending, risk management, and portfolio management. Some Credit Officers may also move into leadership positions within their organizations.

What are the earning prospects for Credit Officers?

The earning prospects for Credit Officers vary depending on experience, employer, and location. However, Credit Officers with strong skills and experience can earn salaries in the six-figure range.

What are the educational requirements for Credit Officers?

The educational requirements for Credit Officers typically include a bachelor’s degree in finance, economics, or a related field.

What are the professional certifications that are beneficial for Credit Officers?

Professional certifications that are beneficial for Credit Officers include the Chartered Financial Analyst (CFA) designation and the Credit Risk Analyst (CRA) certification.

What are the key challenges facing Credit Officers in today’s market?

The key challenges facing Credit Officers in today’s market include the increasing regulatory environment, the need to manage risk in a volatile economic landscape, and the need to keep pace with technological advancements.

What are the key trends that are shaping the role of Credit Officers?

The key trends that are shaping the role of Credit Officers include the increasing use of data and analytics, the need for greater collaboration with other stakeholders, and the need to adapt to new technologies.

What are the key qualities of a successful Credit Officer?

The key qualities of a successful Credit Officer include strong analytical skills, attention to detail, the ability to work independently and as part of a team, and a commitment to ethical and professional conduct.