Are you a seasoned Credit Operations Processor seeking a new career path? Discover our professionally built Credit Operations Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

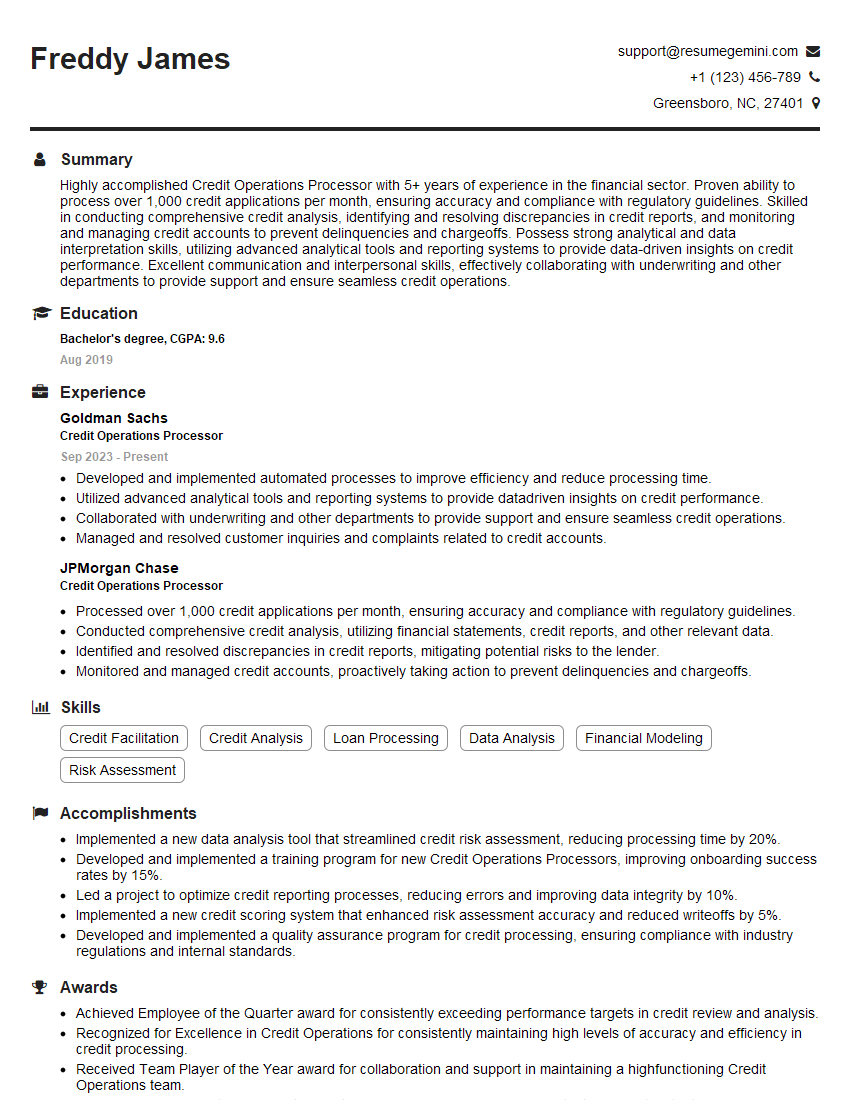

Freddy James

Credit Operations Processor

Summary

Highly accomplished Credit Operations Processor with 5+ years of experience in the financial sector. Proven ability to process over 1,000 credit applications per month, ensuring accuracy and compliance with regulatory guidelines. Skilled in conducting comprehensive credit analysis, identifying and resolving discrepancies in credit reports, and monitoring and managing credit accounts to prevent delinquencies and chargeoffs. Possess strong analytical and data interpretation skills, utilizing advanced analytical tools and reporting systems to provide data-driven insights on credit performance. Excellent communication and interpersonal skills, effectively collaborating with underwriting and other departments to provide support and ensure seamless credit operations.

Education

Bachelor’s degree

August 2019

Skills

- Credit Facilitation

- Credit Analysis

- Loan Processing

- Data Analysis

- Financial Modeling

- Risk Assessment

Work Experience

Credit Operations Processor

- Developed and implemented automated processes to improve efficiency and reduce processing time.

- Utilized advanced analytical tools and reporting systems to provide datadriven insights on credit performance.

- Collaborated with underwriting and other departments to provide support and ensure seamless credit operations.

- Managed and resolved customer inquiries and complaints related to credit accounts.

Credit Operations Processor

- Processed over 1,000 credit applications per month, ensuring accuracy and compliance with regulatory guidelines.

- Conducted comprehensive credit analysis, utilizing financial statements, credit reports, and other relevant data.

- Identified and resolved discrepancies in credit reports, mitigating potential risks to the lender.

- Monitored and managed credit accounts, proactively taking action to prevent delinquencies and chargeoffs.

Accomplishments

- Implemented a new data analysis tool that streamlined credit risk assessment, reducing processing time by 20%.

- Developed and implemented a training program for new Credit Operations Processors, improving onboarding success rates by 15%.

- Led a project to optimize credit reporting processes, reducing errors and improving data integrity by 10%.

- Implemented a new credit scoring system that enhanced risk assessment accuracy and reduced writeoffs by 5%.

- Developed and implemented a quality assurance program for credit processing, ensuring compliance with industry regulations and internal standards.

Awards

- Achieved Employee of the Quarter award for consistently exceeding performance targets in credit review and analysis.

- Recognized for Excellence in Credit Operations for consistently maintaining high levels of accuracy and efficiency in credit processing.

- Received Team Player of the Year award for collaboration and support in maintaining a highfunctioning Credit Operations team.

- Recognized for Innovation in Credit Operations for developing a new fraud detection algorithm that reduced false positives by 25%.

Certificates

- Certified Credit Executive (CCE)

- Certified Credit Risk Analyst (CCRA)

- Certified Credit Manager (CCM)

- Certified Collections Specialist (CCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Operations Processor

- Highlight your expertise in credit analysis and risk assessment.

- Quantify your accomplishments and provide specific examples of how you have improved efficiency and reduced risk.

- Showcase your strong analytical and data interpretation skills.

- Emphasize your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Credit Operations Processor Resume

- Processed over 1,000 credit applications per month, ensuring accuracy and compliance with regulatory guidelines.

- Conducted comprehensive credit analysis, utilizing financial statements, credit reports, and other relevant data.

- Identified and resolved discrepancies in credit reports, mitigating potential risks to the lender.

- Monitored and managed credit accounts, proactively taking action to prevent delinquencies and chargeoffs.

- Developed and implemented automated processes to improve efficiency and reduce processing time.

- Utilized advanced analytical tools and reporting systems to provide data-driven insights on credit performance.

- Collaborated with underwriting and other departments to provide support and ensure seamless credit operations.

Frequently Asked Questions (FAQ’s) For Credit Operations Processor

What are the key skills required for a Credit Operations Processor?

Key skills for a Credit Operations Processor include credit analysis, loan processing, data analysis, financial modeling, risk assessment, and credit facilitation.

What are the typical duties and responsibilities of a Credit Operations Processor?

Typical duties and responsibilities of a Credit Operations Processor include processing credit applications, conducting credit analysis, identifying and resolving discrepancies in credit reports, monitoring and managing credit accounts, and developing and implementing automated processes to improve efficiency.

What are the career prospects for a Credit Operations Processor?

Credit Operations Processors can advance to roles such as Credit Analyst, Underwriter, or Portfolio Manager with experience and additional qualifications.

What is the average salary for a Credit Operations Processor?

The average salary for a Credit Operations Processor varies depending on experience, location, and company size, but typically ranges from $50,000 to $75,000 per year.

What are the educational requirements for a Credit Operations Processor?

Most Credit Operations Processors have a bachelor’s degree in finance, accounting, or a related field.

What are the certification programs available for Credit Operations Processors?

There are several certification programs available for Credit Operations Processors, such as the Certified Credit Operations Professional (CCOP) certification offered by the National Association of Credit Management (NACM).

What are the key challenges faced by Credit Operations Processors?

Credit Operations Processors face challenges such as increasing regulatory compliance requirements, the need to improve efficiency and reduce costs, and the growing use of technology in the credit industry.

What are the emerging trends in the credit operations industry?

Emerging trends in the credit operations industry include the use of artificial intelligence (AI) and machine learning (ML) to automate tasks, the adoption of cloud-based credit management systems, and the increasing focus on data analytics to improve decision-making.