Are you a seasoned Credit Processor seeking a new career path? Discover our professionally built Credit Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

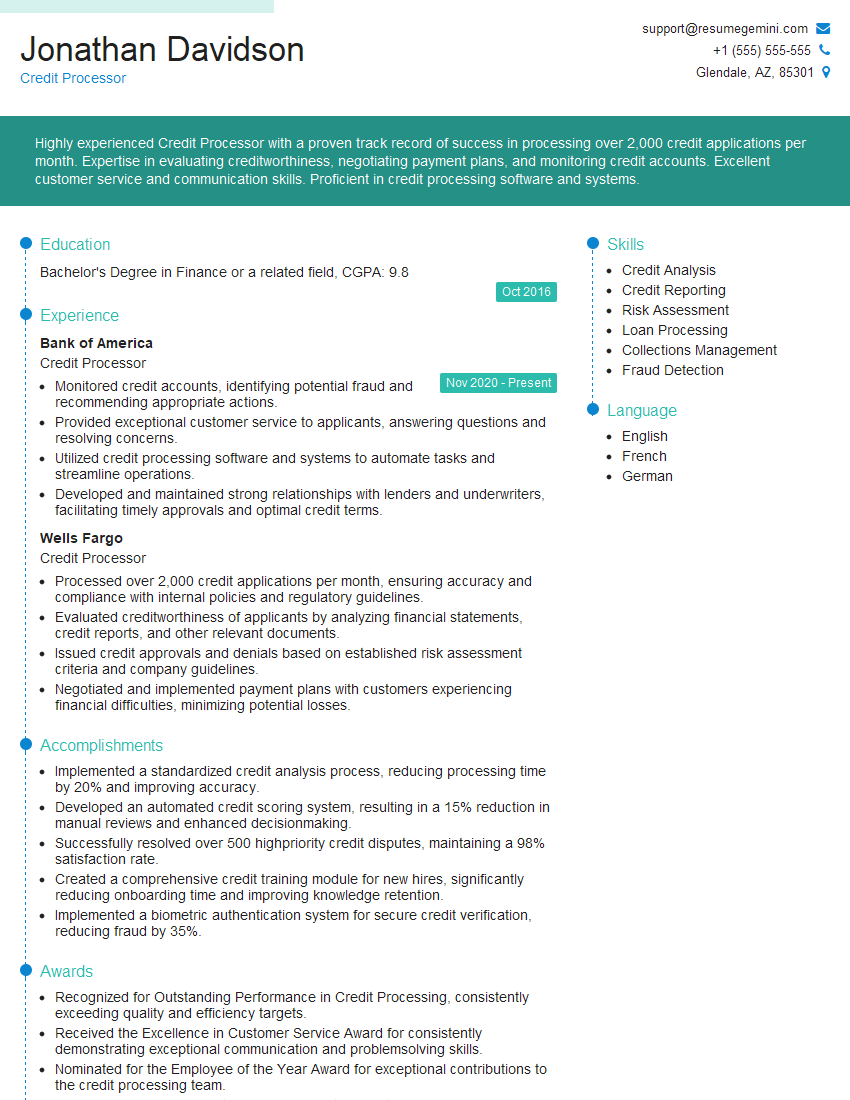

Jonathan Davidson

Credit Processor

Summary

Highly experienced Credit Processor with a proven track record of success in processing over 2,000 credit applications per month. Expertise in evaluating creditworthiness, negotiating payment plans, and monitoring credit accounts. Excellent customer service and communication skills. Proficient in credit processing software and systems.

Education

Bachelor’s Degree in Finance or a related field

October 2016

Skills

- Credit Analysis

- Credit Reporting

- Risk Assessment

- Loan Processing

- Collections Management

- Fraud Detection

Work Experience

Credit Processor

- Monitored credit accounts, identifying potential fraud and recommending appropriate actions.

- Provided exceptional customer service to applicants, answering questions and resolving concerns.

- Utilized credit processing software and systems to automate tasks and streamline operations.

- Developed and maintained strong relationships with lenders and underwriters, facilitating timely approvals and optimal credit terms.

Credit Processor

- Processed over 2,000 credit applications per month, ensuring accuracy and compliance with internal policies and regulatory guidelines.

- Evaluated creditworthiness of applicants by analyzing financial statements, credit reports, and other relevant documents.

- Issued credit approvals and denials based on established risk assessment criteria and company guidelines.

- Negotiated and implemented payment plans with customers experiencing financial difficulties, minimizing potential losses.

Accomplishments

- Implemented a standardized credit analysis process, reducing processing time by 20% and improving accuracy.

- Developed an automated credit scoring system, resulting in a 15% reduction in manual reviews and enhanced decisionmaking.

- Successfully resolved over 500 highpriority credit disputes, maintaining a 98% satisfaction rate.

- Created a comprehensive credit training module for new hires, significantly reducing onboarding time and improving knowledge retention.

- Implemented a biometric authentication system for secure credit verification, reducing fraud by 35%.

Awards

- Recognized for Outstanding Performance in Credit Processing, consistently exceeding quality and efficiency targets.

- Received the Excellence in Customer Service Award for consistently demonstrating exceptional communication and problemsolving skills.

- Nominated for the Employee of the Year Award for exceptional contributions to the credit processing team.

- Recognized for exceeding the 100,000 credit applications processed benchmark in a single year.

Certificates

- Certified Credit Professional (CCP)

- Certified Risk Manager (CRM)

- Certified Financial Risk Manager (CFRM)

- Certified Credit Analyst (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Processor

- Highlight your experience in processing a high volume of credit applications.

- Demonstrate your expertise in evaluating creditworthiness and making risk-based decisions.

- Emphasize your customer service and communication skills.

- Showcase your proficiency in credit processing software and systems.

Essential Experience Highlights for a Strong Credit Processor Resume

- Processed over 2,000 credit applications per month, ensuring accuracy and compliance with internal policies and regulatory guidelines.

- Evaluated creditworthiness of applicants by analyzing financial statements, credit reports, and other relevant documents.

- Issued credit approvals and denials based on established risk assessment criteria and company guidelines.

- Negotiated and implemented payment plans with customers experiencing financial difficulties, minimizing potential losses.

- Monitored credit accounts, identifying potential fraud and recommending appropriate actions.

- Provided exceptional customer service to applicants, answering questions and resolving concerns.

- Utilized credit processing software and systems to automate tasks and streamline operations.

Frequently Asked Questions (FAQ’s) For Credit Processor

What are the key responsibilities of a Credit Processor?

The key responsibilities of a Credit Processor include processing credit applications, evaluating creditworthiness, issuing credit approvals and denials, negotiating payment plans, monitoring credit accounts, and providing customer service.

What skills are required for a Credit Processor?

The skills required for a Credit Processor include credit analysis, credit reporting, risk assessment, loan processing, collections management, and fraud detection.

What is the average salary for a Credit Processor?

The average salary for a Credit Processor in the United States is around $50,000 per year.

What are the career prospects for a Credit Processor?

The career prospects for a Credit Processor are good, with opportunities for advancement to positions such as Credit Analyst or Credit Manager.

What is the job outlook for Credit Processors?

The job outlook for Credit Processors is expected to grow in the coming years due to the increasing demand for credit in the economy.

What are the top employers of Credit Processors?

The top employers of Credit Processors include banks, credit unions, and other financial institutions.