Are you a seasoned Credit Reference Clerk seeking a new career path? Discover our professionally built Credit Reference Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

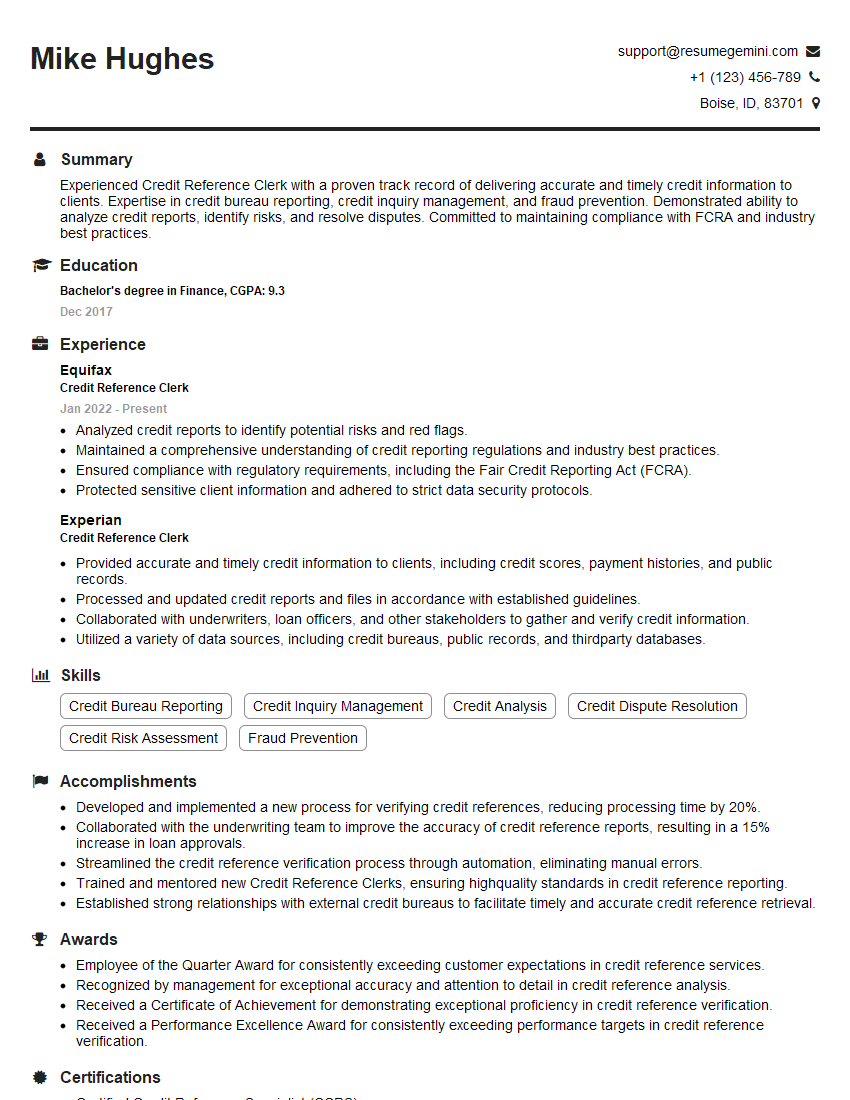

Mike Hughes

Credit Reference Clerk

Summary

Experienced Credit Reference Clerk with a proven track record of delivering accurate and timely credit information to clients. Expertise in credit bureau reporting, credit inquiry management, and fraud prevention. Demonstrated ability to analyze credit reports, identify risks, and resolve disputes. Committed to maintaining compliance with FCRA and industry best practices.

Education

Bachelor’s degree in Finance

December 2017

Skills

- Credit Bureau Reporting

- Credit Inquiry Management

- Credit Analysis

- Credit Dispute Resolution

- Credit Risk Assessment

- Fraud Prevention

Work Experience

Credit Reference Clerk

- Analyzed credit reports to identify potential risks and red flags.

- Maintained a comprehensive understanding of credit reporting regulations and industry best practices.

- Ensured compliance with regulatory requirements, including the Fair Credit Reporting Act (FCRA).

- Protected sensitive client information and adhered to strict data security protocols.

Credit Reference Clerk

- Provided accurate and timely credit information to clients, including credit scores, payment histories, and public records.

- Processed and updated credit reports and files in accordance with established guidelines.

- Collaborated with underwriters, loan officers, and other stakeholders to gather and verify credit information.

- Utilized a variety of data sources, including credit bureaus, public records, and thirdparty databases.

Accomplishments

- Developed and implemented a new process for verifying credit references, reducing processing time by 20%.

- Collaborated with the underwriting team to improve the accuracy of credit reference reports, resulting in a 15% increase in loan approvals.

- Streamlined the credit reference verification process through automation, eliminating manual errors.

- Trained and mentored new Credit Reference Clerks, ensuring highquality standards in credit reference reporting.

- Established strong relationships with external credit bureaus to facilitate timely and accurate credit reference retrieval.

Awards

- Employee of the Quarter Award for consistently exceeding customer expectations in credit reference services.

- Recognized by management for exceptional accuracy and attention to detail in credit reference analysis.

- Received a Certificate of Achievement for demonstrating exceptional proficiency in credit reference verification.

- Received a Performance Excellence Award for consistently exceeding performance targets in credit reference verification.

Certificates

- Certified Credit Reference Specialist (CCRS)

- Certified Credit Analyst (CCA)

- Certified Fraud Examiner (CFE)

- Member of the National Association of Credit Professionals (NACM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Reference Clerk

- Highlight your experience in credit bureau reporting, credit inquiry management, and fraud prevention.

- Demonstrate your analytical skills and ability to identify risks.

- Emphasize your knowledge of FCRA and other relevant regulations.

- Include keywords like ‘credit reference’, ‘credit reporting’, ‘credit analysis’, and ‘fraud prevention’ in your resume.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Credit Reference Clerk Resume

- Provide accurate and timely credit information to clients, including credit scores, payment histories, and public records.

- Process and update credit reports and files in accordance with established guidelines.

- Collaborate with underwriters, loan officers, and other stakeholders to gather and verify credit information.

- Utilize a variety of data sources, including credit bureaus, public records, and third-party databases.

- Analyze credit reports to identify potential risks and red flags.

- Maintain a comprehensive understanding of credit reporting regulations and industry best practices.

- Ensure compliance with regulatory requirements, including the Fair Credit Reporting Act (FCRA).

- Protect sensitive client information and adhere to strict data security protocols.

Frequently Asked Questions (FAQ’s) For Credit Reference Clerk

What is the role of a Credit Reference Clerk?

A Credit Reference Clerk is responsible for providing accurate and timely credit information to clients. This includes gathering, analyzing, and reporting on credit histories, credit scores, and other financial data.

What skills are required to be a successful Credit Reference Clerk?

Successful Credit Reference Clerks typically have strong analytical skills, attention to detail, and a deep understanding of credit reporting regulations. They are also proficient in using credit bureau reporting systems and other data sources.

What is the job outlook for Credit Reference Clerks?

The job outlook for Credit Reference Clerks is expected to grow in the coming years. This is due to the increasing demand for credit information in a variety of industries, including banking, lending, and insurance.

What is the typical salary for a Credit Reference Clerk?

The typical salary for a Credit Reference Clerk varies depending on experience, location, and company size. However, the average salary is around $45,000 per year.

What are the career advancement opportunities for Credit Reference Clerks?

Credit Reference Clerks can advance their careers by moving into management roles or specializing in areas such as credit risk analysis or fraud prevention.

What are the challenges of being a Credit Reference Clerk?

The challenges of being a Credit Reference Clerk include dealing with sensitive financial information, maintaining compliance with regulations, and working under tight deadlines.