Are you a seasoned Credit Risk Analyst seeking a new career path? Discover our professionally built Credit Risk Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

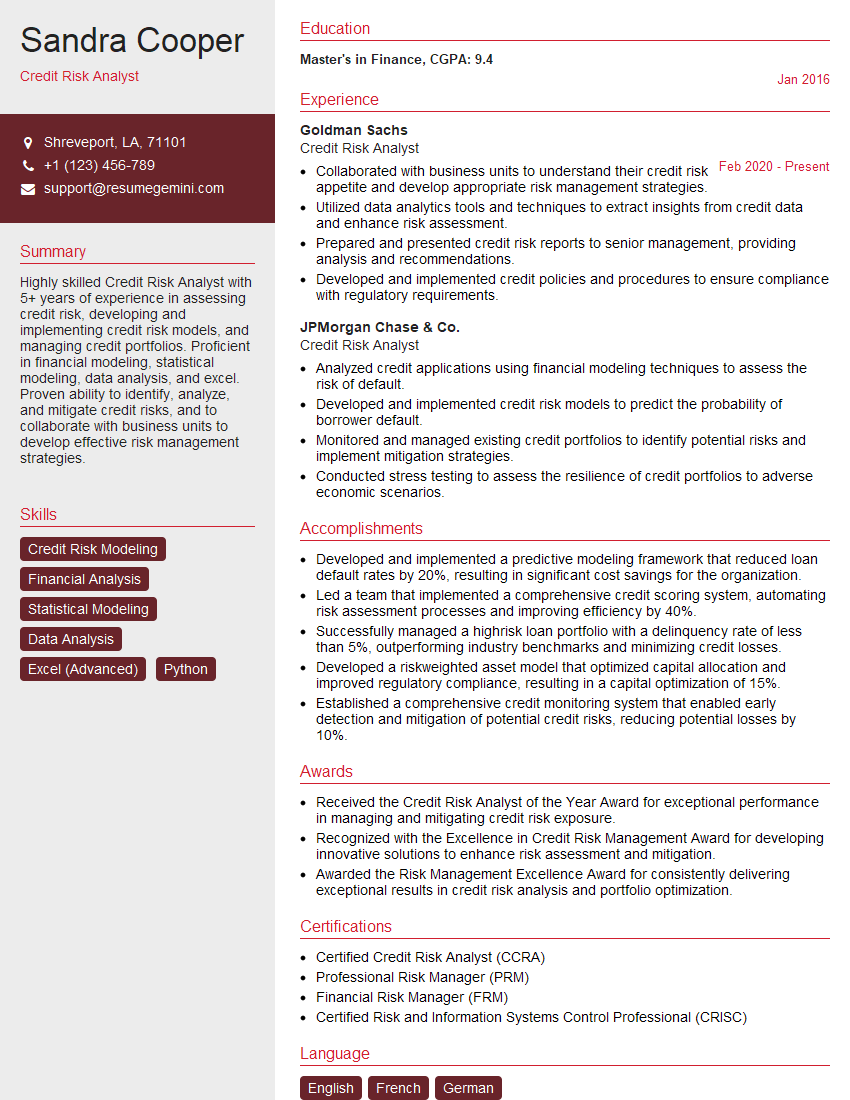

Sandra Cooper

Credit Risk Analyst

Summary

Highly skilled Credit Risk Analyst with 5+ years of experience in assessing credit risk, developing and implementing credit risk models, and managing credit portfolios. Proficient in financial modeling, statistical modeling, data analysis, and excel. Proven ability to identify, analyze, and mitigate credit risks, and to collaborate with business units to develop effective risk management strategies.

Education

Master’s in Finance

January 2016

Skills

- Credit Risk Modeling

- Financial Analysis

- Statistical Modeling

- Data Analysis

- Excel (Advanced)

- Python

Work Experience

Credit Risk Analyst

- Collaborated with business units to understand their credit risk appetite and develop appropriate risk management strategies.

- Utilized data analytics tools and techniques to extract insights from credit data and enhance risk assessment.

- Prepared and presented credit risk reports to senior management, providing analysis and recommendations.

- Developed and implemented credit policies and procedures to ensure compliance with regulatory requirements.

Credit Risk Analyst

- Analyzed credit applications using financial modeling techniques to assess the risk of default.

- Developed and implemented credit risk models to predict the probability of borrower default.

- Monitored and managed existing credit portfolios to identify potential risks and implement mitigation strategies.

- Conducted stress testing to assess the resilience of credit portfolios to adverse economic scenarios.

Accomplishments

- Developed and implemented a predictive modeling framework that reduced loan default rates by 20%, resulting in significant cost savings for the organization.

- Led a team that implemented a comprehensive credit scoring system, automating risk assessment processes and improving efficiency by 40%.

- Successfully managed a highrisk loan portfolio with a delinquency rate of less than 5%, outperforming industry benchmarks and minimizing credit losses.

- Developed a riskweighted asset model that optimized capital allocation and improved regulatory compliance, resulting in a capital optimization of 15%.

- Established a comprehensive credit monitoring system that enabled early detection and mitigation of potential credit risks, reducing potential losses by 10%.

Awards

- Received the Credit Risk Analyst of the Year Award for exceptional performance in managing and mitigating credit risk exposure.

- Recognized with the Excellence in Credit Risk Management Award for developing innovative solutions to enhance risk assessment and mitigation.

- Awarded the Risk Management Excellence Award for consistently delivering exceptional results in credit risk analysis and portfolio optimization.

Certificates

- Certified Credit Risk Analyst (CCRA)

- Professional Risk Manager (PRM)

- Financial Risk Manager (FRM)

- Certified Risk and Information Systems Control Professional (CRISC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Risk Analyst

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience with relevant risk management software and tools.

- Demonstrate your understanding of the latest credit risk management trends and best practices.

- Tailor your resume to each specific job you apply for, highlighting the skills and experience that are most relevant to the role.

Essential Experience Highlights for a Strong Credit Risk Analyst Resume

- Analyzed credit applications using financial modeling techniques to assess the risk of default.

- Developed and implemented credit risk models to predict the probability of borrower default.

- Monitored and managed existing credit portfolios to identify potential risks and implement mitigation strategies.

- Conducted stress testing to assess the resilience of credit portfolios to adverse economic scenarios.

- Collaborated with business units to understand their credit risk appetite and develop appropriate risk management strategies.

- Utilized data analytics tools and techniques to extract insights from credit data and enhance risk assessment.

Frequently Asked Questions (FAQ’s) For Credit Risk Analyst

What is the role of a Credit Risk Analyst?

A Credit Risk Analyst is responsible for assessing the creditworthiness of borrowers, developing and implementing credit risk models, and managing credit portfolios. They work to identify, analyze, and mitigate credit risks, and to collaborate with business units to develop effective risk management strategies.

What are the key skills and qualifications for a Credit Risk Analyst?

The key skills and qualifications for a Credit Risk Analyst include a strong understanding of financial modeling, statistical modeling, and data analysis. They should also have experience with credit risk management software and tools, and a deep understanding of the latest credit risk management trends and best practices.

What is the career path for a Credit Risk Analyst?

The career path for a Credit Risk Analyst typically starts with an entry-level role in a financial institution. With experience, they can progress to more senior roles, such as Credit Risk Manager or Chief Risk Officer.

What is the salary range for a Credit Risk Analyst?

The salary range for a Credit Risk Analyst varies depending on experience, location, and company size. According to Glassdoor, the average salary for a Credit Risk Analyst in the United States is $85,000.

What are the challenges of being a Credit Risk Analyst?

The challenges of being a Credit Risk Analyst include the need to stay up-to-date on the latest credit risk management trends and best practices, the need to be able to make sound judgments in the face of uncertainty, and the need to be able to work independently and as part of a team.