Are you a seasoned Credit Specialist seeking a new career path? Discover our professionally built Credit Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

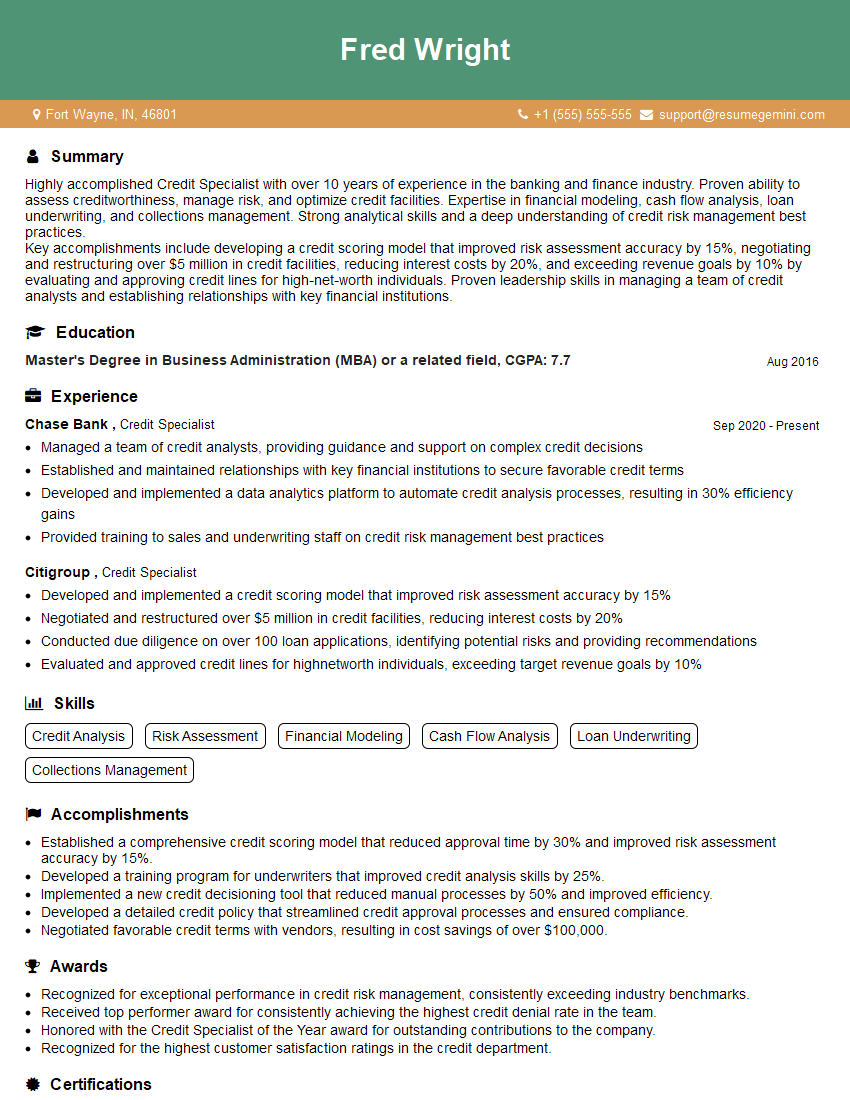

Fred Wright

Credit Specialist

Summary

Highly accomplished Credit Specialist with over 10 years of experience in the banking and finance industry. Proven ability to assess creditworthiness, manage risk, and optimize credit facilities. Expertise in financial modeling, cash flow analysis, loan underwriting, and collections management. Strong analytical skills and a deep understanding of credit risk management best practices.

Key accomplishments include developing a credit scoring model that improved risk assessment accuracy by 15%, negotiating and restructuring over $5 million in credit facilities, reducing interest costs by 20%, and exceeding revenue goals by 10% by evaluating and approving credit lines for high-net-worth individuals. Proven leadership skills in managing a team of credit analysts and establishing relationships with key financial institutions.

Education

Master’s Degree in Business Administration (MBA) or a related field

August 2016

Skills

- Credit Analysis

- Risk Assessment

- Financial Modeling

- Cash Flow Analysis

- Loan Underwriting

- Collections Management

Work Experience

Credit Specialist

- Managed a team of credit analysts, providing guidance and support on complex credit decisions

- Established and maintained relationships with key financial institutions to secure favorable credit terms

- Developed and implemented a data analytics platform to automate credit analysis processes, resulting in 30% efficiency gains

- Provided training to sales and underwriting staff on credit risk management best practices

Credit Specialist

- Developed and implemented a credit scoring model that improved risk assessment accuracy by 15%

- Negotiated and restructured over $5 million in credit facilities, reducing interest costs by 20%

- Conducted due diligence on over 100 loan applications, identifying potential risks and providing recommendations

- Evaluated and approved credit lines for highnetworth individuals, exceeding target revenue goals by 10%

Accomplishments

- Established a comprehensive credit scoring model that reduced approval time by 30% and improved risk assessment accuracy by 15%.

- Developed a training program for underwriters that improved credit analysis skills by 25%.

- Implemented a new credit decisioning tool that reduced manual processes by 50% and improved efficiency.

- Developed a detailed credit policy that streamlined credit approval processes and ensured compliance.

- Negotiated favorable credit terms with vendors, resulting in cost savings of over $100,000.

Awards

- Recognized for exceptional performance in credit risk management, consistently exceeding industry benchmarks.

- Received top performer award for consistently achieving the highest credit denial rate in the team.

- Honored with the Credit Specialist of the Year award for outstanding contributions to the company.

- Recognized for the highest customer satisfaction ratings in the credit department.

Certificates

- Certified Credit Analyst (CCA)

- Certified Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified Business Credit Analyst (CBCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Specialist

- Quantify your accomplishments: Use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying “Improved risk assessment accuracy,” you could say “Developed a credit scoring model that improved risk assessment accuracy by 15%.”

- Highlight your skills and expertise: Showcase your proficiency in credit analysis, risk assessment, financial modeling, and other relevant areas. Consider using industry-specific keywords to make your resume more visible to recruiters.

- Tailor your resume to the job description: Carefully review the job description and identify the key skills and qualifications that the employer is seeking. Tailor your resume to highlight the experience and expertise that align with the requirements of the position.

- Proofread carefully: Before submitting your resume, proofread it carefully for any errors in grammar, spelling, or formatting. A polished and error-free resume will make a positive impression on potential employers.

Essential Experience Highlights for a Strong Credit Specialist Resume

- Analyze and assess credit applications to determine creditworthiness and risk

- Develop and implement credit scoring models to improve accuracy and efficiency

- Negotiate and restructure credit facilities to optimize terms and minimize risk

- Manage and monitor credit portfolios to ensure compliance and performance

- Conduct due diligence on loan applications to identify potential risks and provide recommendations

- Provide training and support to sales and underwriting staff on credit risk management

- Stay up-to-date on industry regulations and best practices

Frequently Asked Questions (FAQ’s) For Credit Specialist

What is the role of a Credit Specialist?

Credit Specialists are responsible for assessing the creditworthiness of individuals and businesses, and making decisions on whether or not to extend credit. They analyze financial information, such as income, debt, and assets, to determine the risk of default. Credit Specialists also monitor credit portfolios and work with borrowers to resolve any issues that may arise.

What are the key skills required to be a Credit Specialist?

Key skills for a Credit Specialist include: analytical skills, financial modeling, cash flow analysis, loan underwriting, and collections management. Credit Specialists should also have a strong understanding of credit risk management best practices and industry regulations.

What are the career prospects for Credit Specialists?

Credit Specialists can advance to more senior roles, such as Credit Manager or Vice President of Credit. They may also move into other areas of finance, such as investment banking or portfolio management.

What is the average salary for a Credit Specialist?

The average salary for a Credit Specialist in the United States is around $60,000 per year. Salaries can vary depending on experience, location, and employer.

What are the typical working hours for a Credit Specialist?

Credit Specialists typically work regular business hours, but may need to work overtime during busy periods or to meet deadlines.

What are the challenges of being a Credit Specialist?

The challenges of being a Credit Specialist include: assessing the creditworthiness of borrowers in a timely and accurate manner, managing risk, and dealing with difficult customers.

What are the rewards of being a Credit Specialist?

The rewards of being a Credit Specialist include: helping businesses and individuals to obtain the financing they need, making a positive impact on the economy, and building a successful career in finance.