Are you a seasoned Credit Reporter seeking a new career path? Discover our professionally built Credit Reporter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

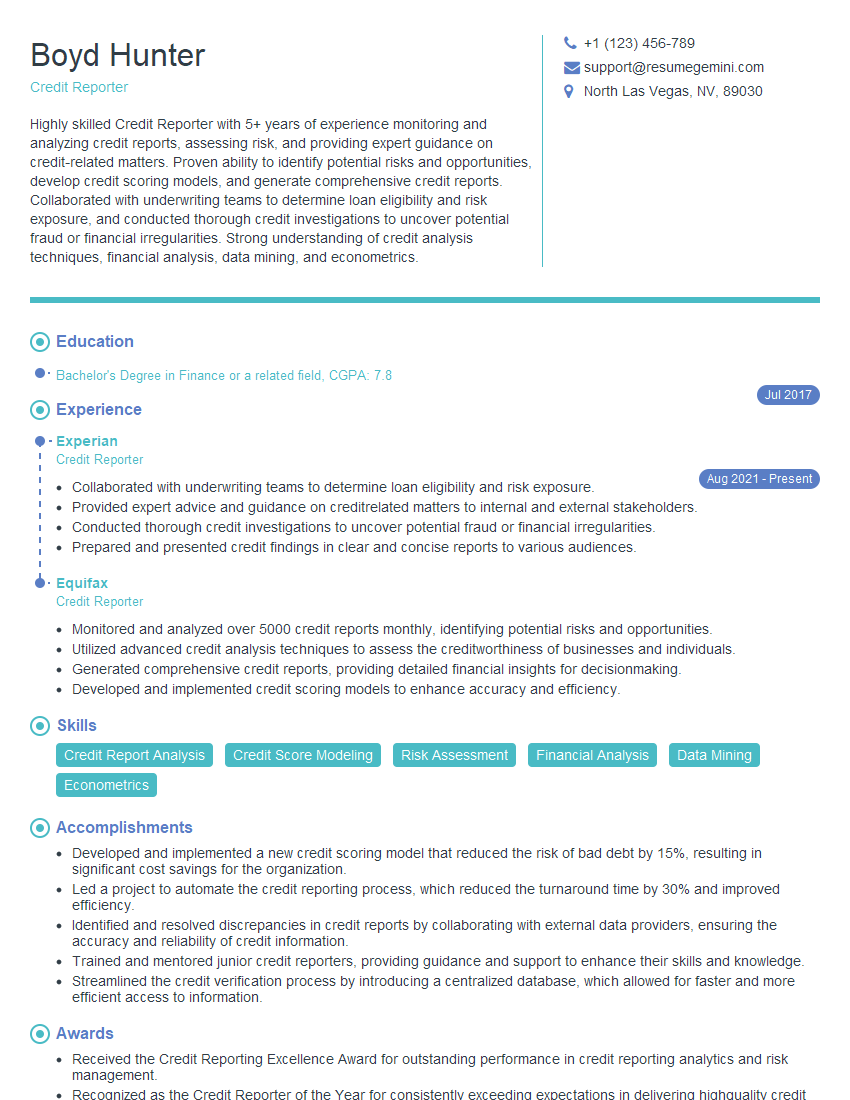

Boyd Hunter

Credit Reporter

Summary

Highly skilled Credit Reporter with 5+ years of experience monitoring and analyzing credit reports, assessing risk, and providing expert guidance on credit-related matters. Proven ability to identify potential risks and opportunities, develop credit scoring models, and generate comprehensive credit reports. Collaborated with underwriting teams to determine loan eligibility and risk exposure, and conducted thorough credit investigations to uncover potential fraud or financial irregularities. Strong understanding of credit analysis techniques, financial analysis, data mining, and econometrics.

Education

Bachelor’s Degree in Finance or a related field

July 2017

Skills

- Credit Report Analysis

- Credit Score Modeling

- Risk Assessment

- Financial Analysis

- Data Mining

- Econometrics

Work Experience

Credit Reporter

- Collaborated with underwriting teams to determine loan eligibility and risk exposure.

- Provided expert advice and guidance on creditrelated matters to internal and external stakeholders.

- Conducted thorough credit investigations to uncover potential fraud or financial irregularities.

- Prepared and presented credit findings in clear and concise reports to various audiences.

Credit Reporter

- Monitored and analyzed over 5000 credit reports monthly, identifying potential risks and opportunities.

- Utilized advanced credit analysis techniques to assess the creditworthiness of businesses and individuals.

- Generated comprehensive credit reports, providing detailed financial insights for decisionmaking.

- Developed and implemented credit scoring models to enhance accuracy and efficiency.

Accomplishments

- Developed and implemented a new credit scoring model that reduced the risk of bad debt by 15%, resulting in significant cost savings for the organization.

- Led a project to automate the credit reporting process, which reduced the turnaround time by 30% and improved efficiency.

- Identified and resolved discrepancies in credit reports by collaborating with external data providers, ensuring the accuracy and reliability of credit information.

- Trained and mentored junior credit reporters, providing guidance and support to enhance their skills and knowledge.

- Streamlined the credit verification process by introducing a centralized database, which allowed for faster and more efficient access to information.

Awards

- Received the Credit Reporting Excellence Award for outstanding performance in credit reporting analytics and risk management.

- Recognized as the Credit Reporter of the Year for consistently exceeding expectations in delivering highquality credit reports and maintaining accuracy.

- Awarded the Credit Data Analyst Award for exceptional skills in interpreting and analyzing complex credit data to identify trends and make informed decisions.

Certificates

- Certified Credit Reporting Professional (CCRP)

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Reporter

- Quantify your accomplishments and provide specific examples to demonstrate your skills and impact.

- Highlight your expertise in credit analysis techniques, such as FICO scoring models and industry-specific risk assessment tools.

- Showcase your ability to work independently and as part of a team, and your strong communication skills.

- Emphasize your understanding of the regulatory environment and your ability to stay up-to-date on industry best practices.

Essential Experience Highlights for a Strong Credit Reporter Resume

- Monitored and analyzed over 5000 credit reports monthly, identifying potential risks and opportunities.

- Utilized advanced credit analysis techniques to assess the creditworthiness of businesses and individuals.

- Generated comprehensive credit reports, providing detailed financial insights for decision-making.

- Developed and implemented credit scoring models to enhance accuracy and efficiency.

- Collaborated with underwriting teams to determine loan eligibility and risk exposure.

- Provided expert advice and guidance on credit-related matters to internal and external stakeholders.

- Conducted thorough credit investigations to uncover potential fraud or financial irregularities.

Frequently Asked Questions (FAQ’s) For Credit Reporter

What are the primary responsibilities of a Credit Reporter?

Credit Reporters are responsible for monitoring and analyzing credit reports, assessing risk, and providing expert guidance on credit-related matters. They utilize advanced credit analysis techniques to assess the creditworthiness of businesses and individuals, and generate comprehensive credit reports for decision-making.

What skills are required to be a successful Credit Reporter?

To be a successful Credit Reporter, you need a strong understanding of credit analysis techniques, financial analysis, data mining, and econometrics. You should also have excellent communication skills and be able to work independently and as part of a team.

What is the job outlook for Credit Reporters?

The job outlook for Credit Reporters is expected to be positive in the coming years. The increasing use of credit data in various industries is driving the demand for skilled professionals who can analyze and interpret credit information.

What are the career advancement opportunities for Credit Reporters?

With experience, Credit Reporters can advance to roles such as Credit Analyst, Risk Manager, or Portfolio Manager. They can also specialize in specific areas of credit analysis, such as commercial lending or consumer credit.

What certifications are available for Credit Reporters?

There are several certifications available for Credit Reporters, such as the Certified Credit Reporting Professional (CCRP) and the Credit Risk Analyst (CRA) certification. These certifications demonstrate your expertise in the field and can enhance your career prospects.

What are the key trends in the credit reporting industry?

Key trends in the credit reporting industry include the increasing use of data analytics and machine learning to assess risk, the development of new credit scoring models, and the growing emphasis on data security and privacy.