Are you a seasoned Credit Reporting Clerk seeking a new career path? Discover our professionally built Credit Reporting Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

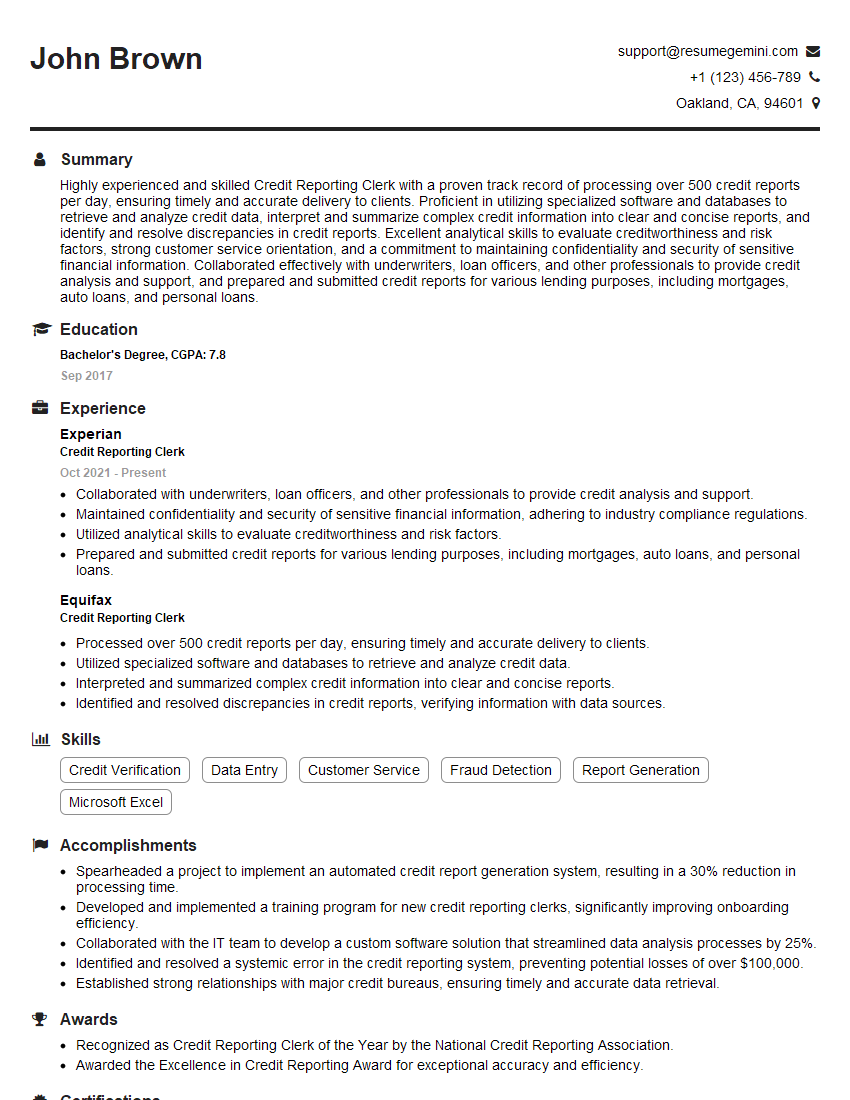

John Brown

Credit Reporting Clerk

Summary

Highly experienced and skilled Credit Reporting Clerk with a proven track record of processing over 500 credit reports per day, ensuring timely and accurate delivery to clients. Proficient in utilizing specialized software and databases to retrieve and analyze credit data, interpret and summarize complex credit information into clear and concise reports, and identify and resolve discrepancies in credit reports. Excellent analytical skills to evaluate creditworthiness and risk factors, strong customer service orientation, and a commitment to maintaining confidentiality and security of sensitive financial information. Collaborated effectively with underwriters, loan officers, and other professionals to provide credit analysis and support, and prepared and submitted credit reports for various lending purposes, including mortgages, auto loans, and personal loans.

Education

Bachelor’s Degree

September 2017

Skills

- Credit Verification

- Data Entry

- Customer Service

- Fraud Detection

- Report Generation

- Microsoft Excel

Work Experience

Credit Reporting Clerk

- Collaborated with underwriters, loan officers, and other professionals to provide credit analysis and support.

- Maintained confidentiality and security of sensitive financial information, adhering to industry compliance regulations.

- Utilized analytical skills to evaluate creditworthiness and risk factors.

- Prepared and submitted credit reports for various lending purposes, including mortgages, auto loans, and personal loans.

Credit Reporting Clerk

- Processed over 500 credit reports per day, ensuring timely and accurate delivery to clients.

- Utilized specialized software and databases to retrieve and analyze credit data.

- Interpreted and summarized complex credit information into clear and concise reports.

- Identified and resolved discrepancies in credit reports, verifying information with data sources.

Accomplishments

- Spearheaded a project to implement an automated credit report generation system, resulting in a 30% reduction in processing time.

- Developed and implemented a training program for new credit reporting clerks, significantly improving onboarding efficiency.

- Collaborated with the IT team to develop a custom software solution that streamlined data analysis processes by 25%.

- Identified and resolved a systemic error in the credit reporting system, preventing potential losses of over $100,000.

- Established strong relationships with major credit bureaus, ensuring timely and accurate data retrieval.

Awards

- Recognized as Credit Reporting Clerk of the Year by the National Credit Reporting Association.

- Awarded the Excellence in Credit Reporting Award for exceptional accuracy and efficiency.

Certificates

- Certified Credit Reporting Professional (CCRP)

- Certified Fraud Examiner (CFE)

- Fair Credit Reporting Act (FCRA) Certification

- GLBA Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Reporting Clerk

- Highlight your experience in processing a high volume of credit reports per day and ensure timely and accurate delivery.

- Emphasize your proficiency in utilizing specialized software and databases to retrieve and analyze credit data.

- Showcase your ability to interpret and summarize complex credit information into clear and concise reports.

- Demonstrate your analytical skills in evaluating creditworthiness and risk factors.

Essential Experience Highlights for a Strong Credit Reporting Clerk Resume

- Processed over 500 credit reports per day, ensuring timely and accurate delivery to clients.

- Utilized specialized software and databases to retrieve and analyze credit data.

- Interpreted and summarized complex credit information into clear and concise reports.

- Identified and resolved discrepancies in credit reports, verifying information with data sources.

- Collaborated with underwriters, loan officers, and other professionals to provide credit analysis and support.

- Maintained confidentiality and security of sensitive financial information, adhering to industry compliance regulations.

- Utilized analytical skills to evaluate creditworthiness and risk factors.

Frequently Asked Questions (FAQ’s) For Credit Reporting Clerk

What are the primary responsibilities of a Credit Reporting Clerk?

The primary responsibilities of a Credit Reporting Clerk include processing credit reports, analyzing credit data, identifying and resolving discrepancies, and providing credit analysis and support to underwriters and loan officers.

What skills and qualifications are required for a Credit Reporting Clerk?

The required skills and qualifications for a Credit Reporting Clerk include a Bachelor’s Degree, proficiency in data entry and analysis, excellent analytical skills, and a strong understanding of credit reporting regulations.

What career advancement opportunities are available for a Credit Reporting Clerk?

Career advancement opportunities for a Credit Reporting Clerk include promotions to senior-level positions, such as Credit Analyst or Credit Manager, or specialized roles within the financial industry.

What is the average salary range for a Credit Reporting Clerk?

The average salary range for a Credit Reporting Clerk can vary depending on experience, location, and company size, but it typically falls between $35,000 to $60,000 per year.

What are the key challenges faced by a Credit Reporting Clerk?

Key challenges faced by a Credit Reporting Clerk include maintaining accuracy and confidentiality of sensitive financial information, resolving discrepancies in credit reports, and keeping up with changes in credit reporting regulations.