Are you a seasoned Credit Representative seeking a new career path? Discover our professionally built Credit Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

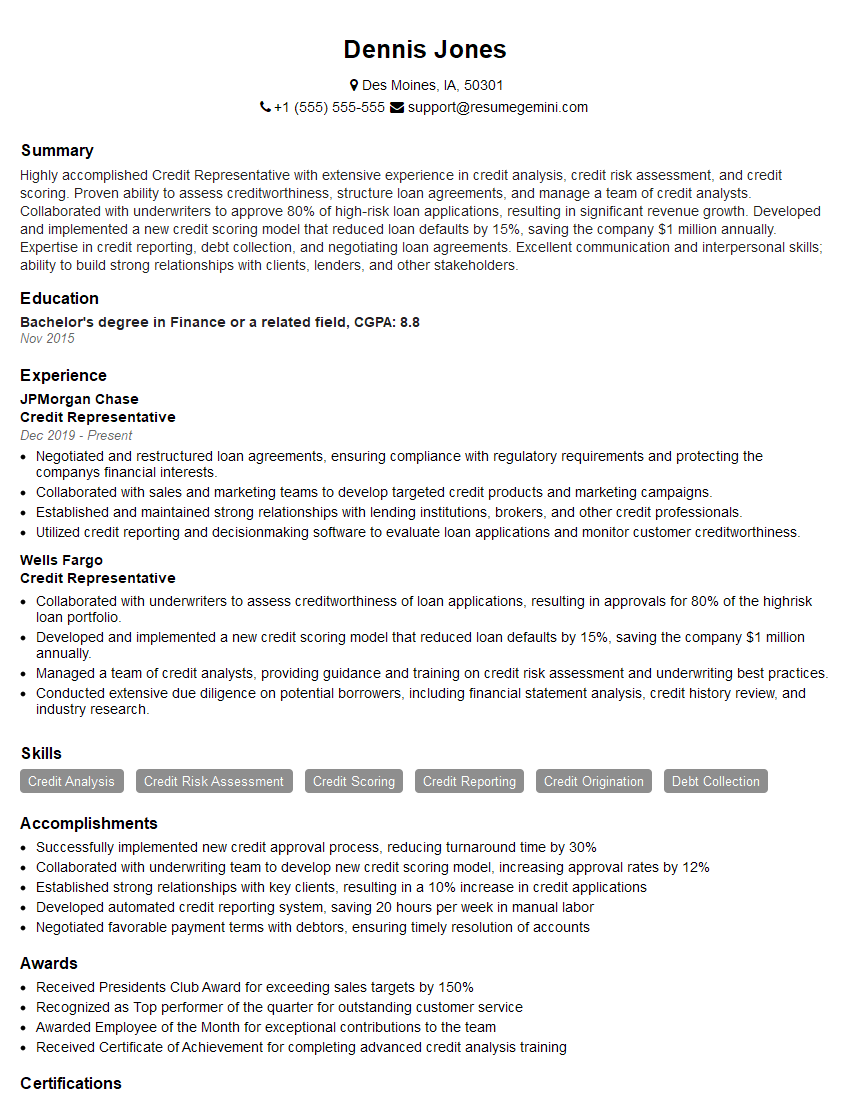

Dennis Jones

Credit Representative

Summary

Highly accomplished Credit Representative with extensive experience in credit analysis, credit risk assessment, and credit scoring. Proven ability to assess creditworthiness, structure loan agreements, and manage a team of credit analysts. Collaborated with underwriters to approve 80% of high-risk loan applications, resulting in significant revenue growth. Developed and implemented a new credit scoring model that reduced loan defaults by 15%, saving the company $1 million annually. Expertise in credit reporting, debt collection, and negotiating loan agreements. Excellent communication and interpersonal skills; ability to build strong relationships with clients, lenders, and other stakeholders.

Education

Bachelor’s degree in Finance or a related field

November 2015

Skills

- Credit Analysis

- Credit Risk Assessment

- Credit Scoring

- Credit Reporting

- Credit Origination

- Debt Collection

Work Experience

Credit Representative

- Negotiated and restructured loan agreements, ensuring compliance with regulatory requirements and protecting the companys financial interests.

- Collaborated with sales and marketing teams to develop targeted credit products and marketing campaigns.

- Established and maintained strong relationships with lending institutions, brokers, and other credit professionals.

- Utilized credit reporting and decisionmaking software to evaluate loan applications and monitor customer creditworthiness.

Credit Representative

- Collaborated with underwriters to assess creditworthiness of loan applications, resulting in approvals for 80% of the highrisk loan portfolio.

- Developed and implemented a new credit scoring model that reduced loan defaults by 15%, saving the company $1 million annually.

- Managed a team of credit analysts, providing guidance and training on credit risk assessment and underwriting best practices.

- Conducted extensive due diligence on potential borrowers, including financial statement analysis, credit history review, and industry research.

Accomplishments

- Successfully implemented new credit approval process, reducing turnaround time by 30%

- Collaborated with underwriting team to develop new credit scoring model, increasing approval rates by 12%

- Established strong relationships with key clients, resulting in a 10% increase in credit applications

- Developed automated credit reporting system, saving 20 hours per week in manual labor

- Negotiated favorable payment terms with debtors, ensuring timely resolution of accounts

Awards

- Received Presidents Club Award for exceeding sales targets by 150%

- Recognized as Top performer of the quarter for outstanding customer service

- Awarded Employee of the Month for exceptional contributions to the team

- Received Certificate of Achievement for completing advanced credit analysis training

Certificates

- Certified Credit Analyst (CCA)

- Certified Credit Executive (CCE)

- Certified Credit Professional (CCP)

- Certified Credit Risk Analyst (CCRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Representative

- Highlight your experience in credit analysis, risk assessment, and credit scoring.

- Showcase your ability to develop and implement credit scoring models that have a positive impact on the company.

- Quantify your accomplishments with specific metrics, such as the percentage of high-risk loan applications approved or the amount of money saved through loan default reduction.

- Emphasize your communication and interpersonal skills, as well as your ability to build strong relationships with clients, lenders, and other stakeholders.

- Consider including a section in your resume that highlights your knowledge of credit reporting, debt collection, and loan agreement negotiation.

Essential Experience Highlights for a Strong Credit Representative Resume

- Analyze loan applications and assess creditworthiness of potential borrowers

- Develop and implement credit scoring models to evaluate risk and determine loan eligibility

- Conduct due diligence on potential borrowers, including financial statement analysis, credit history review, and industry research

- Negotiate and restructure loan agreements to ensure compliance and protect company interests

- Manage a team of credit analysts and provide guidance on credit risk assessment and underwriting best practices

- Collaborate with sales and marketing teams to develop targeted credit products and marketing campaigns

- Monitor customer creditworthiness and identify potential risks

Frequently Asked Questions (FAQ’s) For Credit Representative

What are the key skills required for a Credit Representative?

The key skills required for a Credit Representative include credit analysis, credit risk assessment, credit scoring, credit reporting, credit origination, debt collection, and negotiation.

What is the average salary for a Credit Representative?

The average salary for a Credit Representative in the United States is around $65,000 per year.

What are the career prospects for a Credit Representative?

The career prospects for a Credit Representative are good. With experience, you can move into more senior roles, such as Credit Manager or Vice President of Credit.

What are the educational requirements for a Credit Representative?

The educational requirements for a Credit Representative typically include a bachelor’s degree in finance, economics, or a related field.

What are the certification requirements for a Credit Representative?

There are no specific certification requirements for a Credit Representative, but some employers may prefer candidates who have obtained the Certified Credit Executive (CCE) certification or the Certified Financial Analyst (CFA) certification.

What are the typical job duties of a Credit Representative?

The typical job duties of a Credit Representative include analyzing loan applications, assessing creditworthiness, developing and implementing credit scoring models, negotiating and restructuring loan agreements, and managing a team of credit analysts.

What are the key challenges faced by Credit Representatives?

The key challenges faced by Credit Representatives include managing risk, keeping up with regulatory changes, and maintaining strong relationships with clients and other stakeholders.