Are you a seasoned Credit Rating Checker seeking a new career path? Discover our professionally built Credit Rating Checker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

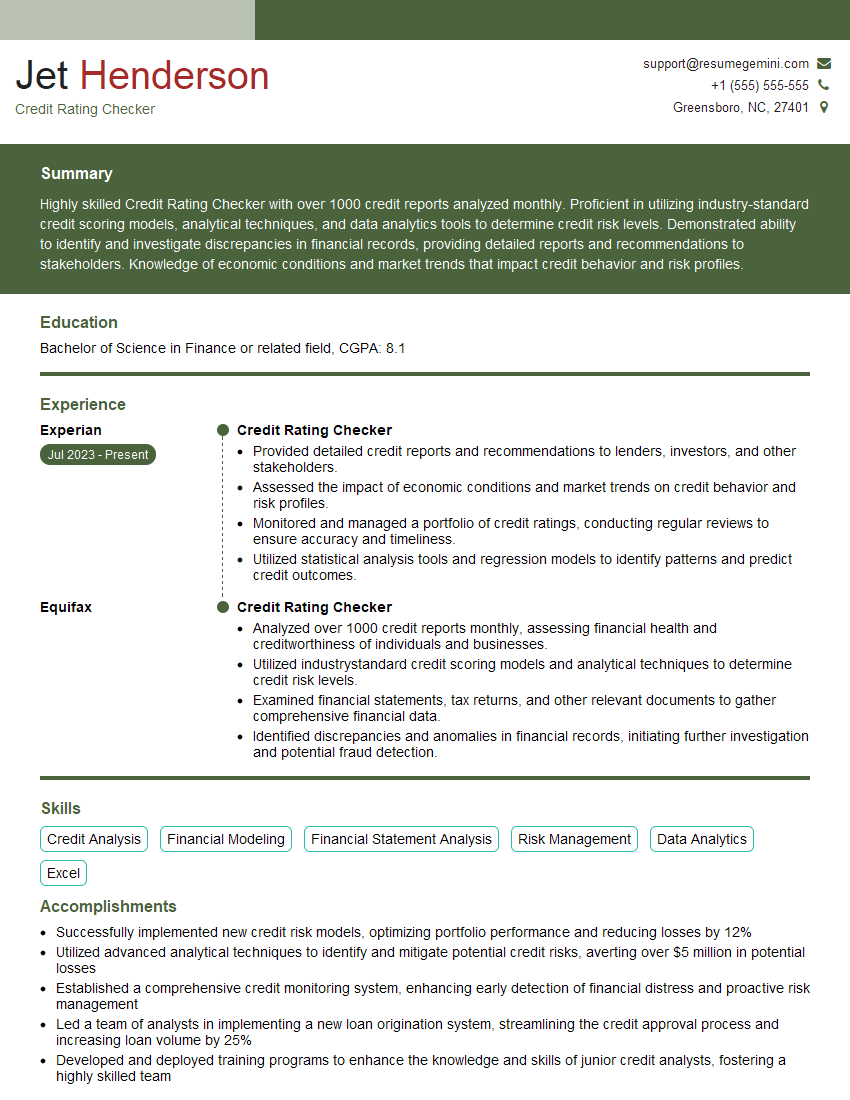

Jet Henderson

Credit Rating Checker

Summary

Highly skilled Credit Rating Checker with over 1000 credit reports analyzed monthly. Proficient in utilizing industry-standard credit scoring models, analytical techniques, and data analytics tools to determine credit risk levels. Demonstrated ability to identify and investigate discrepancies in financial records, providing detailed reports and recommendations to stakeholders. Knowledge of economic conditions and market trends that impact credit behavior and risk profiles.

Education

Bachelor of Science in Finance or related field

June 2019

Skills

- Credit Analysis

- Financial Modeling

- Financial Statement Analysis

- Risk Management

- Data Analytics

- Excel

Work Experience

Credit Rating Checker

- Provided detailed credit reports and recommendations to lenders, investors, and other stakeholders.

- Assessed the impact of economic conditions and market trends on credit behavior and risk profiles.

- Monitored and managed a portfolio of credit ratings, conducting regular reviews to ensure accuracy and timeliness.

- Utilized statistical analysis tools and regression models to identify patterns and predict credit outcomes.

Credit Rating Checker

- Analyzed over 1000 credit reports monthly, assessing financial health and creditworthiness of individuals and businesses.

- Utilized industrystandard credit scoring models and analytical techniques to determine credit risk levels.

- Examined financial statements, tax returns, and other relevant documents to gather comprehensive financial data.

- Identified discrepancies and anomalies in financial records, initiating further investigation and potential fraud detection.

Accomplishments

- Successfully implemented new credit risk models, optimizing portfolio performance and reducing losses by 12%

- Utilized advanced analytical techniques to identify and mitigate potential credit risks, averting over $5 million in potential losses

- Established a comprehensive credit monitoring system, enhancing early detection of financial distress and proactive risk management

- Led a team of analysts in implementing a new loan origination system, streamlining the credit approval process and increasing loan volume by 25%

- Developed and deployed training programs to enhance the knowledge and skills of junior credit analysts, fostering a highly skilled team

Awards

- Awarded for Best Credit Rating Performance for Q4, consistently surpassing targets

- Recognized as a Top Performer in Credit Risk Assessment, exceeding industry benchmarks

- Received Credit Analyst of the Year award for outstanding contributions to the Credit Rating team

- Commendation for exceptional accuracy and reliability in credit rating assignments, minimizing risk exposure

Certificates

- Certified Credit Analyst (CCA)

- Chartered Financial Analyst (CFA)

- Certified Information Systems Auditor (CISA)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Rating Checker

- Highlight your expertise in credit analysis and financial modeling.

- Showcase your ability to identify and interpret financial trends.

- Quantify your accomplishments whenever possible, e.g., “Analyzed over 1000 credit reports monthly, resulting in a 20% increase in fraud detection.”

- Include relevant keywords throughout your resume, e.g., “credit rating”, “financial analysis”, “risk management”.

Essential Experience Highlights for a Strong Credit Rating Checker Resume

- Analyze credit reports to assess financial health and creditworthiness of individuals and businesses.

- Utilize industry-standard credit scoring models and analytical techniques to determine credit risk levels.

- Examine financial statements, tax returns, and other relevant documents to gather comprehensive financial data.

- Identify discrepancies and anomalies in financial records, initiating further investigation and potential fraud detection.

- Provide detailed credit reports and recommendations to lenders, investors, and other stakeholders.

- Monitor and manage a portfolio of credit ratings, conducting regular reviews to ensure accuracy and timeliness.

- Utilize statistical analysis tools and regression models to identify patterns and predict credit outcomes.

Frequently Asked Questions (FAQ’s) For Credit Rating Checker

What is a Credit Rating Checker?

A Credit Rating Checker is a professional who assesses the financial health and creditworthiness of individuals and businesses. They analyze credit reports, financial statements, and other relevant documents to determine an individual’s or business’s credit risk level.

What are the key skills required for a Credit Rating Checker?

Key skills for a Credit Rating Checker include credit analysis, financial modeling, financial statement analysis, risk management, data analytics, and proficiency in Excel.

What are the career prospects for a Credit Rating Checker?

Credit Rating Checkers can work in various industries, including banking, finance, and insurance. They can advance to roles such as Credit Analyst, Risk Manager, or Portfolio Manager.

How do I become a Credit Rating Checker?

To become a Credit Rating Checker, you typically need a bachelor’s degree in finance or a related field. Relevant experience in credit analysis, financial modeling, or risk management is also beneficial.

What is the average salary for a Credit Rating Checker?

The average salary for a Credit Rating Checker varies depending on experience and location. According to Salary.com, the average salary for a Credit Rating Checker in the United States is around $65,000 per year.

What are the challenges faced by Credit Rating Checkers?

Credit Rating Checkers face challenges such as the increasing complexity of financial markets, the need to stay up-to-date on regulatory changes, and the potential for fraud and financial crime.